- United Kingdom

- /

- Consumer Durables

- /

- AIM:VCP

Exploring Victoria And Two More Undervalued Small Caps With Insider Actions

Amidst a backdrop of fluctuating global markets, with the FTSE 100 showing signs of continued pressure and broader economic uncertainties stemming from international events, investors might find potential opportunities in undervalued small-cap stocks. These smaller companies can sometimes offer unique growth prospects especially when larger indices and sectors face challenges.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MONY Group | 16.3x | 2.7x | 45.12% | ★★★★★★ |

| Bytes Technology Group | 27.4x | 6.2x | 16.16% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.21% | ★★★★★☆ |

| THG | NA | 0.4x | 33.96% | ★★★★★☆ |

| Ultimate Products | 9.5x | 0.7x | 18.86% | ★★★★☆☆ |

| Bodycote | 15.4x | 1.6x | 19.85% | ★★★★☆☆ |

| Eurocell | 14.8x | 0.4x | 23.30% | ★★★★☆☆ |

| Robert Walters | 20.6x | 0.3x | 35.51% | ★★★☆☆☆ |

| Savills | 36.8x | 0.7x | 24.48% | ★★★☆☆☆ |

| Henry Boot | 10.5x | 0.8x | -107.42% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

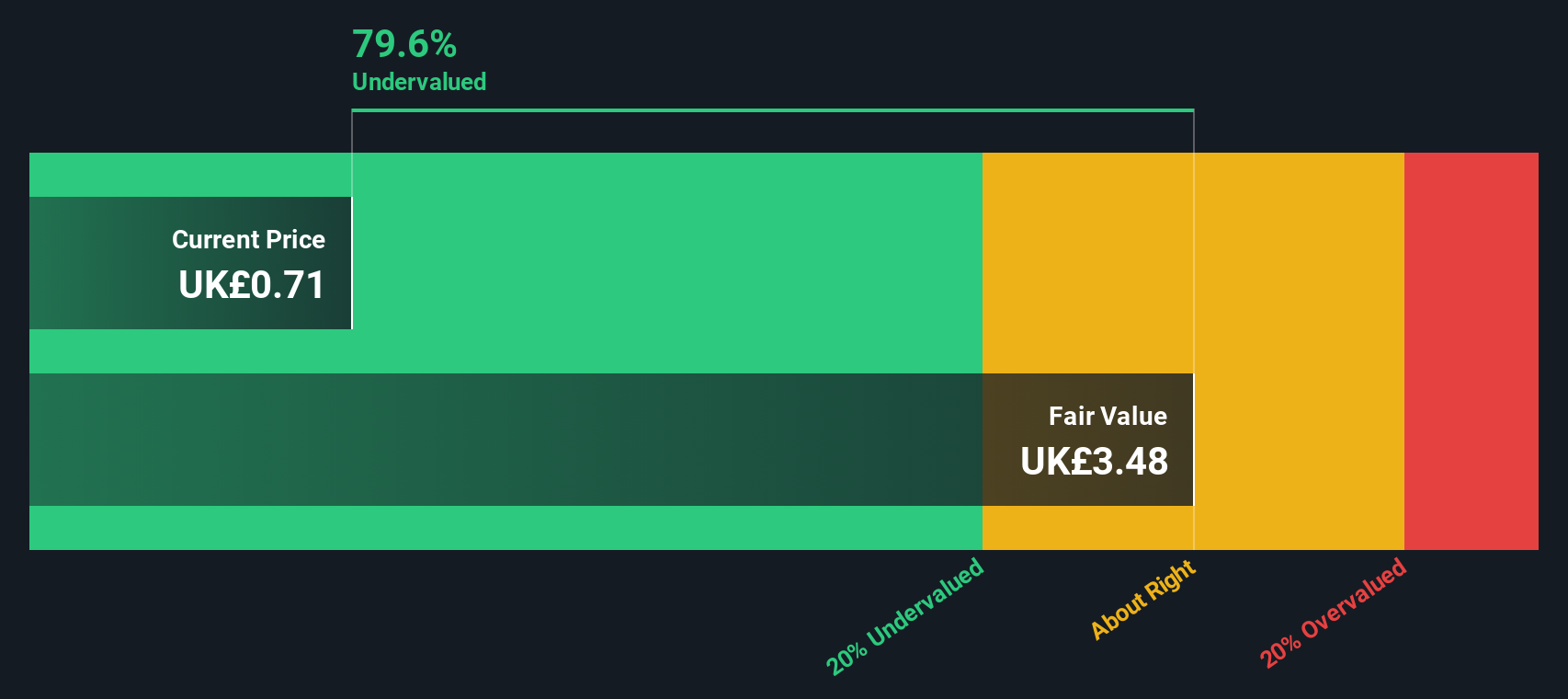

Victoria (AIM:VCP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Victoria is a diversified flooring company with operations spanning Australia, North America, and the UK & Europe in both ceramic tiles and soft flooring sectors.

Operations: The company generates revenue from diverse geographical segments, including Australia (£110.7 million), North America (£173 million), and the UK & Europe across Ceramic Tiles (£399.4 million) and Soft Flooring (£669.4 million). It has experienced a gross profit margin fluctuation, with a notable increase to 36.49% in September 2019 before declining to 31.75% by September 2023, reflecting varying cost of goods sold and operational efficiency over the period.

PE: -1.3x

Victoria, a standout among UK's smaller companies, recently witnessed insider confidence with significant share purchases, signaling strong belief in its potential. Despite a highly volatile share price in the past three months, earnings forecasts suggest an impressive growth rate of 95% annually. This financial optimism is tempered by its reliance on higher-risk external borrowing for funding. With insiders investing in their own firm, it points to promising prospects and a robust understanding of its intrinsic worth.

- Get an in-depth perspective on Victoria's performance by reading our valuation report here.

-

Explore historical data to track Victoria's performance over time in our Past section.

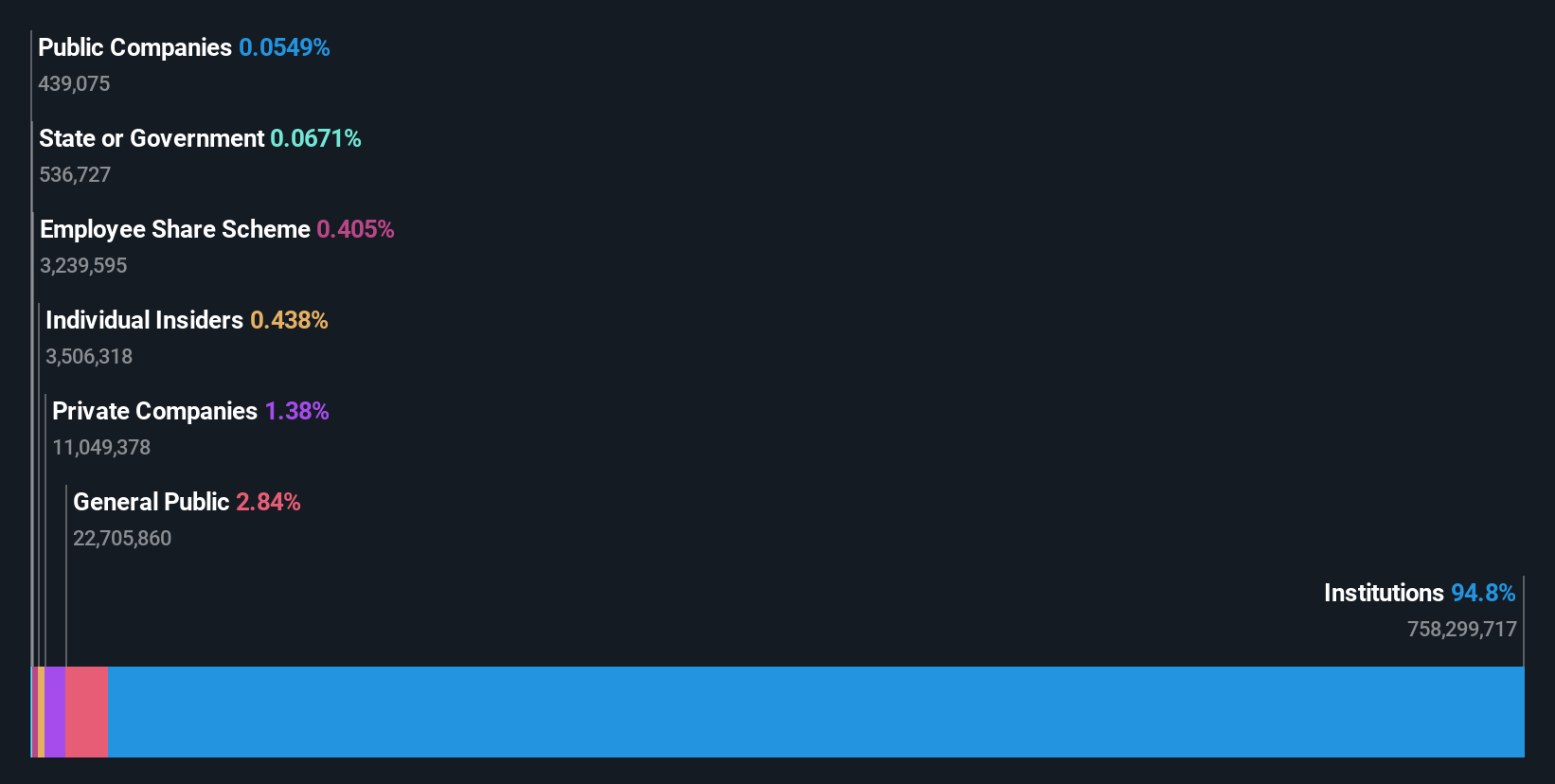

SSP Group (LSE:SSPG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SSP Group operates primarily in the food and beverage sector, focusing on travel locations such as airports and railway stations, with a market cap of approximately £2.24 billion.

Operations: In the most recent fiscal period, the company reported a revenue of £3.21 billion with a corresponding gross profit of £925.40 million, reflecting a gross profit margin of 28.84%. This indicates an efficiency in managing cost of goods sold relative to revenue generation over time.

PE: 176.5x

Amidst challenging financial landscapes, SSP Group's recent declaration of a dividend increase to 1.2 pence per share signals a strategic push to maintain investor confidence. Despite experiencing a slight dip in net profit margins from the previous year and grappling with high-risk funding structures exclusively reliant on external borrowing, insider confidence is evident as they recently purchased shares, underscoring their belief in the company's potential. With earnings projected to grow by over 50% annually, SSP Group exemplifies an intriguing prospect within the undervalued segments of the UK market.

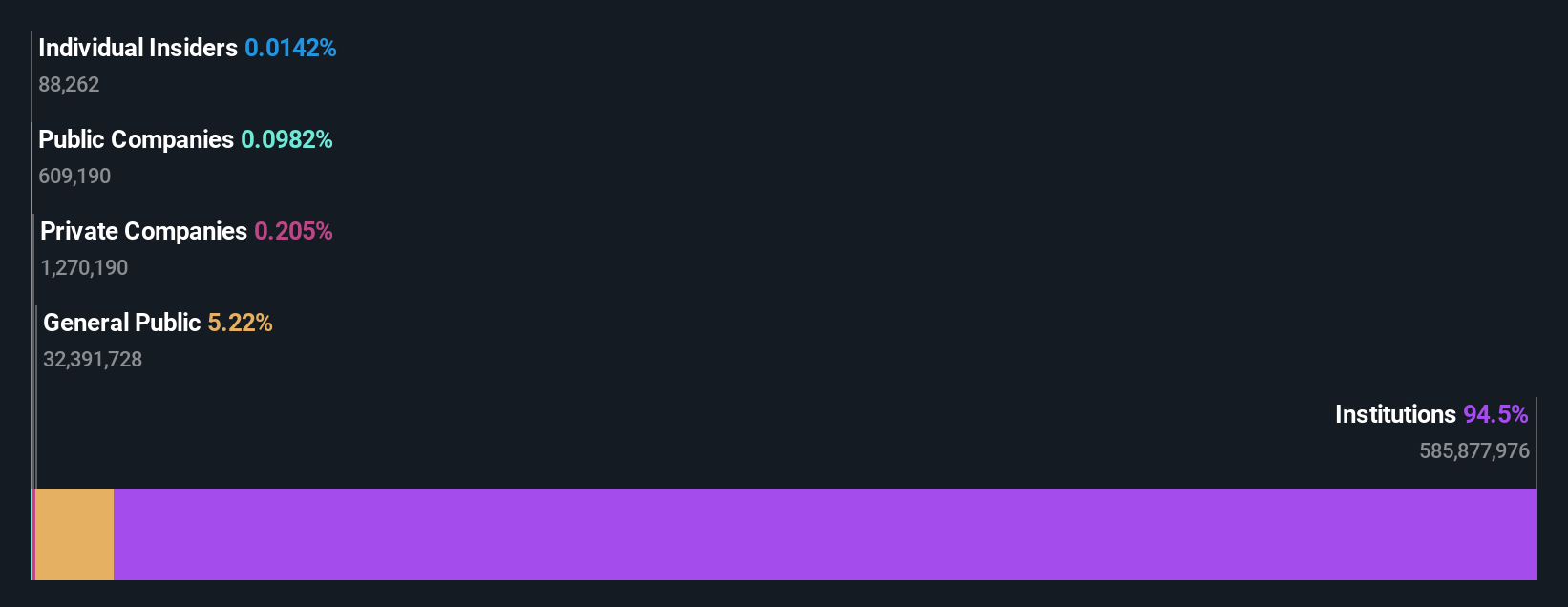

Target Healthcare REIT (LSE:THRL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Target Healthcare REIT is a real estate investment trust specializing in UK care homes, with a market capitalization of approximately £430 million.

Operations: The entity generates revenue primarily through property investments, with a recent reported figure of £67.77 million. It has demonstrated a notable gross profit margin of 89.22% as of the latest reporting period, reflecting efficient cost management relative to its revenue generation.

PE: 8.4x

Target Healthcare REIT has demonstrated a commitment to shareholder returns, recently declaring an interim dividend of 1.428 pence per share, underscoring its stable cash flow generation. With earnings expected to grow by approximately 7.73% annually, this entity reflects promising financial health amid a challenging market environment. Insider confidence is evident as they have recently purchased shares, signaling strong belief in the company’s prospects and stability despite relying solely on external borrowing for funding. This strategic positioning suggests potential for growth and enhanced investor interest in the near future.

Make It Happen

- Reveal the 32 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VCP

Victoria

Designs, manufactures, and distributes flooring products primarily in the United Kingdom, Italy, Belgium, Spain, Australia, the Netherlands, Turkey, France, Ireland, Portugal, and the United States.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives