- United Kingdom

- /

- Luxury

- /

- AIM:MUL

Earnings are growing at Mulberry Group (LON:MUL) but shareholders still don't like its prospects

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Mulberry Group plc (LON:MUL) shareholders for doubting their decision to hold, with the stock down 50% over a half decade. Furthermore, it's down 34% in about a quarter. That's not much fun for holders.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Mulberry Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Mulberry Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We don't think that the 0.6% is big factor in the share price, since it's quite small, as dividends go. It could be that the revenue decline of 3.2% per year is viewed as evidence that Mulberry Group is shrinking. This has probably encouraged some shareholders to sell down the stock.

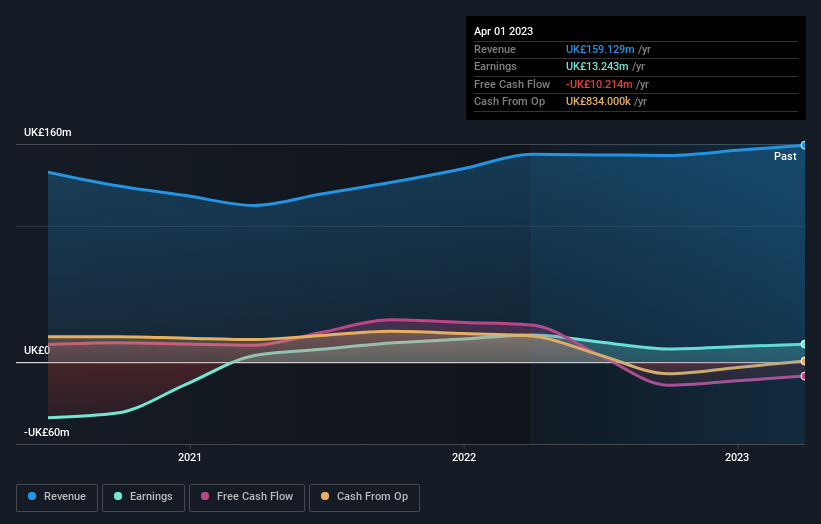

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Mulberry Group had a tough year, with a total loss of 19% (including dividends), against a market gain of about 2.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Mulberry Group (of which 1 can't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MUL

Mulberry Group

Designs and manufactures fashion accessories and clothing in the United Kingdom, Asia Pacific, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives