- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Uncovering 3 Undervalued Small Caps In United Kingdom With Insider Activity

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been influenced by global economic shifts, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of international economies. As these broader market sentiments impact small-cap stocks, investors may look for opportunities in companies that demonstrate resilience and potential for growth despite challenging conditions. In this context, identifying undervalued small-cap stocks with notable insider activity can offer insights into potential investment opportunities within the UK market.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dr. Martens | 7.8x | 0.6x | 40.20% | ★★★★★★ |

| Domino's Pizza Group | 15.3x | 1.8x | 39.20% | ★★★★★☆ |

| Bytes Technology Group | 26.4x | 6.0x | 5.58% | ★★★★☆☆ |

| NWF Group | 8.8x | 0.1x | 34.81% | ★★★★☆☆ |

| CVS Group | 29.1x | 1.2x | 36.77% | ★★★★☆☆ |

| Essentra | 718.6x | 1.4x | 38.15% | ★★★★☆☆ |

| Genus | 171.0x | 2.0x | -2.43% | ★★★★☆☆ |

| Harworth Group | 12.2x | 6.4x | -596.32% | ★★★☆☆☆ |

| Oxford Instruments | 23.1x | 2.5x | -29.24% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -1417.11% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a British footwear company known for its iconic boots and shoes, with a market capitalization of approximately £2.43 billion.

Operations: The company's revenue primarily comes from its footwear segment, with a recent revenue figure of £877.10 million. Over the years, the gross profit margin has shown an upward trend, reaching 65.58% in the latest period. Operating expenses have been significant, with general and administrative expenses being a major component at £377.70 million in the most recent data point.

PE: 7.8x

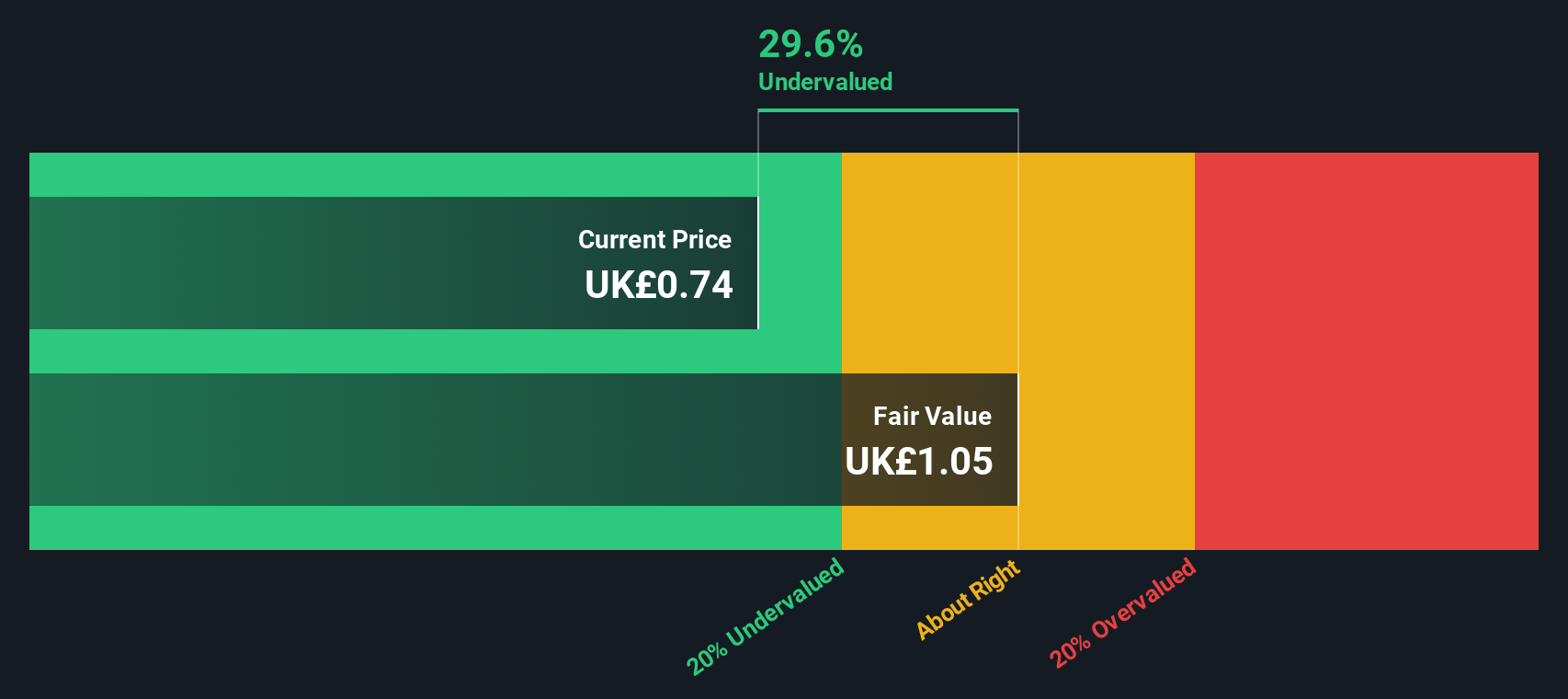

Dr. Martens, a notable player in the UK market, has seen its profit margins dip from 12.9% to 7.9% over the past year, reflecting financial challenges despite a forecasted earnings growth of 5.88% annually. Insider confidence is evident with recent share purchases by company insiders, suggesting belief in potential value recovery. The company's high debt level and reliance on external borrowing add risk factors but also underscore its small cap nature amidst fluctuating share prices over three months.

- Dive into the specifics of Dr. Martens here with our thorough valuation report.

Review our historical performance report to gain insights into Dr. Martens''s past performance.

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout company, primarily generating income through sales to franchisees, corporate store operations, advertising and ecommerce activities, property rentals, and various franchise-related fees; it has a market capitalization of approximately £1.57 billion.

Operations: The company's revenue streams are primarily derived from sales to franchisees, corporate store income, national advertising and ecommerce income, rental income on properties, and royalties and fees. The gross profit margin has shown a trend of increasing over time, reaching 47.48% in the latest period. Operating expenses include significant allocations for general and administrative expenses as well as sales and marketing efforts.

PE: 15.3x

Domino's Pizza Group, a UK-based company, has been navigating challenging waters with its recent earnings showing a dip in net income to £42.3 million for the first half of 2024 from £80.2 million the previous year. Despite this, insider confidence is evident as they continue strategic initiatives aiming for growth in order count and sales through fiscal 2024. The company commenced share repurchases under an AGM mandate and declared an interim dividend of 3.5p per share, indicating potential value in its current market position amidst ongoing transformations.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★☆☆

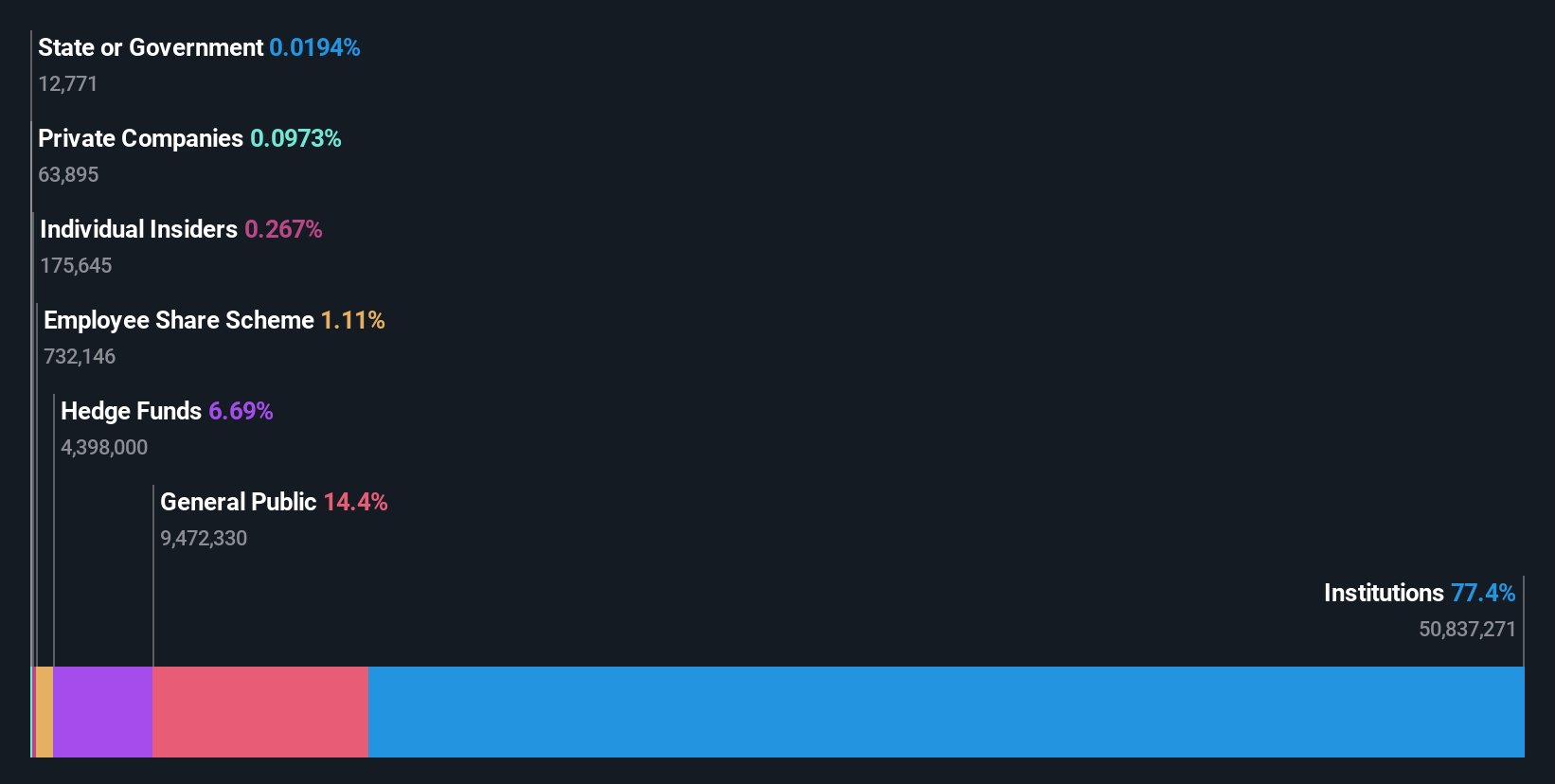

Overview: Genus is a company specializing in animal genetics, focusing on bovine and porcine breeding, with a market cap of £1.75 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million, respectively. The company experienced fluctuations in gross profit margin, peaking at 68.02% as of March 31, 2024. Operating expenses have varied significantly over time, with recent figures reaching up to £614.90 million by June 30, 2024.

PE: 171.0x

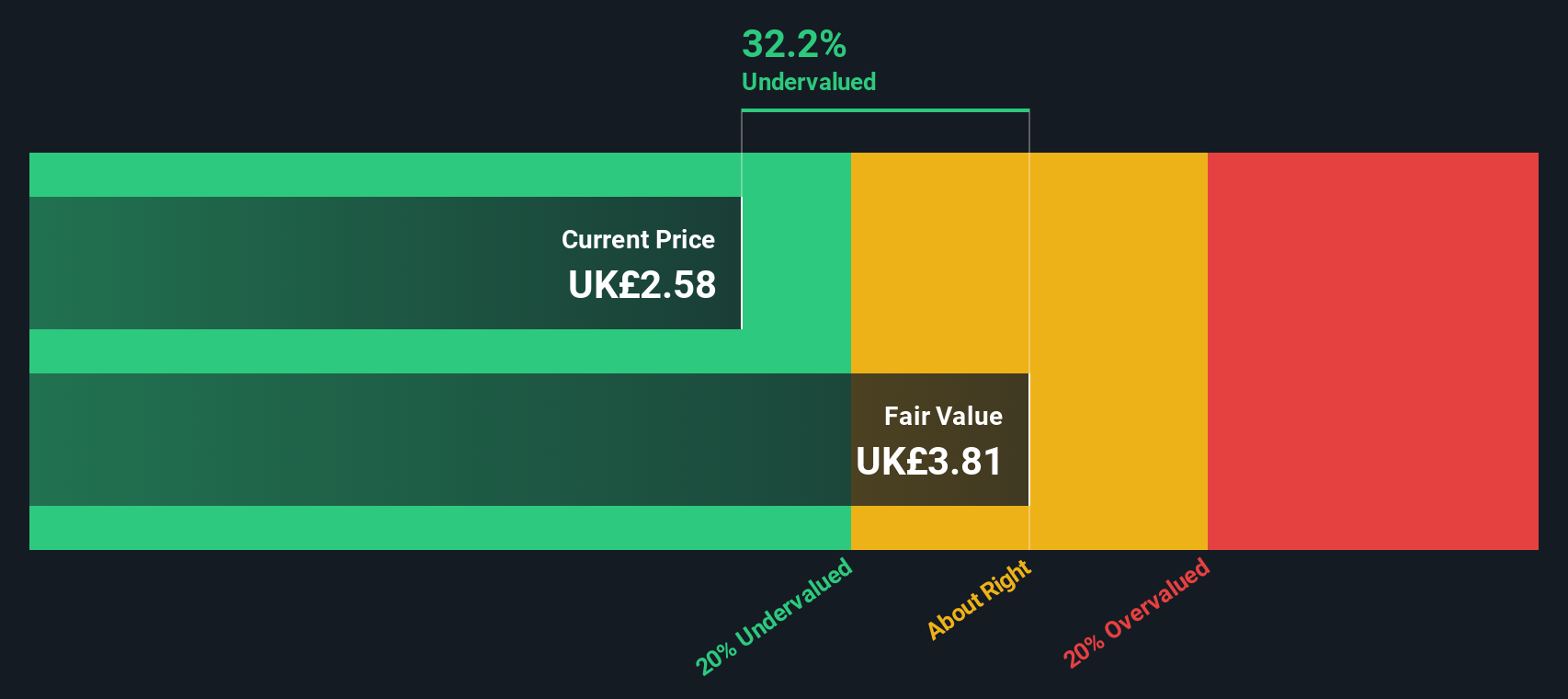

Genus, a UK-based company, recently reported a decline in net income to £7.9 million from £33.3 million the previous year, despite sales of £668.8 million. Their profit margins have narrowed significantly over the past year, and earnings have been impacted by large one-off items. Although insider confidence is evident with recent share purchases, Genus faces challenges with its funding structure relying solely on external borrowing and lower profit margins compared to last year.

- Click here and access our complete valuation analysis report to understand the dynamics of Genus.

Evaluate Genus' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 21 Undervalued UK Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.