- United Kingdom

- /

- Software

- /

- AIM:GBG

UK Market Stocks Estimated Below Intrinsic Value In July 2025

Reviewed by Simply Wall St

In recent months, the UK market has experienced fluctuations, with the FTSE 100 index facing pressures due to weak trade data from China and declining commodity prices. As these global economic challenges unfold, investors are increasingly on the lookout for stocks that may be undervalued relative to their intrinsic value, offering potential opportunities in a market characterized by uncertainty. Identifying such stocks requires careful analysis of fundamentals and a keen understanding of how external factors might impact long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.024 | £11.89 | 49.3% |

| TBC Bank Group (LSE:TBCG) | £49.00 | £96.40 | 49.2% |

| Moonpig Group (LSE:MOON) | £2.095 | £4.00 | 47.7% |

| Marlowe (AIM:MRL) | £4.36 | £8.36 | 47.9% |

| LSL Property Services (LSE:LSL) | £3.06 | £5.91 | 48.2% |

| Hostelworld Group (LSE:HSW) | £1.29 | £2.57 | 49.7% |

| Gooch & Housego (AIM:GHH) | £6.10 | £11.20 | 45.5% |

| Burberry Group (LSE:BRBY) | £12.185 | £23.75 | 48.7% |

| AstraZeneca (LSE:AZN) | £104.50 | £193.23 | 45.9% |

| 1Spatial (AIM:SPA) | £0.435 | £0.81 | 46.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

GB Group (AIM:GBG)

Overview: GB Group plc, with a market cap of £589.15 million, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets.

Operations: The company's revenue segments include Fraud (£38.09 million), Identity (£158.99 million), and Location (£85.64 million).

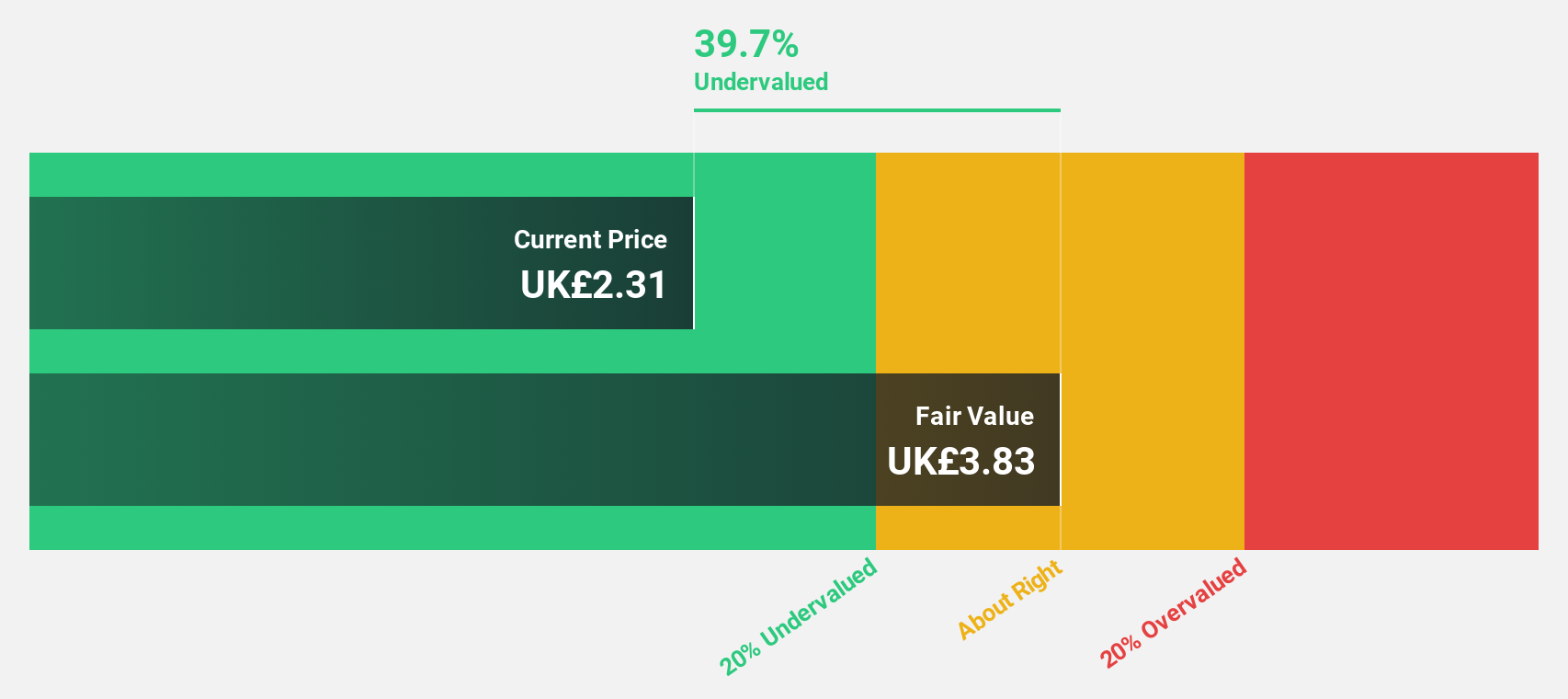

Estimated Discount To Fair Value: 37.9%

GB Group plc's recent financial performance highlights a turnaround, with net income reaching £8.63 million compared to last year's loss. The company is trading at 37.9% below its estimated fair value and more than 20% under its discounted cash flow valuation, suggesting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 33% annually over the next three years, outpacing the UK market's growth rate of 14.5%.

- Insights from our recent growth report point to a promising forecast for GB Group's business outlook.

- Unlock comprehensive insights into our analysis of GB Group stock in this financial health report.

Restore (AIM:RST)

Overview: Restore plc, along with its subsidiaries, offers secure and sustainable business services for data, information, communications, and assets mainly in the United Kingdom and has a market cap of £360.79 million.

Operations: The company's revenue segments include Datashred (£36 million), Technology (£36.10 million), Harrow Green (£35.30 million), and Information Management (£167.90 million).

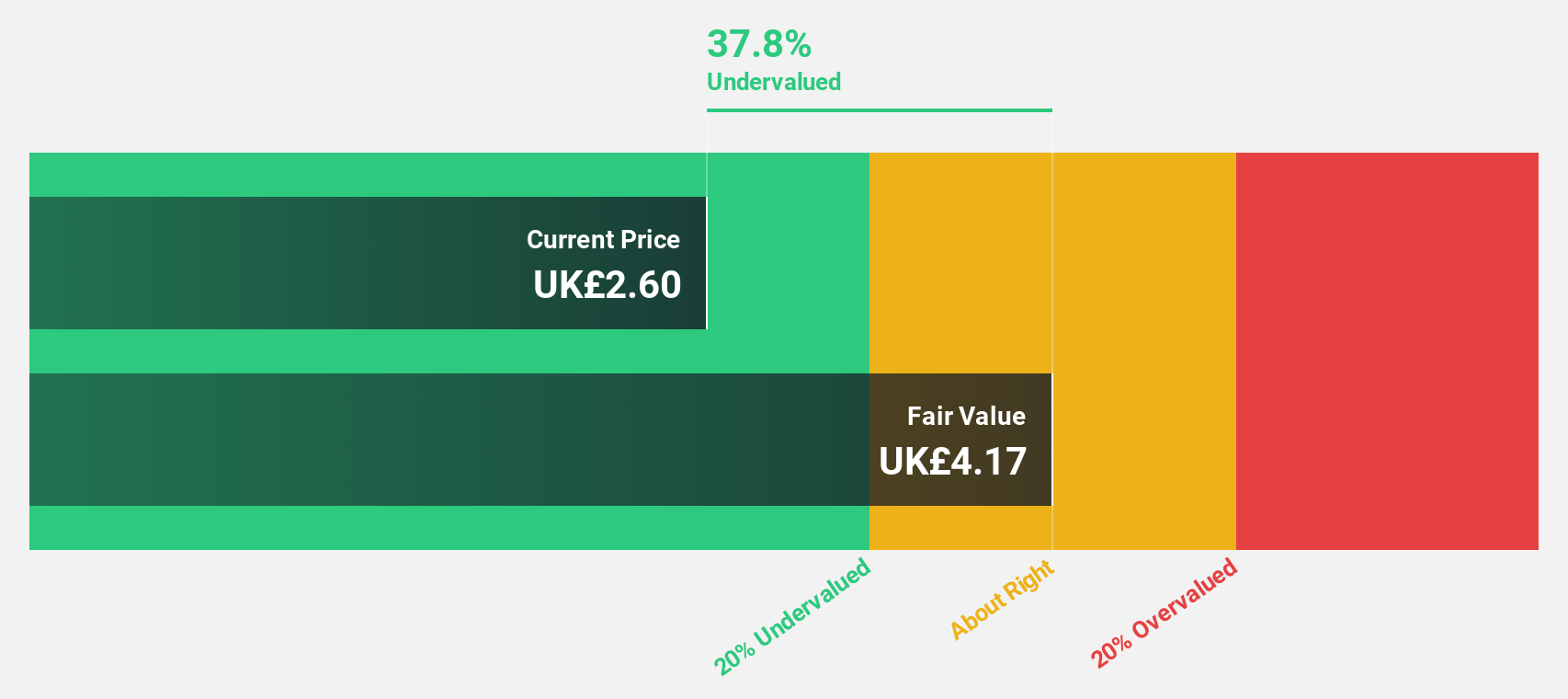

Estimated Discount To Fair Value: 40.6%

Restore plc is currently trading 40.6% below its estimated fair value of £4.44, with a market price of £2.64, highlighting potential undervaluation based on cash flows. The company has recently turned profitable and anticipates significant annual earnings growth of 24.76%, surpassing the UK market's expected rate of 14.5%. However, revenue growth is projected at a slower pace of 10.6% per year, and its dividend track record remains unstable.

- According our earnings growth report, there's an indication that Restore might be ready to expand.

- Dive into the specifics of Restore here with our thorough financial health report.

Dr. Martens (LSE:DOCS)

Overview: Dr. Martens plc is involved in the design, development, procurement, marketing, sale, and distribution of footwear with a market cap of approximately £763.41 million.

Operations: The company's revenue is primarily derived from its footwear segment, which generated £787.60 million.

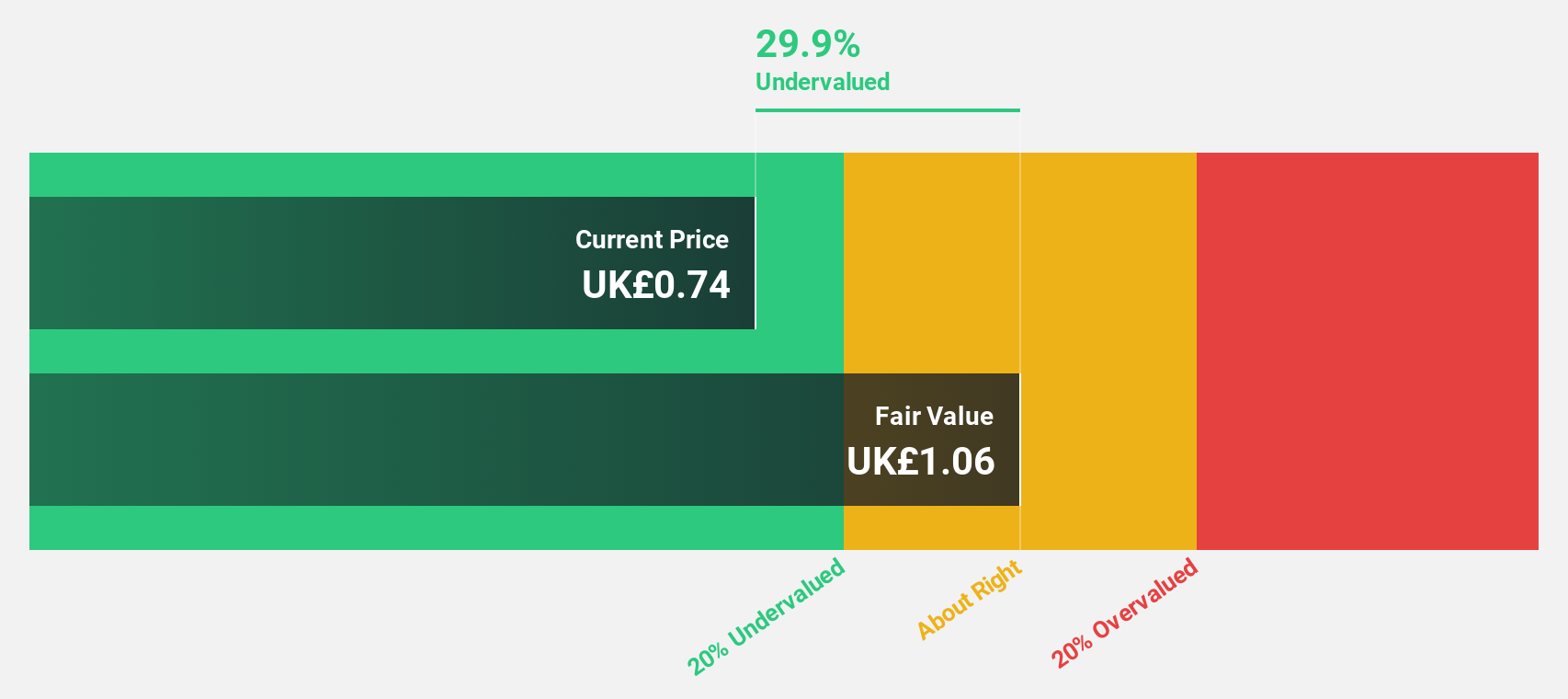

Estimated Discount To Fair Value: 28.6%

Dr. Martens is trading 28.6% below its estimated fair value of £1.11, with a current price of £0.79, suggesting undervaluation based on cash flows. Despite a forecasted revenue growth rate of 4.7% per year and significant earnings growth expectations of 47.8%, recent financials show a decline in net income from £69.2 million to £4.5 million year-over-year, reflecting challenges in maintaining profit margins and dividend sustainability at 3.23%.

- Our earnings growth report unveils the potential for significant increases in Dr. Martens' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Dr. Martens.

Next Steps

- Dive into all 59 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives