- United Kingdom

- /

- Consumer Durables

- /

- LSE:CSP

If You Had Bought Countryside Properties (LON:CSP) Shares Three Years Ago You'd Have Earned 26% Returns

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, the Countryside Properties PLC (LON:CSP) share price is up 26% in the last three years, clearly besting the market decline of around 8.0% (not including dividends).

View our latest analysis for Countryside Properties

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, Countryside Properties failed to grow earnings per share, which fell 15% (annualized). In this instance, recent extraordinary items impacted the earnings.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It could be that the revenue growth of 8.0% per year is viewed as evidence that Countryside Properties is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

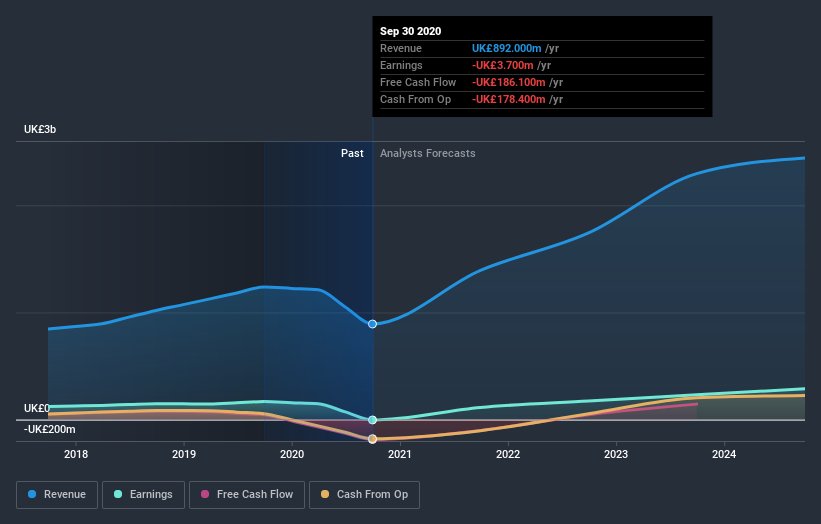

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Countryside Properties will earn in the future (free profit forecasts).

What about the Total Shareholder Return (TSR)?

We've already covered Countryside Properties' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Countryside Properties shareholders, and that cash payout contributed to why its TSR of 36%, over the last 3 years, is better than the share price return.

A Different Perspective

The last twelve months weren't great for Countryside Properties shares, which performed worse than the market, costing holders 14%. The market shed around 3.7%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 11% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Countryside Properties , and understanding them should be part of your investment process.

Countryside Properties is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Countryside Properties, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CSP

Countryside Partnerships

Countryside Partnerships PLC operates as a home builder and urban regeneration partner in the United Kingdom.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives