- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

Undiscovered Gems in the United Kingdom for January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces headwinds due to weak trade data from China, investors are increasingly looking beyond blue-chip stocks for opportunities. In this challenging environment, identifying undiscovered gems within the UK market requires a focus on companies with strong fundamentals and resilience to global economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Supreme (AIM:SUP)

Simply Wall St Value Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes a diverse range of products including batteries, lighting, vaping products, sports nutrition and wellness items, and branded household consumer goods across the UK, Ireland, the Netherlands, France, the rest of Europe, and internationally with a market cap of £211.70 million.

Operations: Supreme Plc generates revenue primarily from vaping (£77.29 million), branded household consumer goods (£67.25 million), and batteries (£42.00 million). The company also earns from sports nutrition & wellness and lighting segments, contributing £18.52 million and £17.13 million, respectively.

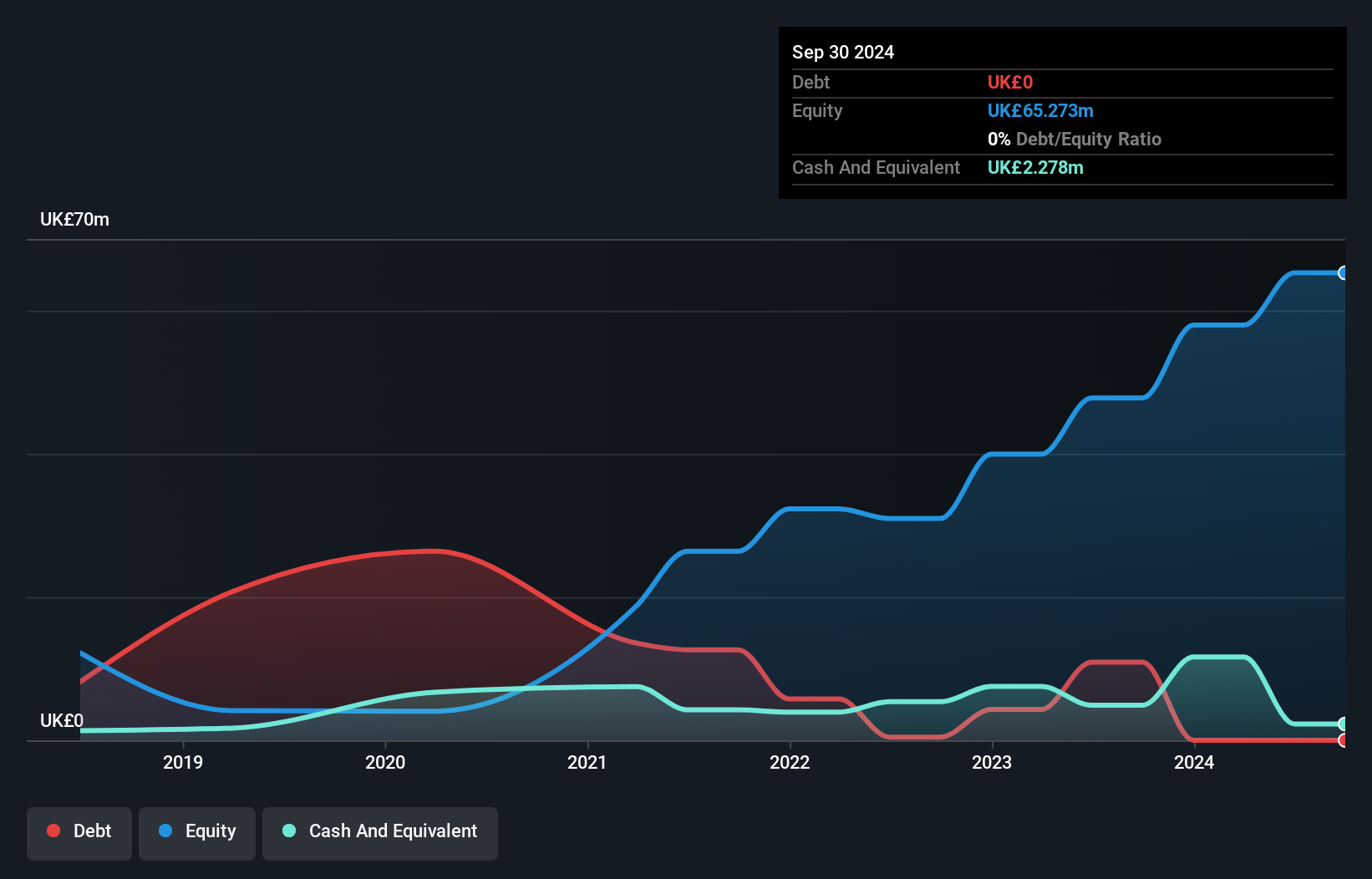

Supreme, a nimble player in the UK market, has been making waves with its impressive earnings growth of 32.7% over the past year, significantly outpacing the Retail Distributors industry. The company boasts a favorable price-to-earnings ratio of 9x compared to the broader UK market's 16.1x, highlighting its value potential. Supreme is debt-free now, a marked improvement from five years ago when it had a hefty debt-to-equity ratio of 594%. Recent discussions about acquiring Typhoo Tea indicate strategic expansion efforts despite no share buybacks this year and an interim dividend declaration of 1.8 pence per share reflecting steady financial management.

- Click here to discover the nuances of Supreme with our detailed analytical health report.

Evaluate Supreme's historical performance by accessing our past performance report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market capitalization of £1.11 billion.

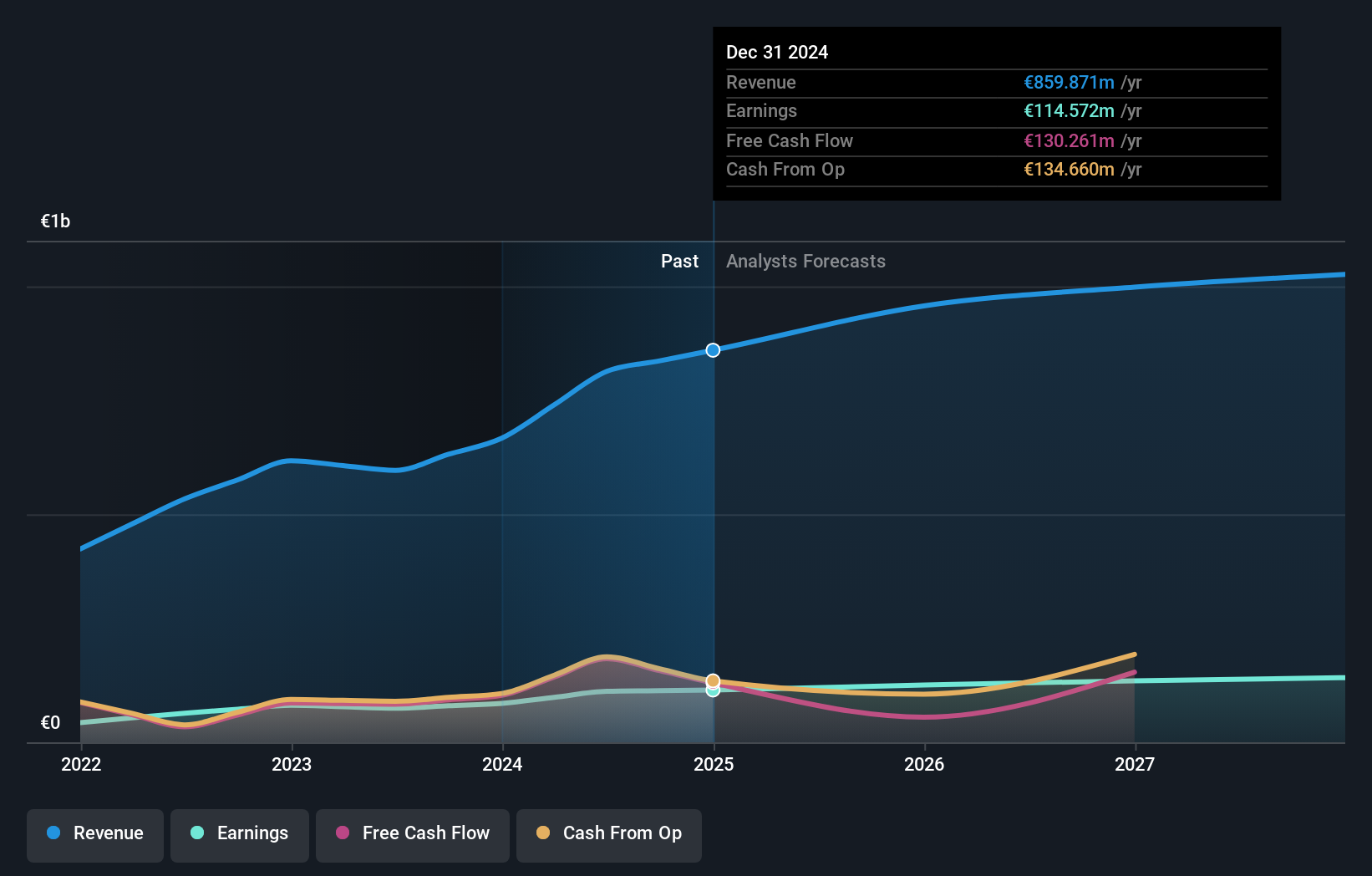

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

With a net debt to equity ratio of 20.7%, Cairn Homes shows satisfactory financial health, and its interest payments are well covered by EBIT at 9.5x. The company boasts high-quality earnings, with a notable growth of 49.5% in the past year, surpassing industry averages. Trading at a price-to-earnings ratio of 12.2x, it's considered good value against the UK market's average of 16.1x. Recently, Cairn Homes completed a share buyback program repurchasing over 22 million shares for €44.92 million, reflecting confidence in its future prospects and enhancing shareholder value through strategic capital management decisions.

- Unlock comprehensive insights into our analysis of Cairn Homes stock in this health report.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Telecom Plus Plc provides utility services in the United Kingdom and has a market cap of £1.30 billion.

Operations: Telecom Plus generates revenue primarily from its non-regulated utility segment, amounting to £1.85 billion.

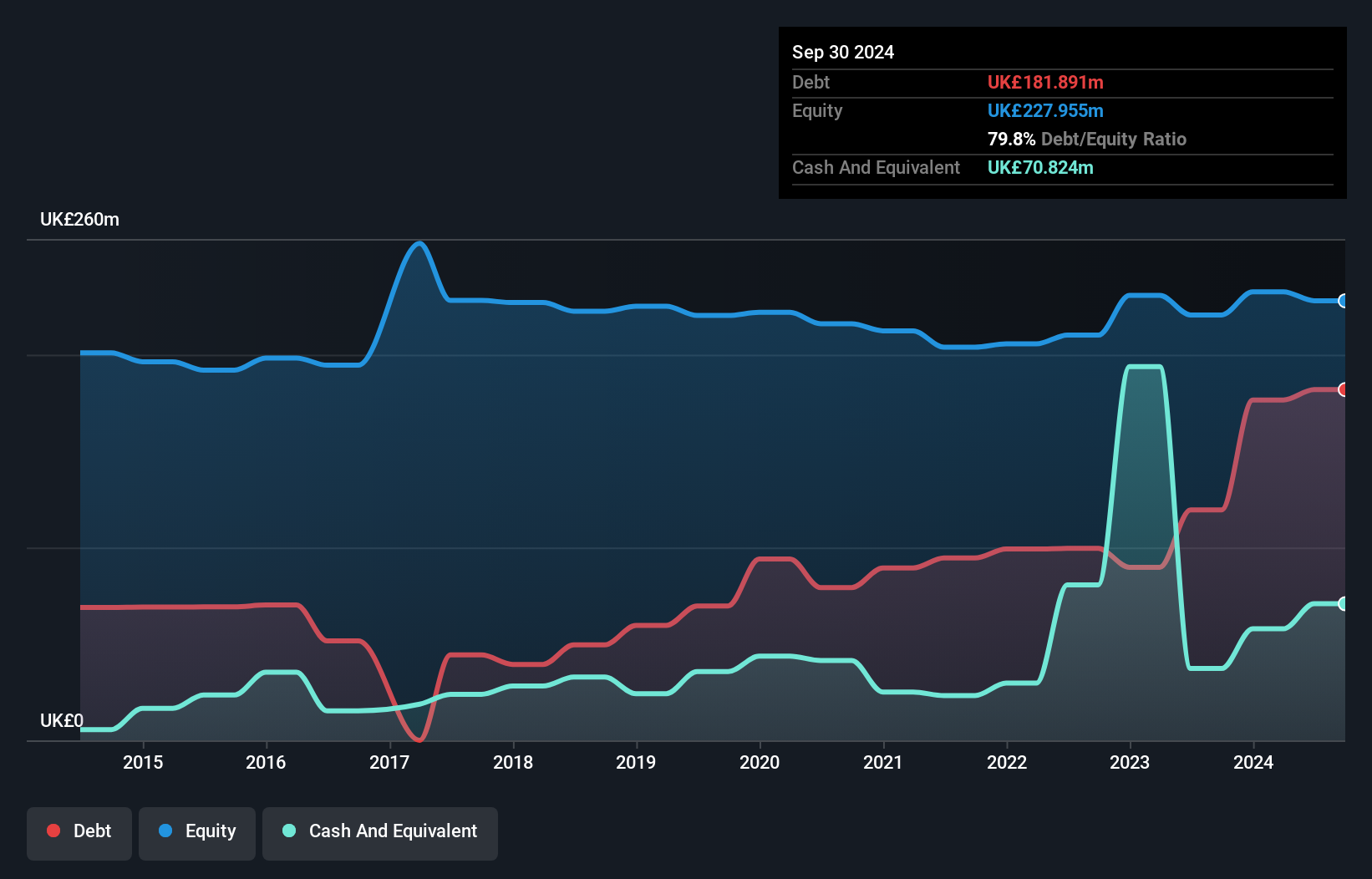

Telecom Plus, a dynamic player in the UK market, has seen its earnings grow by 11% over the past year, outpacing the Integrated Utilities industry. Despite having a high net debt to equity ratio of 49%, its interest payments are well-covered with EBIT at 12 times coverage. The company's recent earnings report showed sales of £697.75 million for H1 2025, down from £883.63 million last year, but net income rose to £27.63 million from £23.37 million. Trading at nearly 32% below estimated fair value suggests potential upside for investors considering this stock's profitability and quality earnings profile.

- Click here and access our complete health analysis report to understand the dynamics of Telecom Plus.

Gain insights into Telecom Plus' past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our UK Undiscovered Gems With Strong Fundamentals screener has unearthed 57 more companies for you to explore.Click here to unveil our expertly curated list of 60 UK Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives