- United Kingdom

- /

- Professional Services

- /

- LSE:RCDO

Ricardo's (LON:RCDO) Dividend Will Be Increased To £0.0861

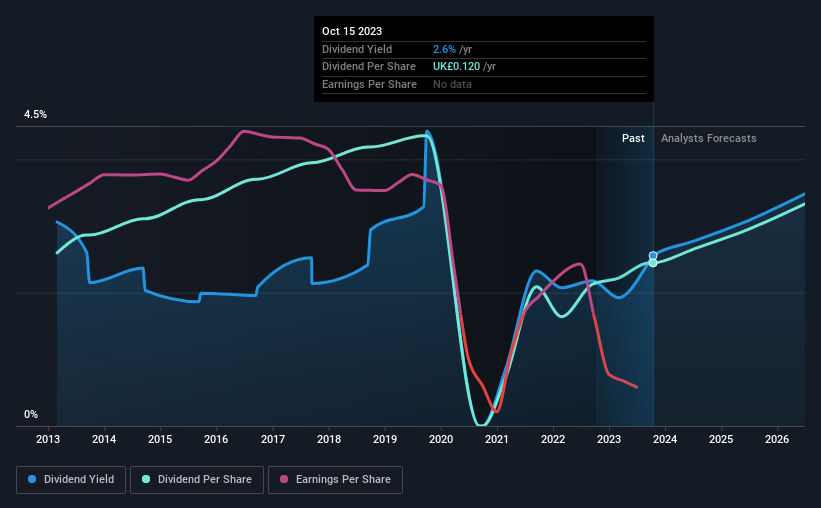

Ricardo plc's (LON:RCDO) dividend will be increasing from last year's payment of the same period to £0.0861 on 24th of November. This makes the dividend yield about the same as the industry average at 2.6%.

View our latest analysis for Ricardo

Ricardo's Dividend Is Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Ricardo is unprofitable despite paying a dividend, and it is paying out 213% of its free cash flow. This makes us feel that the dividend will be hard to maintain.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 18%, which we would be comfortable to see continuing.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the annual payment back then was £0.127, compared to the most recent full-year payment of £0.12. Payments have been decreasing at a very slow pace in this time period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Ricardo's earnings per share has shrunk at 54% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Ricardo's Dividend Doesn't Look Great

In conclusion, we have some concerns about this dividend, even though it being raised is good. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Ricardo that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RCDO

Ricardo

Provides environmental, technical, and strategic consultancy services in the United Kingdom, Europe, North America, China, rest of Asia, Australia, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives