- United Kingdom

- /

- Biotech

- /

- LSE:GNS

UK's September 2025 Stock Picks Possibly Trading Below Fair Value

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index struggles amidst weak trade data from China and declining commodity prices, investors are closely monitoring the market for opportunities. In such uncertain times, identifying stocks that may be trading below their fair value can provide a potential advantage, offering a chance to invest in fundamentally strong companies at attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SigmaRoc (AIM:SRC) | £1.214 | £2.40 | 49.4% |

| PageGroup (LSE:PAGE) | £2.24 | £4.42 | 49.3% |

| Mitie Group (LSE:MTO) | £1.378 | £2.61 | 47.2% |

| Likewise Group (AIM:LIKE) | £0.27 | £0.52 | 48.2% |

| Hollywood Bowl Group (LSE:BOWL) | £2.56 | £4.87 | 47.4% |

| Gym Group (LSE:GYM) | £1.47 | £2.93 | 49.8% |

| Gooch & Housego (AIM:GHH) | £5.40 | £10.73 | 49.7% |

| Essentra (LSE:ESNT) | £1.062 | £1.98 | 46.3% |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £2.21 | 46.6% |

| AstraZeneca (LSE:AZN) | £112.58 | £224.00 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Genus (LSE:GNS)

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.57 billion.

Operations: Genus generates its revenue primarily from two segments: Genus ABS, including operations in Asia, which accounts for £307.70 million, and Genus PIC, also including Asia, contributing £362.90 million.

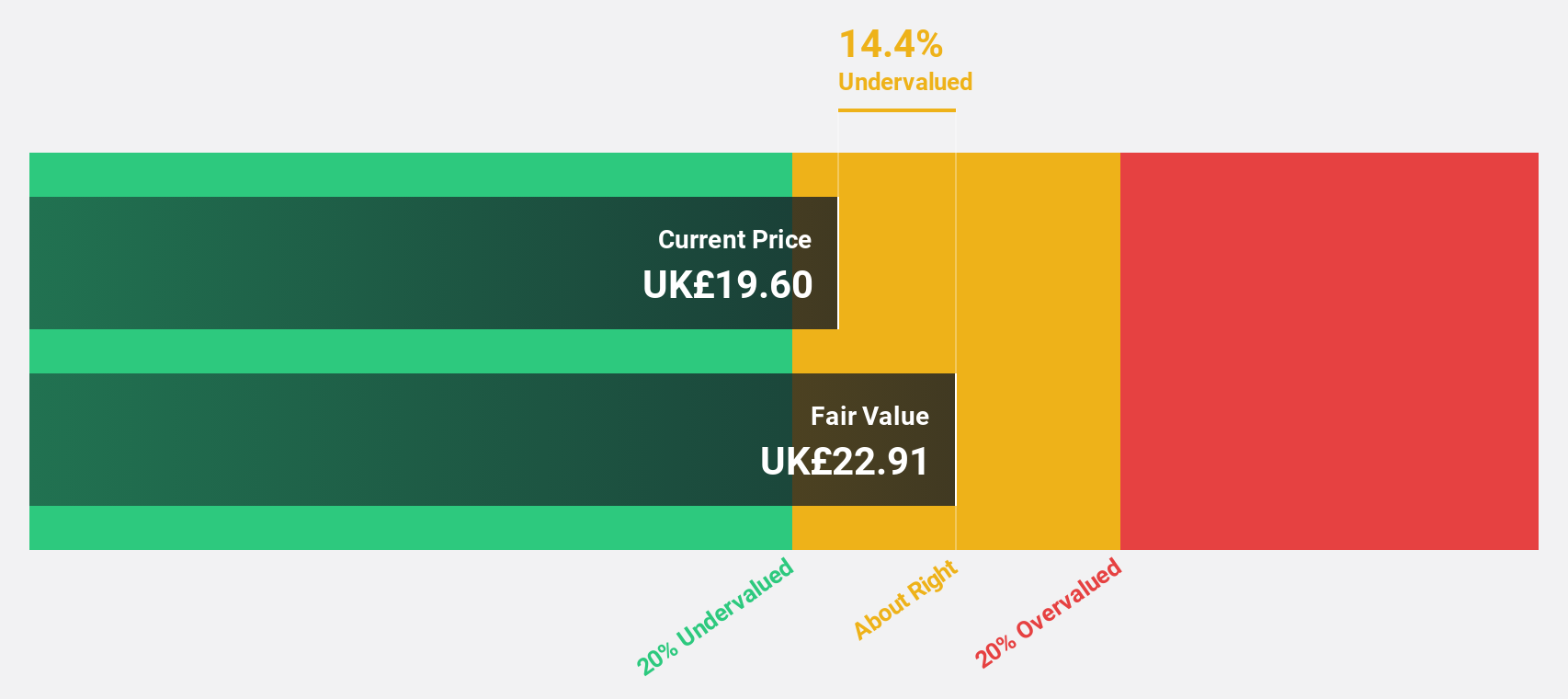

Estimated Discount To Fair Value: 10.8%

Genus plc's strategic alliance in China accelerates the formation of a joint venture, enhancing cash flow prospects. The company reported significant earnings growth with net income rising to £19.3 million from £7.9 million, despite large one-off items affecting results. While trading 10.8% below fair value at £23.7, its expected annual profit growth outpaces the UK market significantly at 24.8%. However, revenue growth remains modest at 4.3% per year compared to broader market expectations.

- Our expertly prepared growth report on Genus implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Genus.

On the Beach Group (LSE:OTB)

Overview: On the Beach Group plc is an online retailer specializing in short haul beach holidays under the On the Beach brand in the United Kingdom, with a market cap of £402.92 million.

Operations: The company's revenue is primarily derived from its OTB segment, including Onthebeach.Co.Uk and Sunshine.Co.Uk, which accounts for £122.30 million, while the Classic Collection contributes £10.20 million.

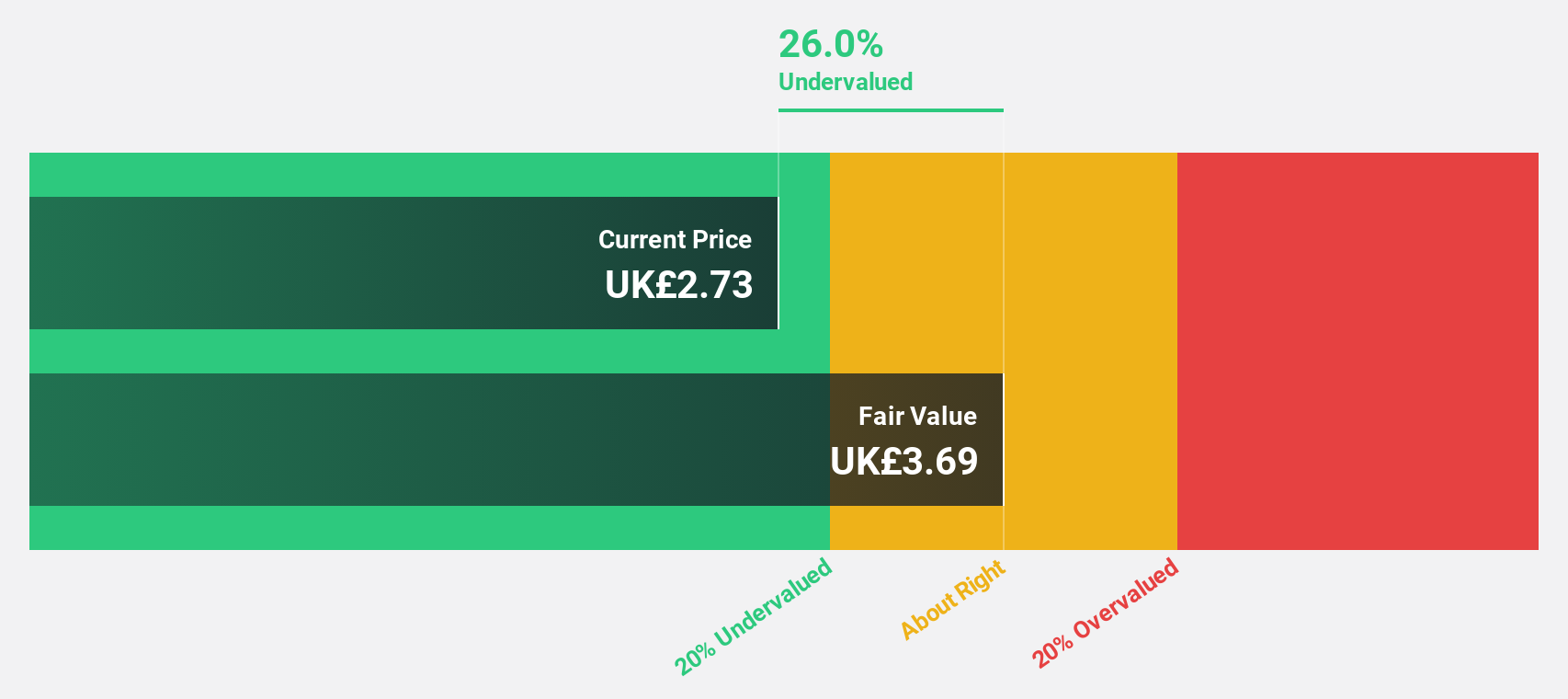

Estimated Discount To Fair Value: 38.8%

On the Beach Group is trading 38.8% below its estimated fair value, with a current price of £2.58 compared to a fair value of £4.21, indicating potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 24.3% annually, outpacing the UK market's growth rate of 13.9%. However, revenue growth is expected at 10.4% per year, which is slower than desired but still exceeds the broader UK market's average growth rate.

- The growth report we've compiled suggests that On the Beach Group's future prospects could be on the up.

- Take a closer look at On the Beach Group's balance sheet health here in our report.

PageGroup (LSE:PAGE)

Overview: PageGroup plc, along with its subsidiaries, offers recruitment consultancy and related services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas with a market cap of £698.94 million.

Operations: The company's revenue segment is primarily derived from recruitment services, totaling £1.64 billion.

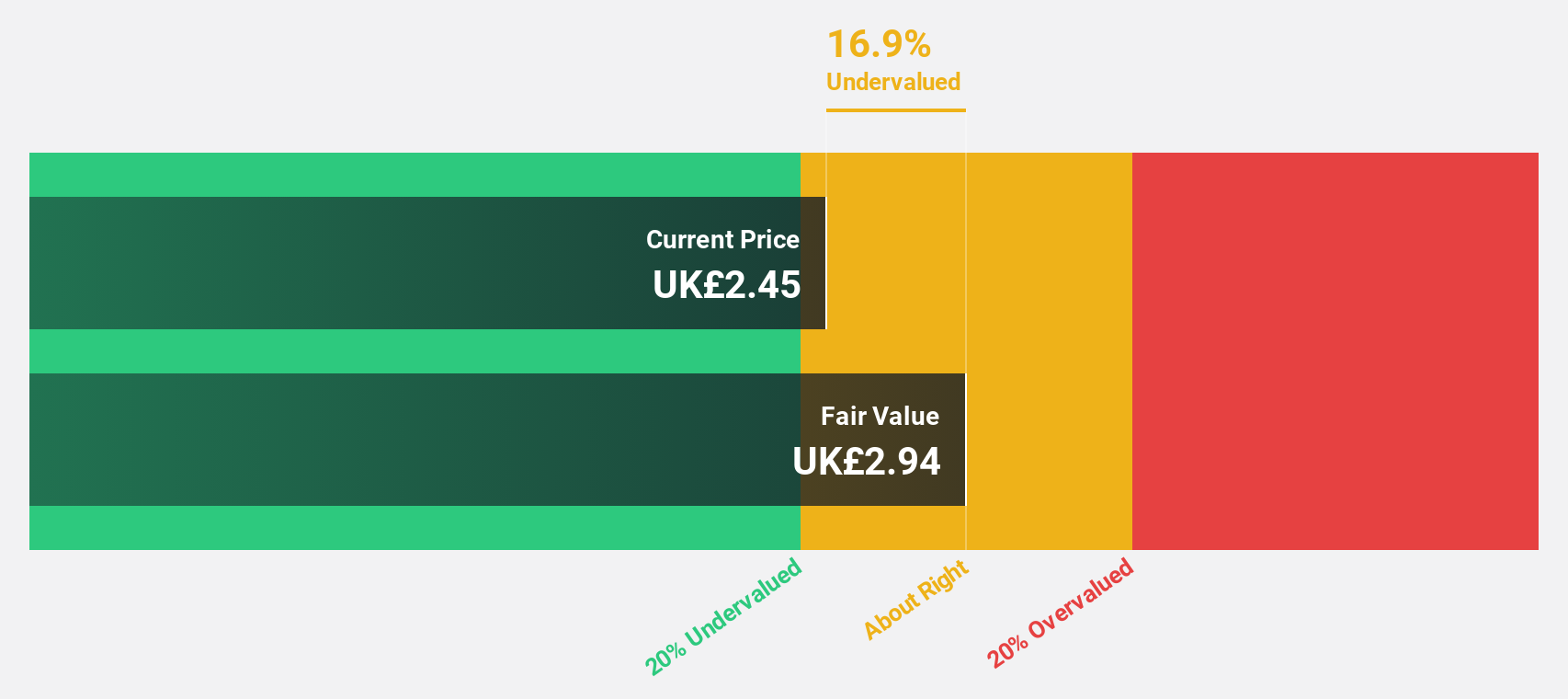

Estimated Discount To Fair Value: 49.3%

PageGroup is trading 49.3% below its estimated fair value of £4.42, with a current price of £2.24, highlighting potential undervaluation based on cash flows. Despite a challenging period with net income dropping to £0.146 million from £16.78 million last year, earnings are projected to grow significantly at 69.9% annually, far exceeding the UK market's growth rate of 13.9%. However, revenue growth remains modest at 1.9%, trailing the broader market's average rate of 4.1%.

- Our growth report here indicates PageGroup may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of PageGroup.

Make It Happen

- Investigate our full lineup of 51 Undervalued UK Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Produces and sells animal genetics to farmers in North America, Latin America, the United Kingdom, the rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives