- United Kingdom

- /

- Consumer Durables

- /

- AIM:SDG

Results: Sanderson Design Group plc Beat Earnings Expectations And Analysts Now Have New Forecasts

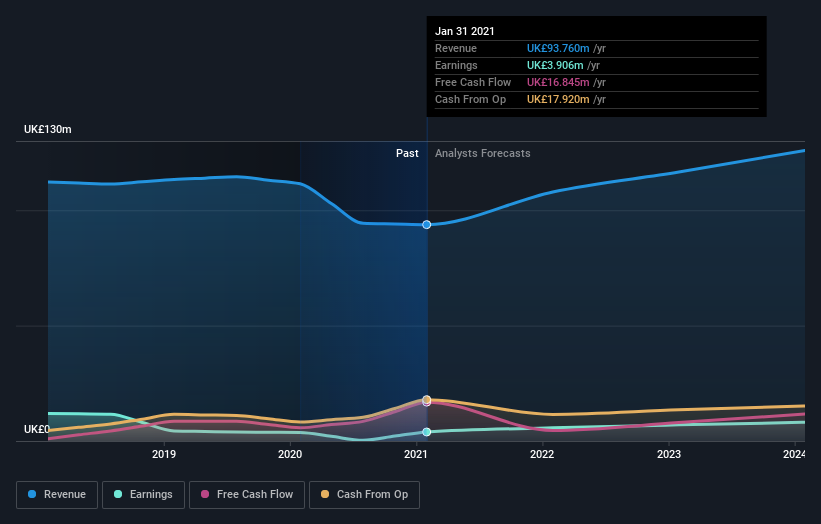

It's been a good week for Sanderson Design Group plc (LON:SDG) shareholders, because the company has just released its latest annual results, and the shares gained 8.2% to UK£1.65. Revenues were UK£94m, approximately in line with whatthe analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at UK£0.054, an impressive 49% ahead of estimates. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Sanderson Design Group

Taking into account the latest results, the most recent consensus for Sanderson Design Group from twin analysts is for revenues of UK£107.9m in 2022 which, if met, would be a notable 15% increase on its sales over the past 12 months. Per-share earnings are expected to leap 22% to UK£0.067. Before this earnings report, the analysts had been forecasting revenues of UK£102.9m and earnings per share (EPS) of UK£0.034 in 2022. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a sizeable expansion in earnings per share in particular.

It will come as no surprise to learn that the analysts have increased their price target for Sanderson Design Group 50% to UK£1.95on the back of these upgrades.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Sanderson Design Group's rate of growth is expected to accelerate meaningfully, with the forecast 15% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 2.8% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 8.9% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Sanderson Design Group is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Sanderson Design Group following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Sanderson Design Group. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Sanderson Design Group , and understanding it should be part of your investment process.

When trading Sanderson Design Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SDG

Sanderson Design Group

Engages in the design, manufacture, marketing, and distribution of interior furnishings, fabrics, and wallpapers worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives