- United Kingdom

- /

- Professional Services

- /

- LSE:PAGE

Be Sure To Check Out PageGroup plc (LON:PAGE) Before It Goes Ex-Dividend

It looks like PageGroup plc (LON:PAGE) is about to go ex-dividend in the next four days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase PageGroup's shares on or after the 19th of May will not receive the dividend, which will be paid on the 17th of June.

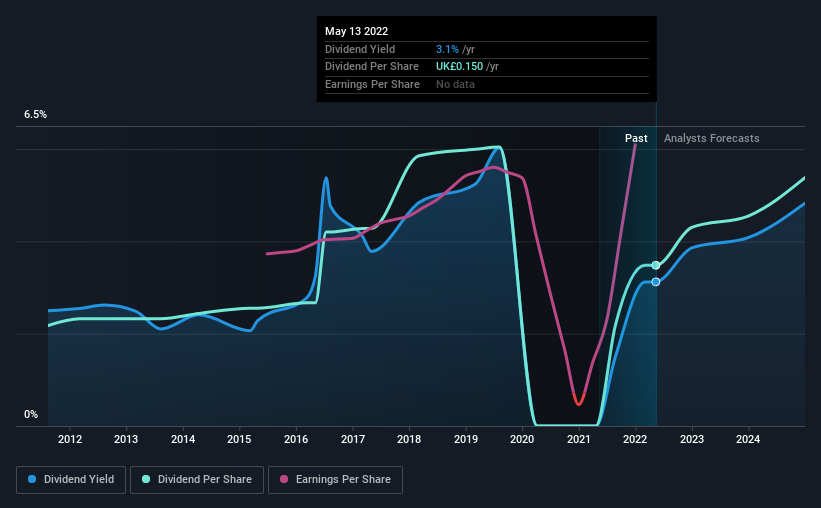

The company's next dividend payment will be UK£0.10 per share. Last year, in total, the company distributed UK£0.15 to shareholders. Last year's total dividend payments show that PageGroup has a trailing yield of 3.1% on the current share price of £4.802. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for PageGroup

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. PageGroup paid out a comfortable 40% of its profit last year. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Luckily it paid out just 12% of its free cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, PageGroup's earnings per share have been growing at 10% a year for the past five years. The company has managed to grow earnings at a rapid rate, while reinvesting most of the profits within the business. Fast-growing businesses that are reinvesting heavily are enticing from a dividend perspective, especially since they can often increase the payout ratio later.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. PageGroup has delivered an average of 4.8% per year annual increase in its dividend, based on the past 10 years of dividend payments. Earnings per share have been growing much quicker than dividends, potentially because PageGroup is keeping back more of its profits to grow the business.

Final Takeaway

Is PageGroup an attractive dividend stock, or better left on the shelf? It's great that PageGroup is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. PageGroup looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. Every company has risks, and we've spotted 2 warning signs for PageGroup you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:PAGE

PageGroup

Provides recruitment consultancy and other ancillary services in the United Kingdom, rest of Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026