- United Kingdom

- /

- Consumer Durables

- /

- LSE:CRN

UK Penny Stocks To Watch With Market Caps Over £100M

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek opportunities in less conventional areas like penny stocks. Although the term "penny stocks" might seem outdated, these smaller or newer companies can offer unique growth potential when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.81 | £549.16M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.24 | £180.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.92 | £13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.09 | £15M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.665 | £95.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.644 | £620.98M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ramsdens Holdings (AIM:RFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ramsdens Holdings PLC provides diversified financial services in the United Kingdom and internationally, with a market cap of £114.05 million.

Operations: The company generates revenue through five main segments: Pawnbroking (£13.69 million), Retail Jewellery Sales (£38.76 million), Foreign Currency Margin (£14.98 million), Purchases of Precious Metals (£35.47 million), and Income from Other Financial Services (£0.55 million).

Market Cap: £114.05M

Ramsdens Holdings PLC, with a market cap of £114.05 million, shows a diversified revenue stream across five segments, including Retail Jewellery Sales (£38.76 million) and Pawnbroking (£13.69 million). Its financial health is robust, with interest payments well covered by EBIT (14.7x) and debt adequately supported by operating cash flow (412.6%). The management team is experienced with an average tenure of 9.3 years, while the board also boasts significant experience at 8.8 years average tenure. Despite stable weekly volatility at 5%, its earnings growth of 27.1% lags behind the Consumer Finance industry growth rate of 55.3%.

- Click to explore a detailed breakdown of our findings in Ramsdens Holdings' financial health report.

- Understand Ramsdens Holdings' earnings outlook by examining our growth report.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, with a market cap of £166.37 million, provides financial management software in the United Kingdom and internationally.

Operations: The company generates revenue of £67.61 million from its financial management software offerings in the United Kingdom and international markets.

Market Cap: £166.37M

Aptitude Software Group, with a market cap of £166.37 million, has faced challenges with declining earnings over the past five years and negative growth in the last year. Despite this, its financial position remains stable as it holds more cash than debt and its interest payments are well covered by EBIT at 20.4 times. The board is experienced with an average tenure of 3.2 years, though management tenure data is insufficient to assess experience levels fully. Trading at a discount to estimated fair value, Aptitude's earnings are forecasted to grow annually by 25.45%.

- Take a closer look at Aptitude Software Group's potential here in our financial health report.

- Gain insights into Aptitude Software Group's future direction by reviewing our growth report.

Cairn Homes (LSE:CRN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of approximately £1.05 billion.

Operations: The company generates revenue primarily through its Building and Property Development segment, which accounted for €778.20 million.

Market Cap: £1.05B

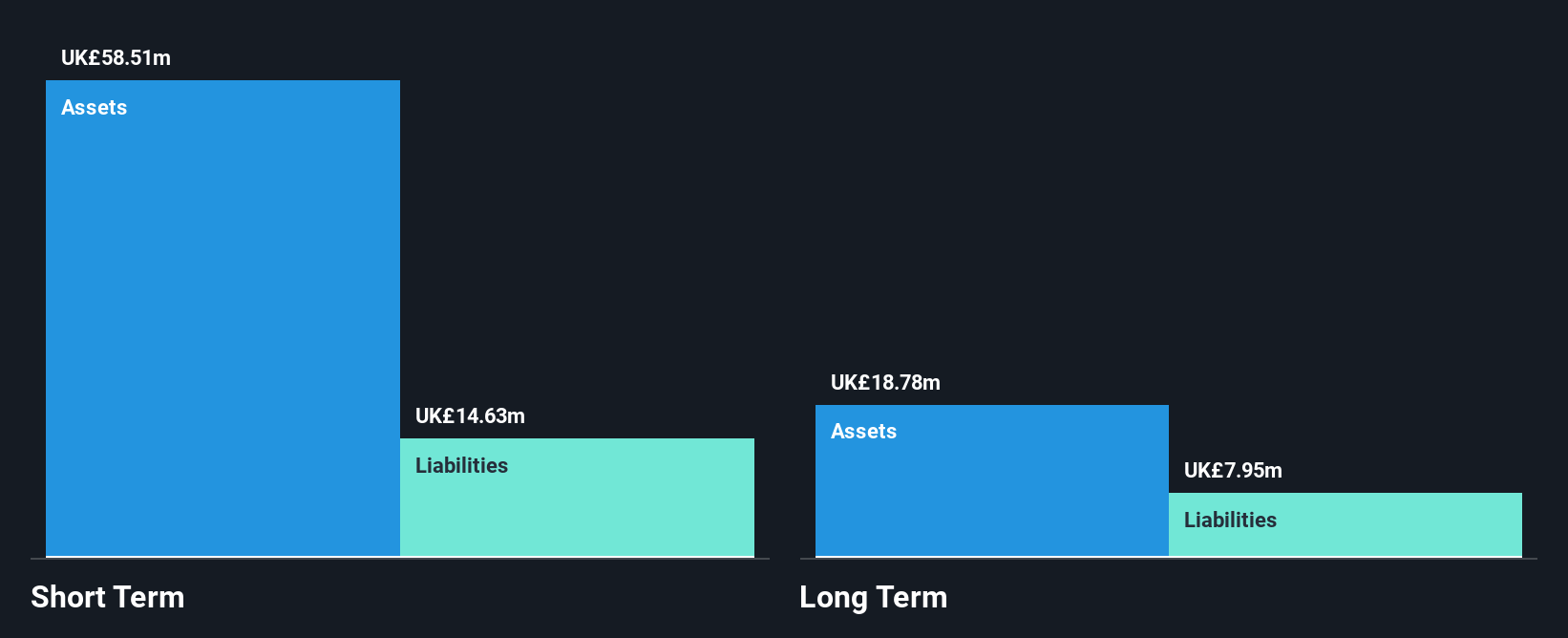

Cairn Homes, with a market cap of £1.05 billion, trades below its estimated fair value and offers good relative value compared to peers. Despite recent earnings decline, the company maintains strong short-term financial health with assets exceeding liabilities. However, debt coverage by cash flow is weak due to negative operating cash flow and high net debt to equity ratio of 40.3%. The dividend yield of 4.23% is not well covered by free cash flows but has increased recently. While earnings growth has been negative over the past year, analysts expect a potential price rise by 22.3%.

- Navigate through the intricacies of Cairn Homes with our comprehensive balance sheet health report here.

- Evaluate Cairn Homes' prospects by accessing our earnings growth report.

Summing It All Up

- Navigate through the entire inventory of 294 UK Penny Stocks here.

- Looking For Alternative Opportunities? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRN

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives