- United Kingdom

- /

- Hospitality

- /

- LSE:DOM

Exploring United Kingdom's Undervalued Small Caps With Insider Buying In November 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, a key trading partner. In this environment, identifying small-cap stocks that are potentially undervalued and exhibit insider buying can be appealing to investors seeking opportunities in sectors less impacted by global economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.2x | 0.6x | 37.47% | ★★★★★★ |

| NWF Group | 8.2x | 0.1x | 39.16% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 39.75% | ★★★★★☆ |

| J D Wetherspoon | 15.0x | 0.4x | 12.46% | ★★★★★☆ |

| Genus | 174.6x | 2.1x | 13.06% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 28.34% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 40.58% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 37.42% | ★★★★☆☆ |

| Sabre Insurance Group | 11.6x | 1.5x | 12.82% | ★★★☆☆☆ |

| THG | NA | 0.4x | -271.22% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

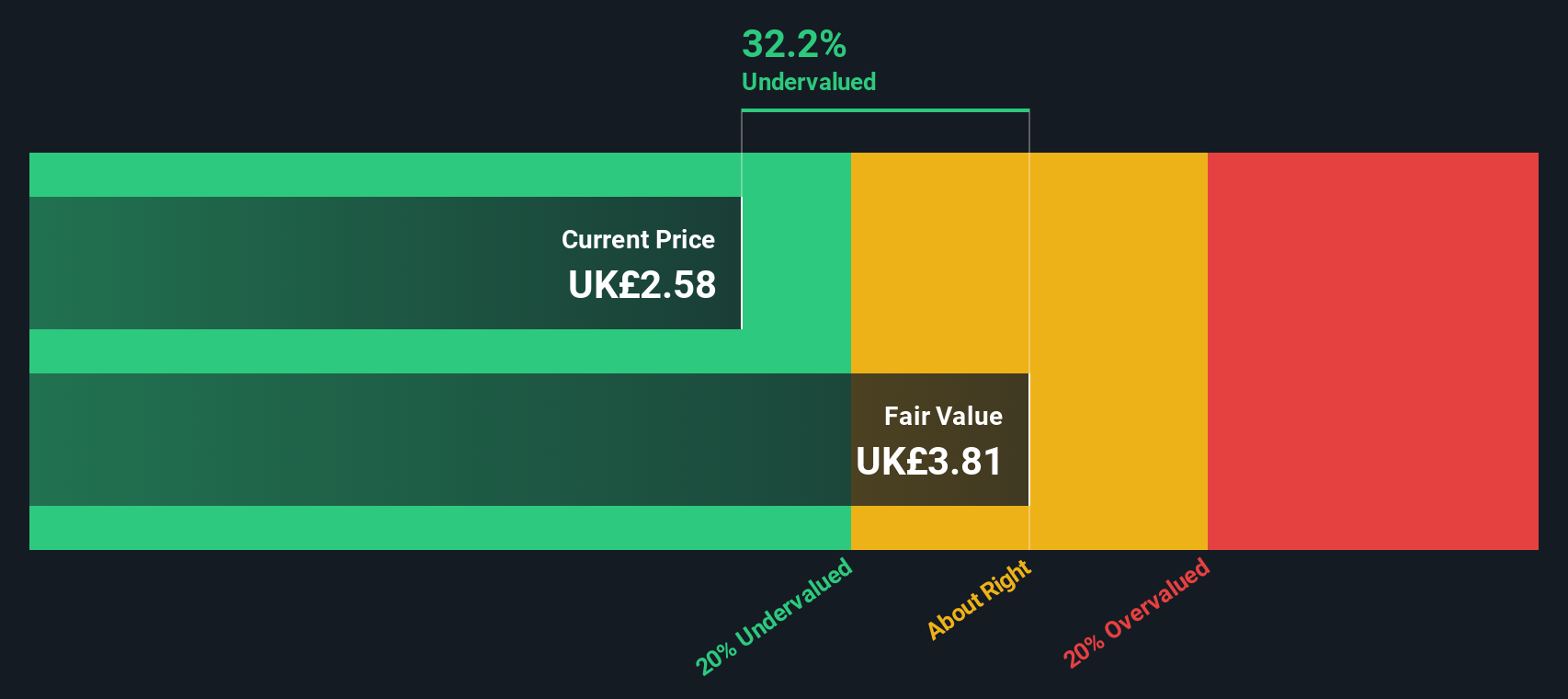

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery and carryout chain, generating income from sales to franchisees, corporate stores, advertising and ecommerce, rental properties, and various franchise fees with a market capitalization of £1.56 billion.

Operations: The primary revenue streams include sales to franchisees, corporate store income, and royalties. The cost of goods sold (COGS) is a significant expense, impacting the gross profit margin which reached 47.48% in June 2024. Operating expenses are substantial, with general and administrative costs being a major component. Net income margins have shown variability, peaking at 18.28% in June 2023 before declining to 11.44% by November 2024.

PE: 15.9x

Domino's Pizza Group, a smaller company in the UK market, has seen its net income dip to £42.3 million for H1 2024 from £80.2 million a year ago, with sales slightly down at £326.8 million. Despite these challenges and higher risk funding due to reliance on external borrowing, insider confidence is evident through share repurchase activities authorized up to August 2025. The company forecasts growth in orders and like-for-like sales for the fiscal year 2024 amidst strategic initiatives execution.

- Unlock comprehensive insights into our analysis of Domino's Pizza Group stock in this valuation report.

Evaluate Domino's Pizza Group's historical performance by accessing our past performance report.

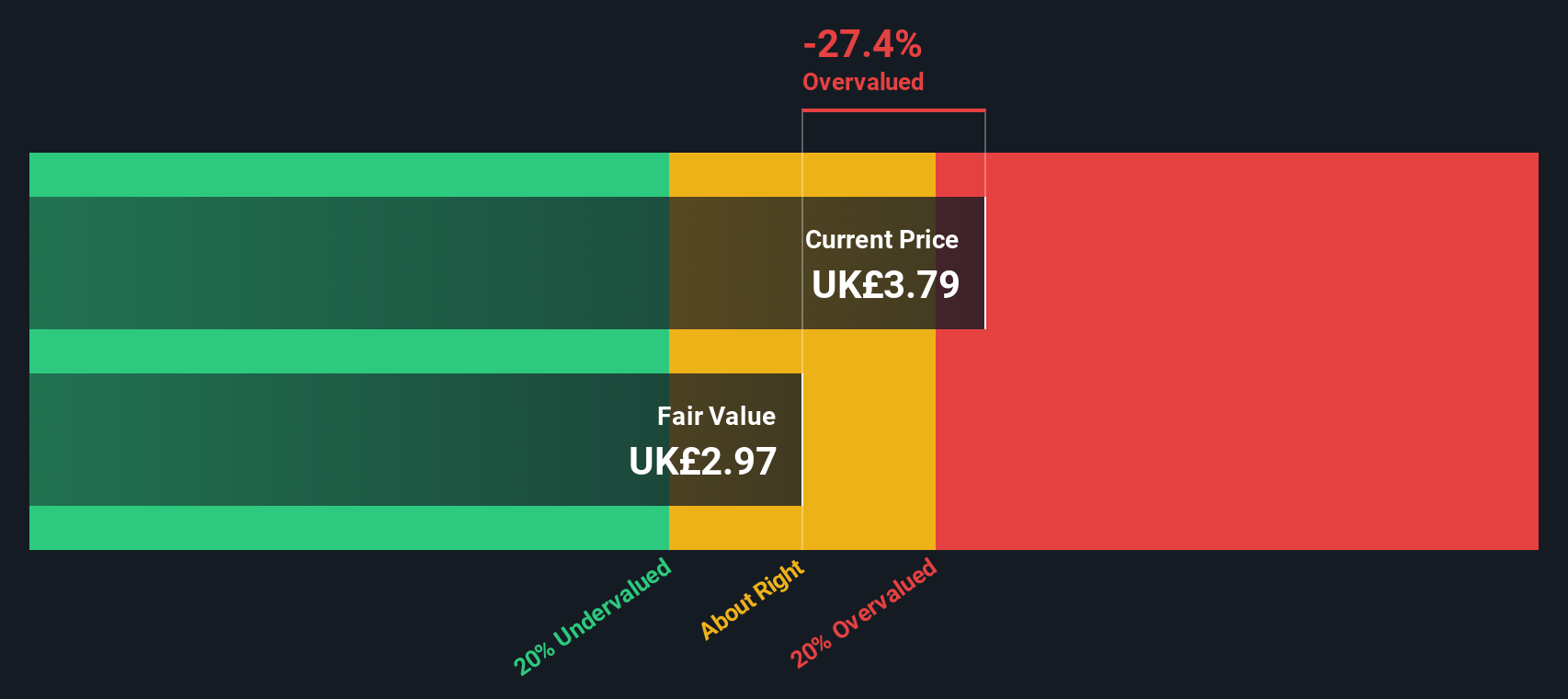

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mears Group is a UK-based company specializing in providing management and maintenance services, with a market capitalization of £0.35 billion.

Operations: The company's revenue streams are primarily derived from management (£591.63 million) and maintenance (£551.73 million). Over recent periods, the gross profit margin has shown an upward trend, reaching 21.68% by mid-2024. Operating expenses have consistently included significant general and administrative costs, which were £183.19 million in the latest period reported.

PE: 7.7x

Mears Group, a UK-based company with a market cap under £1 billion, recently updated its earnings guidance for 2024, projecting revenues of approximately £1.13 billion. Despite forecasts indicating an average annual earnings decline of 15.3% over the next three years, the company has demonstrated insider confidence through share repurchase activities since August 2024. The board also increased dividends to 4.75 pence per share from last year's 3.70 pence, reflecting potential value for investors amidst higher-risk external funding reliance and no customer deposits.

- Click to explore a detailed breakdown of our findings in Mears Group's valuation report.

Explore historical data to track Mears Group's performance over time in our Past section.

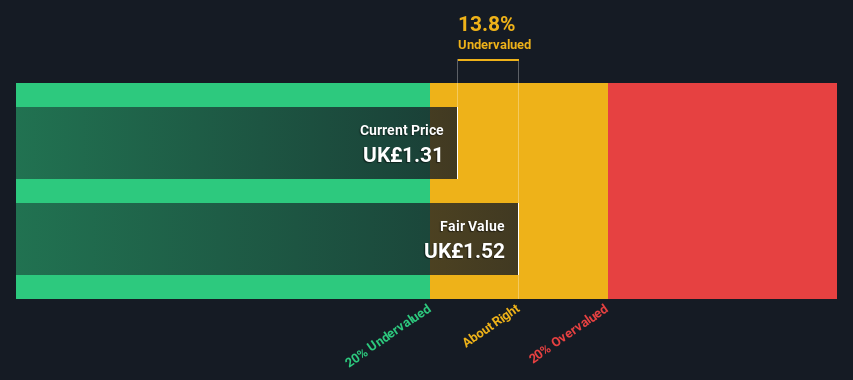

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre Insurance Group is a UK-based insurer specializing in providing coverage for motor vehicles, including taxis and motorcycles, with a market capitalization of £0.25 billion.

Operations: Sabre Insurance Group generates revenue primarily from motor vehicle insurance, with significant contributions from taxi and motorcycle segments. The company has experienced fluctuations in its gross profit margin, which was 37.30% as of June 2024. Operating expenses are a notable component of the cost structure, impacting overall profitability.

PE: 11.6x

Sabre Insurance Group, a UK-based company, has caught attention with its recent insider confidence. Insiders have been buying shares over the past six months, indicating belief in the company's potential. Despite relying on external borrowing for funding, Sabre's earnings are projected to grow by 15.73% annually. Recent trading results show an increase in gross written premiums to £186.5 million for the nine months ending September 2024 from £162.2 million last year, suggesting positive momentum in operations and growth prospects.

Taking Advantage

- Dive into all 25 of the Undervalued UK Small Caps With Insider Buying we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DOM

Domino's Pizza Group

Domino’s Pizza Group plc owns, operates, and franchises Domino’s Pizza stores in the United Kingdom and Ireland.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives