- United Kingdom

- /

- Consumer Durables

- /

- AIM:IGR

2.3% earnings growth over 5 years has not materialized into gains for IG Design Group (LON:IGR) shareholders over that period

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held IG Design Group plc (LON:IGR) for five years would be nursing their metaphorical wounds since the share price dropped 83% in that time. We also note that the stock has performed poorly over the last year, with the share price down 25%. Shareholders have had an even rougher run lately, with the share price down 46% in the last 90 days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

If the past week is anything to go by, investor sentiment for IG Design Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for IG Design Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, IG Design Group moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 7.5% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

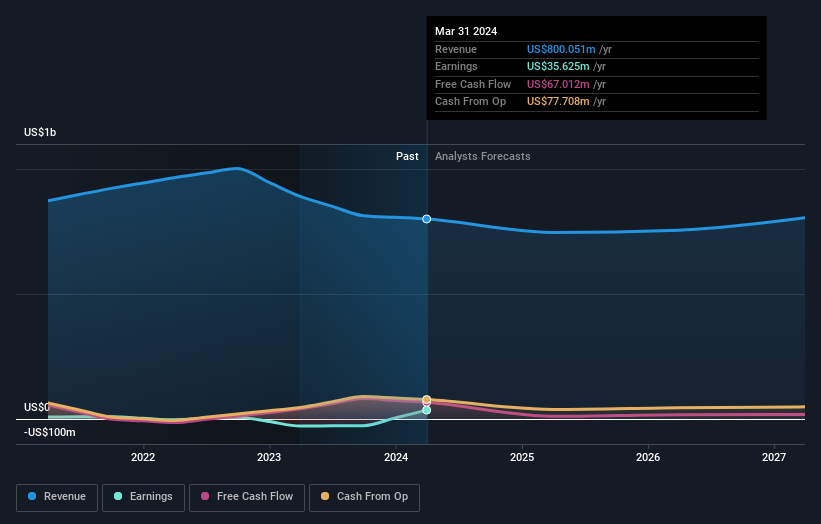

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how IG Design Group has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling IG Design Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

IG Design Group shareholders are down 25% for the year, but the market itself is up 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for IG Design Group you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IGR

IG Design Group

Engages in the design, production, and distribution of celebrations, craft and creative play, stationery, gifting, and not for re-sale consumable products in the Americas, the United Kingdom, Netherlands, and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives