- United Kingdom

- /

- Luxury

- /

- LSE:DOCS

Insider Buying Highlights Undervalued Small Caps In United Kingdom For October 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has been facing challenges, with the FTSE 100 index recently closing lower due to weak trade data from China, impacting companies closely tied to its economic fortunes. As global cues continue to influence market sentiment, particularly for small-cap stocks sensitive to broader economic shifts, investors often look for opportunities where insider buying may signal confidence in a company's potential despite current uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 17.9x | 0.6x | 38.23% | ★★★★★★ |

| Bytes Technology Group | 22.0x | 5.6x | 12.45% | ★★★★★☆ |

| NWF Group | 7.9x | 0.1x | 39.98% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 39.43% | ★★★★★☆ |

| J D Wetherspoon | 16.6x | 0.4x | 14.54% | ★★★★★☆ |

| Genus | 171.7x | 2.0x | 8.31% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 40.87% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 38.71% | ★★★★☆☆ |

| Robert Walters | 43.5x | 0.3x | 39.98% | ★★★☆☆☆ |

| Sabre Insurance Group | 11.5x | 1.5x | 18.50% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dr. Martens (LSE:DOCS)

Simply Wall St Value Rating: ★★★★★★

Overview: Dr. Martens is a renowned British footwear brand known for its iconic boots and shoes, with a market capitalization of £1.25 billion.

Operations: The primary revenue stream is derived from footwear sales, with recent figures indicating a gross profit margin of 65.58%. Operating expenses are a significant component of the cost structure, impacting overall profitability.

PE: 7.9x

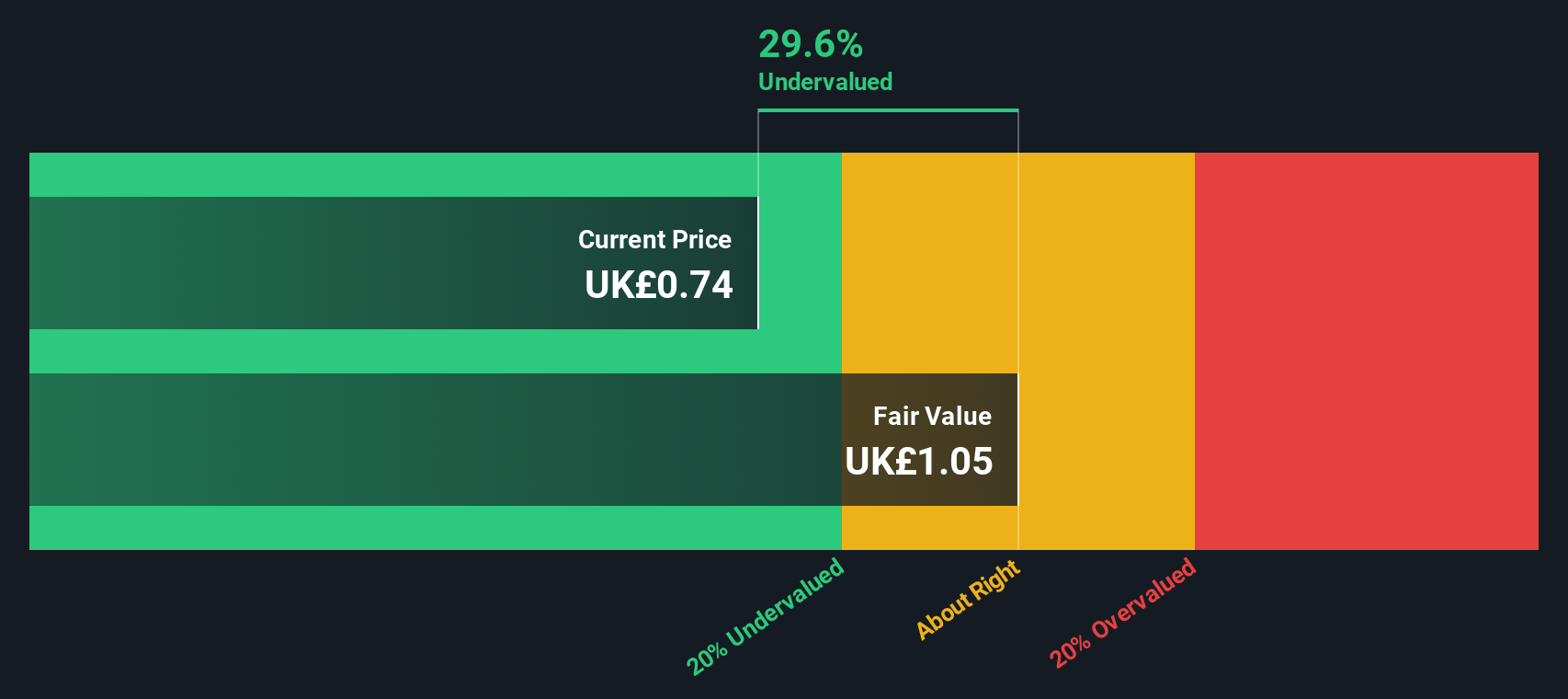

Dr. Martens, a notable player among UK small caps, has seen insider confidence with share purchases in recent months. Despite a volatile share price over the past three months, earnings are forecast to grow by 5.68% annually. However, profit margins have declined from 12.9% last year to 7.9%, and the company carries significant debt with all liabilities funded through external borrowing rather than customer deposits. These factors present both challenges and opportunities for potential investors seeking value in this stock category.

- Click to explore a detailed breakdown of our findings in Dr. Martens' valuation report.

Examine Dr. Martens' past performance report to understand how it has performed in the past.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harworth Group is a UK-based land and property regeneration company focused on income generation and capital growth through the sale of development properties and other property activities, with a market cap of approximately £0.43 billion.

Operations: The company's revenue primarily comes from the sale of development properties, income generation, and other property activities. The gross profit margin has shown variability over time, with a recent figure of 11.43% as of October 2024. Operating expenses have increased consistently across periods, impacting overall profitability.

PE: 12.1x

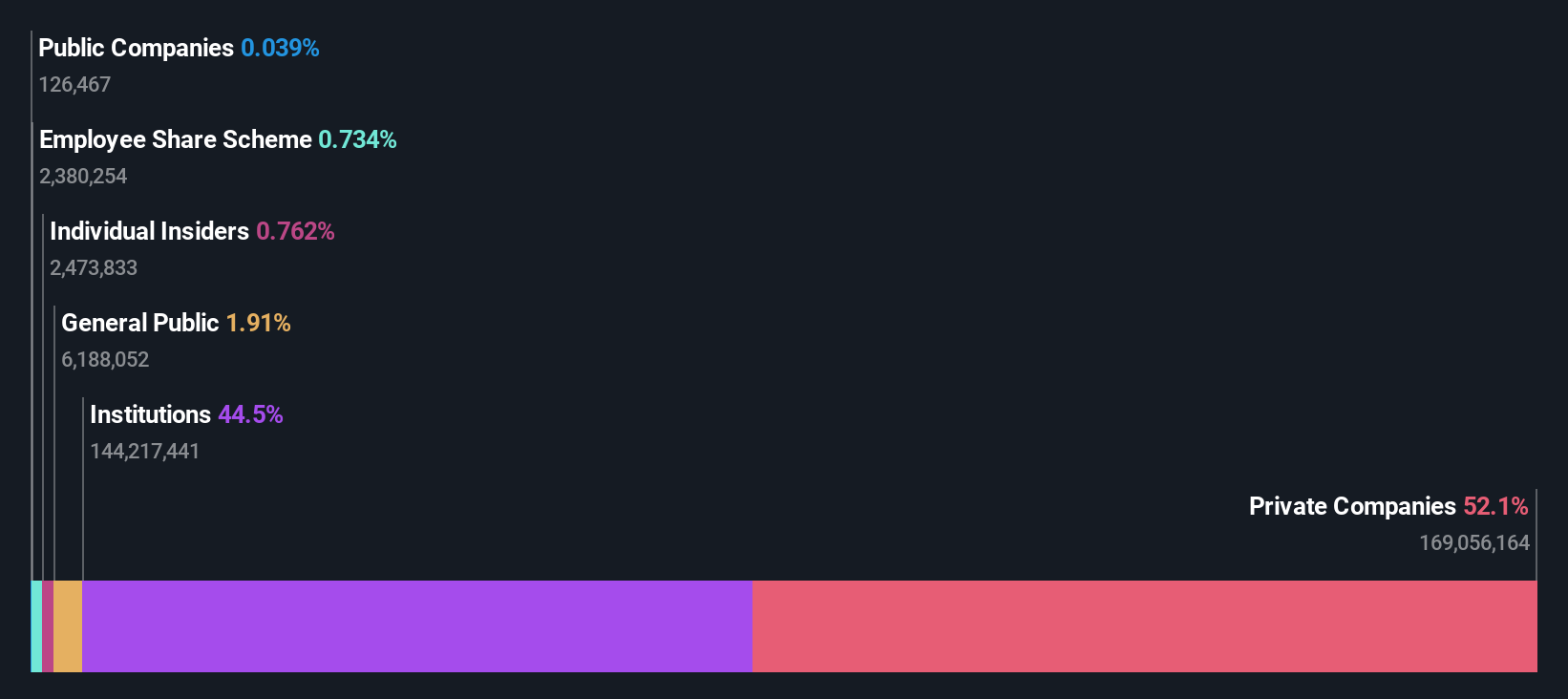

Harworth Group, a company recently added to the FTSE 250 and FTSE 350 indices in September 2024, showcases promising growth potential. Their earnings for H1 2024 surged with sales hitting £41.31 million, up from £18.24 million the previous year, while net income jumped to £14.78 million from £2.85 million. Insider confidence is evident with Alastair Lyons purchasing 50,000 shares valued at approximately £80,000 in recent months, reflecting a significant increase of over 14% in their holdings. Despite relying entirely on external borrowing for funding—considered higher risk—the company's earnings are forecasted to grow by over 26% annually.

- Click here to discover the nuances of Harworth Group with our detailed analytical valuation report.

Review our historical performance report to gain insights into Harworth Group's's past performance.

Videndum (LSE:VID)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Videndum is a company that specializes in providing media, creative, and production solutions with a market cap of £0.25 billion.

Operations: Videndum's revenue streams are primarily derived from Media Solutions (£144.70 million), Creative Solutions (£54.90 million), and Production Solutions (£98 million). Over recent periods, the company has experienced fluctuations in its net income margin, with a notable decline to -8.74% as of October 2024. The gross profit margin has also shown a downward trend, reaching 36.65% in the same period.

PE: -10.3x

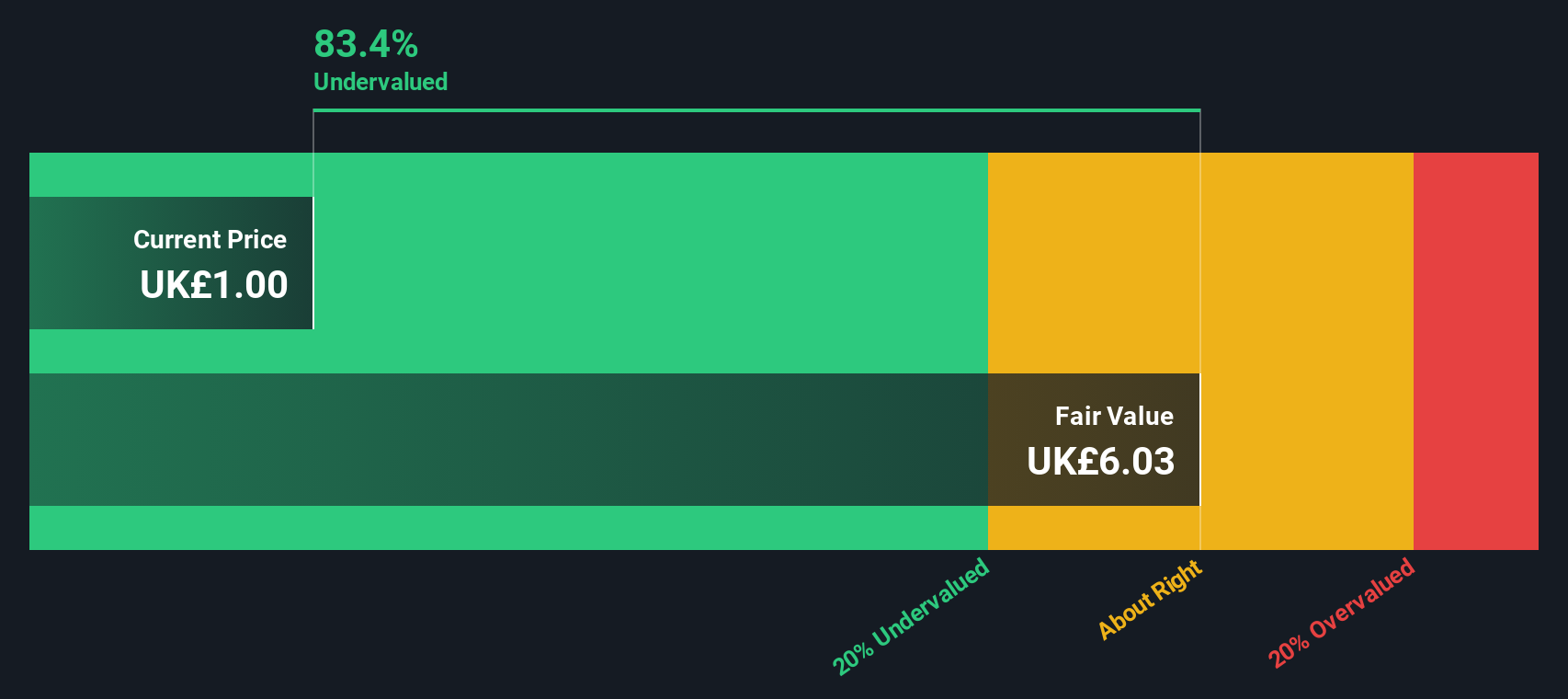

Videndum, a smaller company in the UK market, has experienced a volatile share price over the past three months and faced substantial shareholder dilution recently. Despite these challenges, insider confidence is evident with purchases occurring between March and September 2024. The company's financials show a narrowed net loss of £12.8 million for H1 2024 compared to £46.5 million last year, suggesting potential for improvement as earnings are projected to grow significantly at 113% per year. However, reliance on external borrowing poses higher risk funding concerns that investors should consider while assessing its future prospects.

- Delve into the full analysis valuation report here for a deeper understanding of Videndum.

Gain insights into Videndum's historical performance by reviewing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undervalued UK Small Caps With Insider Buying screener has unearthed 24 more companies for you to explore.Click here to unveil our expertly curated list of 27 Undervalued UK Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dr. Martens, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOCS

Dr. Martens

Designs, develops, procures, markets, sells, and distributes footwear under the Dr.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives