- United Kingdom

- /

- Consumer Durables

- /

- LSE:VID

3 UK Stocks Estimated To Be Up To 45.9% Undervalued Presenting An Opportunity

Reviewed by Simply Wall St

The United Kingdom market has shown stability, remaining flat over the last week but achieving a 6.1% rise over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this environment, identifying undervalued stocks can present potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.3675 | £0.73 | 49.5% |

| Fevertree Drinks (AIM:FEVR) | £6.87 | £12.80 | 46.3% |

| TBC Bank Group (LSE:TBCG) | £31.85 | £62.66 | 49.2% |

| On the Beach Group (LSE:OTB) | £1.59 | £3.00 | 47% |

| BATM Advanced Communications (LSE:BVC) | £0.19275 | £0.38 | 49% |

| Auction Technology Group (LSE:ATG) | £4.45 | £8.54 | 47.9% |

| Foxtons Group (LSE:FOXT) | £0.552 | £1.03 | 46.4% |

| Videndum (LSE:VID) | £2.50 | £4.62 | 45.9% |

| St. James's Place (LSE:STJ) | £8.34 | £16.30 | 48.8% |

| Genel Energy (LSE:GENL) | £0.83 | £1.55 | 46.4% |

Let's explore several standout options from the results in the screener.

Barratt Redrow (LSE:BTRW)

Overview: Barratt Redrow plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £5.77 billion.

Operations: The company generates revenue of £4.17 billion from its housebuilding operations in the United Kingdom.

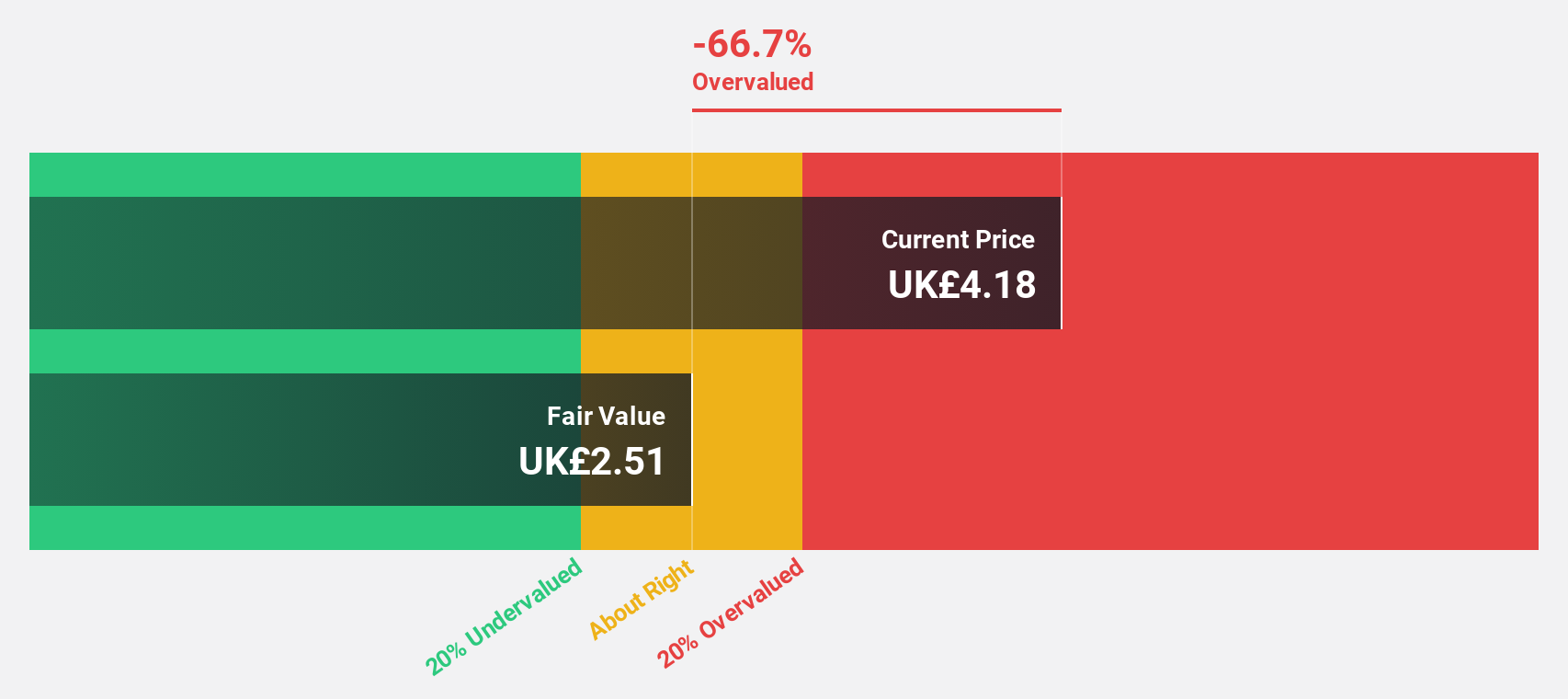

Estimated Discount To Fair Value: 45.8%

Barratt Redrow is trading significantly below its estimated fair value of £7.38, with a current price of £4, suggesting it may be undervalued based on cash flows. Despite recent financial challenges, including reduced profit margins and shareholder dilution, the company's earnings are forecast to grow at 42.7% annually over the next three years, outpacing the UK market's growth rate. However, dividend sustainability remains a concern due to insufficient coverage by earnings or free cash flows.

- The analysis detailed in our Barratt Redrow growth report hints at robust future financial performance.

- Click here to discover the nuances of Barratt Redrow with our detailed financial health report.

Videndum (LSE:VID)

Overview: Videndum Plc is a company that designs, manufactures, and distributes products and services for capturing and sharing content across broadcast, cinematic, video, photographic, and smartphone applications globally with a market cap of £235.47 million.

Operations: The company's revenue is derived from three main segments: Media Solutions (£144.70 million), Creative Solutions (£54.90 million), and Production Solutions (£98 million).

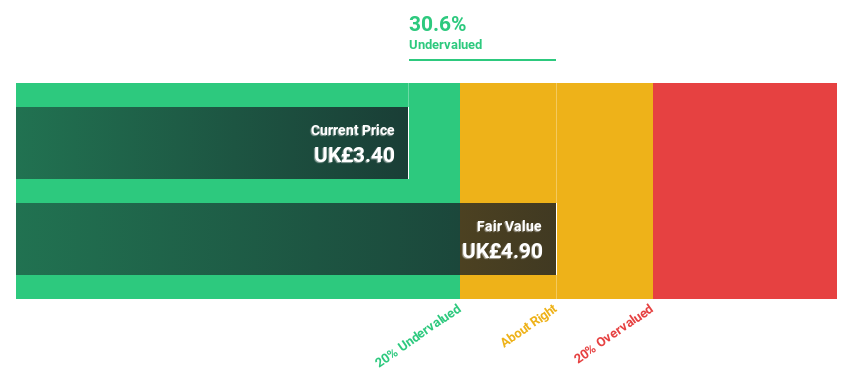

Estimated Discount To Fair Value: 45.9%

Videndum is trading at £2.50, significantly below its estimated fair value of £4.62, highlighting potential undervaluation based on cash flows. Despite recent volatility and executive changes, the company has initiated a share buyback program and forecasts suggest strong earnings growth of 113.59% annually over the next three years. However, Videndum's revenue growth rate is expected to be slower than 20% per year and its forecasted return on equity remains low at 7.1%.

- The growth report we've compiled suggests that Videndum's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Videndum stock in this financial health report.

W.A.G payment solutions (LSE:WPS)

Overview: W.A.G payment solutions plc operates an integrated payments and mobility platform targeting the commercial road transportation industry primarily in Europe, with a market cap of £565.37 million.

Operations: The company's revenue is derived from its Payment Solutions segment, which generated €2.10 billion, and its Mobility Solutions segment, which contributed €124.13 million.

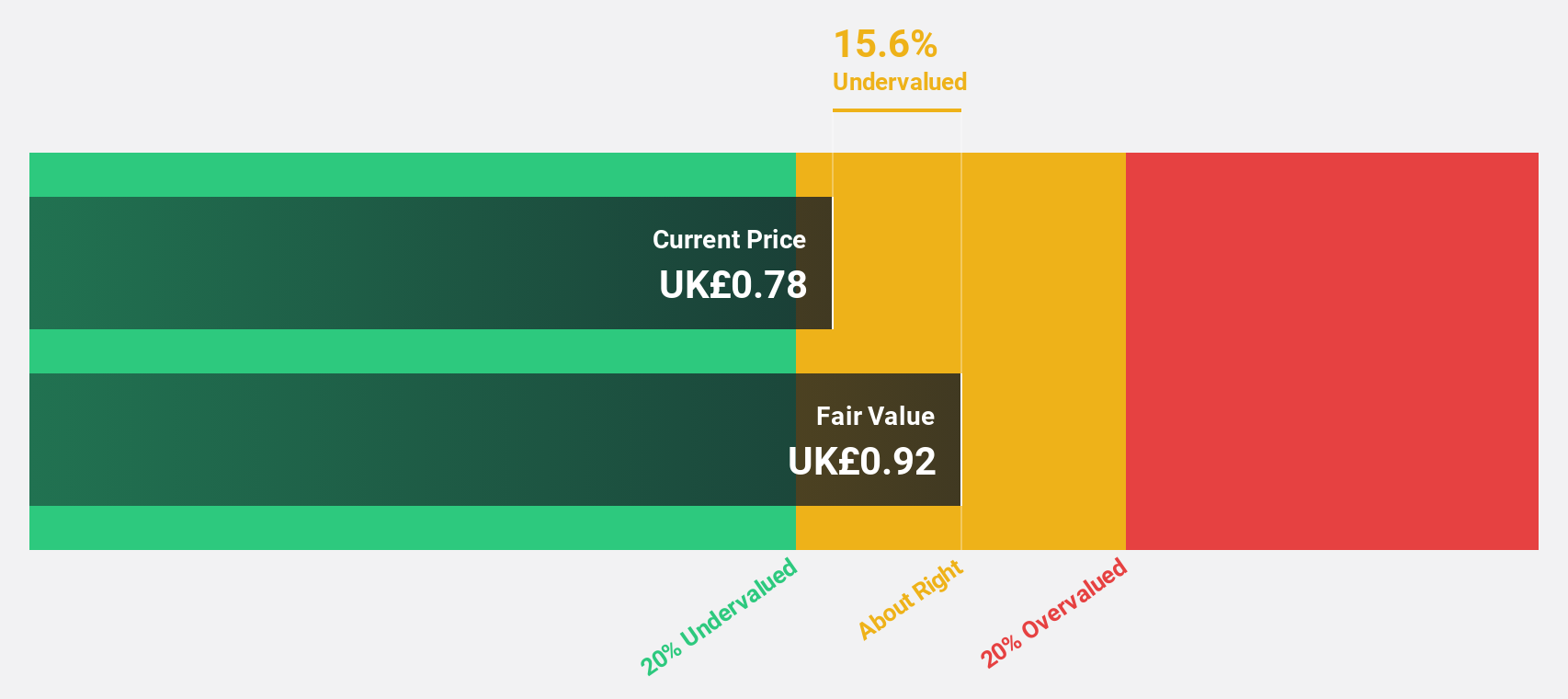

Estimated Discount To Fair Value: 10.3%

W.A.G payment solutions is trading at £0.82, slightly below its fair value estimate of £0.91, indicating modest undervaluation based on cash flows. The company projects earnings growth of 64.33% annually and revenue growth surpassing the UK market average, despite interest payments not being well covered by earnings. Recent half-year results showed increased sales but decreased net income compared to the previous year, with basic EPS dropping from €0.0076 to €0.0035.

- Our earnings growth report unveils the potential for significant increases in W.A.G payment solutions' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of W.A.G payment solutions.

Taking Advantage

- Click this link to deep-dive into the 48 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VID

Videndum

Designs, manufactures, and distributes products and services that enable end users to capture and share content for the broadcast, cinematic, video, photographic, and smartphone applications worldwide.

Undervalued with reasonable growth potential.