- United Kingdom

- /

- Consumer Durables

- /

- AIM:NTBR

Kodal Minerals Leads Our Top 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite such fluctuations, investors can still find promising opportunities by focusing on smaller or less-established companies that offer solid financials and growth potential. Penny stocks, though an older term, continue to represent a valuable investment area for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.45 | £11.31M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.64 | £529.41M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.07 | £167.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.885 | £13.36M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.39 | £241.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.60 | £93.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.564 | £590.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Kodal Minerals (AIM:KOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kodal Minerals PLC, with a market cap of £64.90 million, is involved in the exploration and evaluation of mineral resources in West Africa through its subsidiaries.

Operations: Kodal Minerals PLC does not report any revenue segments.

Market Cap: £64.9M

Kodal Minerals, with a market cap of £64.90 million, remains pre-revenue as it focuses on mineral exploration in West Africa. The company has recently made significant strides with the official opening of its Bougouni Lithium Project in Mali, which has produced over 45,000 tonnes of spodumene concentrate and targets an annual production of 125,000 tonnes. Despite being debt-free and having stable management tenure, Kodal's share price is highly volatile. The first export shipment from the project is anticipated to generate initial revenues soon, marking a potential shift towards revenue generation for the company.

- Jump into the full analysis health report here for a deeper understanding of Kodal Minerals.

- Examine Kodal Minerals' past performance report to understand how it has performed in prior years.

Northern Bear (AIM:NTBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Bear PLC, with a market cap of £17.68 million, offers building and support services to various organizations including local authorities and construction companies in Northern England and internationally.

Operations: Northern Bear's revenue is primarily derived from three segments: Roofing Activities (£33.81 million), Specialist Building Services Activities (£41.84 million), and Materials Handling Activities (£3.75 million).

Market Cap: £17.68M

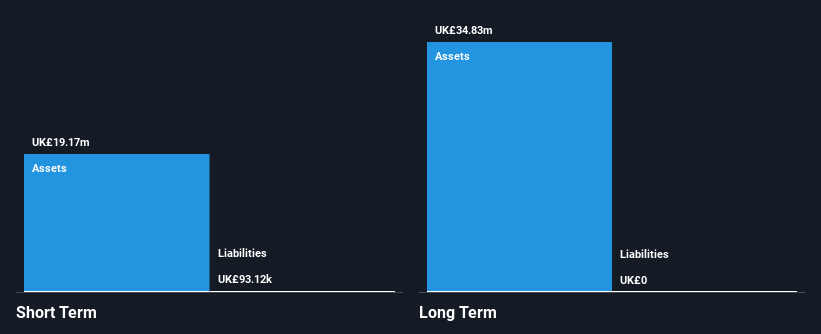

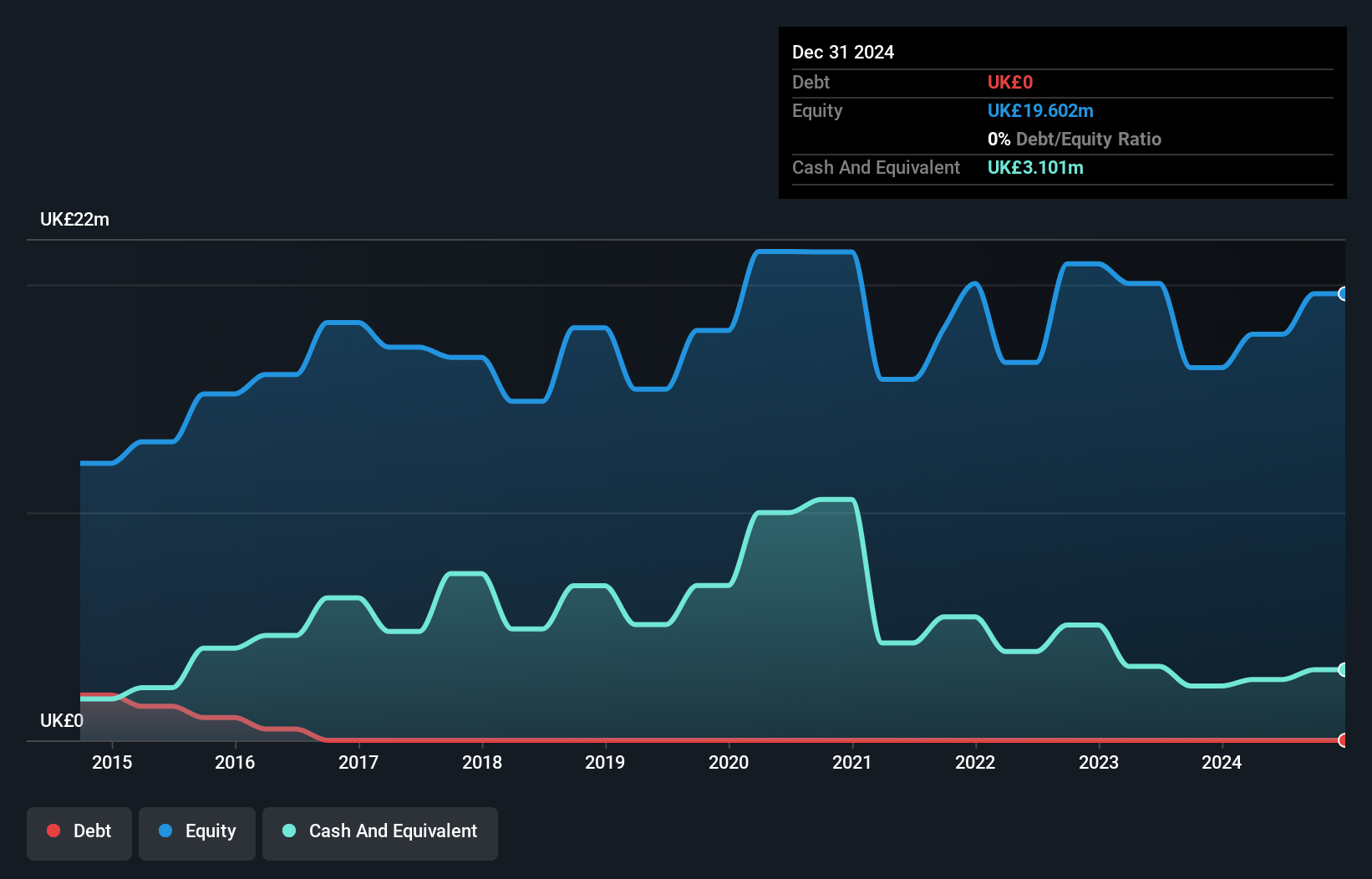

Northern Bear PLC, with a market cap of £17.68 million, presents a compelling case for investors interested in penny stocks due to its valuation and financial stability. Trading significantly below estimated fair value, the company has demonstrated robust earnings growth of 41.9% over the past year and maintains high-quality earnings. Its debt management is prudent, with more cash than total debt and strong interest coverage by EBIT (10.2x). However, while the management team is experienced with an average tenure of 6.4 years, the board's average tenure suggests recent changes that could impact strategic continuity.

- Get an in-depth perspective on Northern Bear's performance by reading our balance sheet health report here.

- Gain insights into Northern Bear's future direction by reviewing our growth report.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and other European territories with a market cap of £128.34 million.

Operations: The company generates revenue from vehicle telematics services primarily in the United Kingdom (£19.46 million), followed by France (£8.53 million), the United States (£3.18 million), and other European territories (£2.77 million).

Market Cap: £128.34M

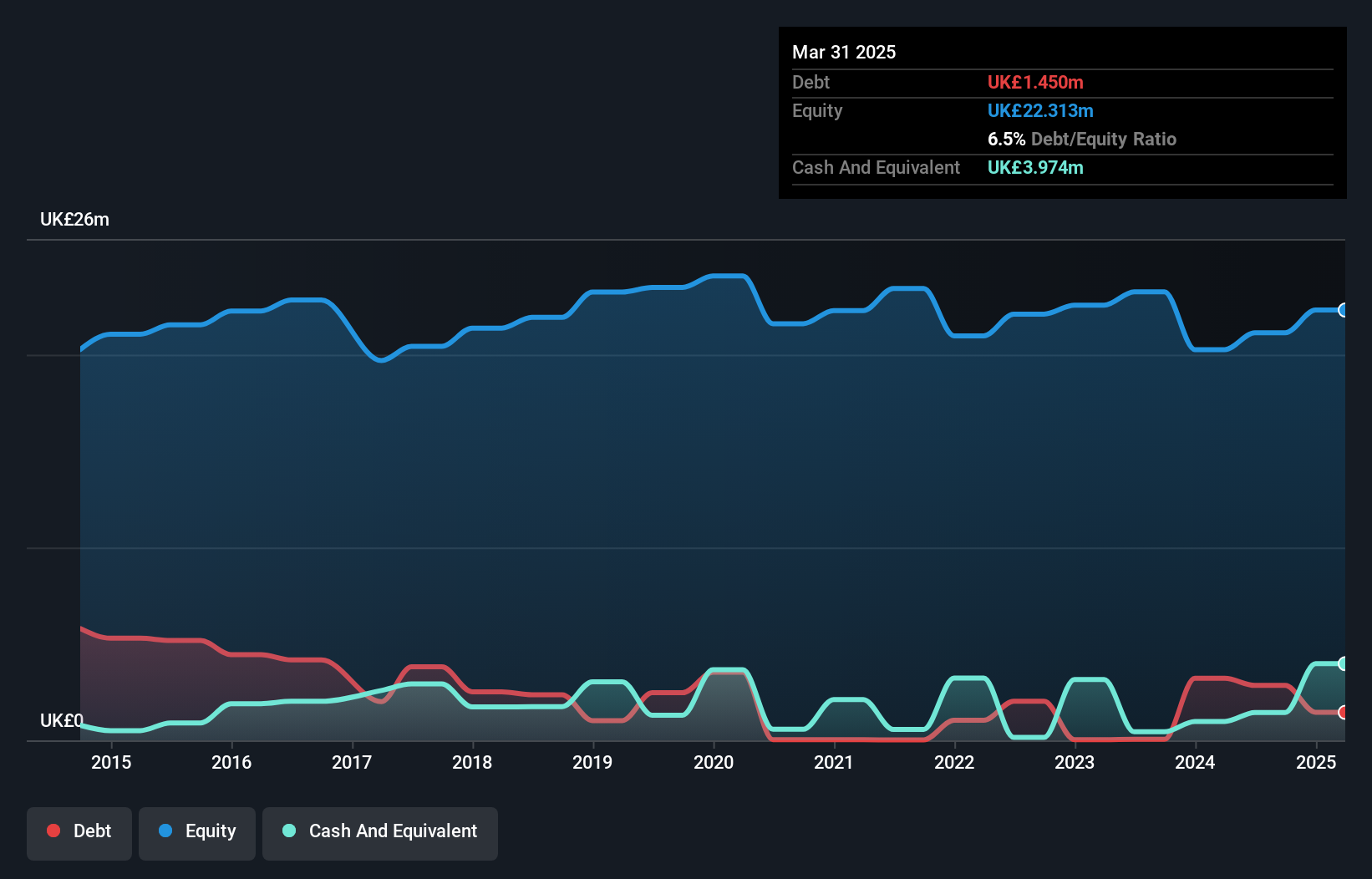

Quartix Technologies plc, with a market cap of £128.34 million, has recently become profitable and is trading at 15.6% below its estimated fair value, making it an intriguing option in the penny stock space. The company is debt-free and boasts high-quality earnings with a strong return on equity of 25%. Short-term assets (£15.4M) comfortably cover both short-term (£9.6M) and long-term liabilities (£1.4M). Despite significant insider selling recently, Quartix's earnings are forecast to grow by 13.46% annually, supported by corporate guidance that anticipates exceeding market estimates for revenue and profit through 2026.

- Unlock comprehensive insights into our analysis of Quartix Technologies stock in this financial health report.

- Explore Quartix Technologies' analyst forecasts in our growth report.

Where To Now?

- Embark on your investment journey to our 298 UK Penny Stocks selection here.

- Want To Explore Some Alternatives? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Bear might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NTBR

Northern Bear

Provides building and support services to local authorities, housing associations, NHS trusts, universities, construction companies, and national house builders in Northern England and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives