- United Kingdom

- /

- Professional Services

- /

- LSE:ITRK

What Can We Conclude About Intertek Group's (LON:ITRK) CEO Pay?

This article will reflect on the compensation paid to André Pierre Lacroix who has served as CEO of Intertek Group plc (LON:ITRK) since 2015. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Intertek Group.

See our latest analysis for Intertek Group

How Does Total Compensation For André Pierre Lacroix Compare With Other Companies In The Industry?

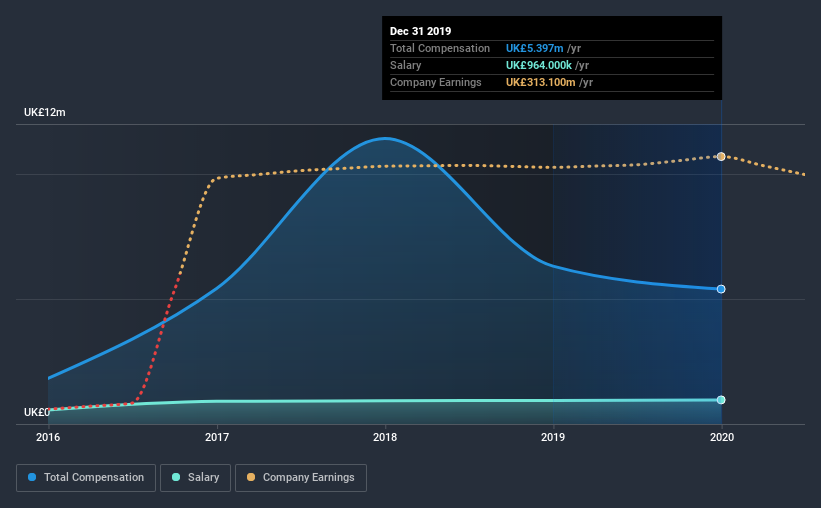

According to our data, Intertek Group plc has a market capitalization of UK£9.5b, and paid its CEO total annual compensation worth UK£5.4m over the year to December 2019. We note that's a decrease of 15% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£964k.

For comparison, other companies in the industry with market capitalizations above UK£5.9b, reported a median total CEO compensation of UK£6.4m. This suggests that Intertek Group remunerates its CEO largely in line with the industry average. Moreover, André Pierre Lacroix also holds UK£25m worth of Intertek Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£964k | UK£945k | 18% |

| Other | UK£4.4m | UK£5.4m | 82% |

| Total Compensation | UK£5.4m | UK£6.3m | 100% |

On an industry level, roughly 80% of total compensation represents salary and 20% is other remuneration. It's interesting to note that Intertek Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Intertek Group plc's Growth

Intertek Group plc has reduced its earnings per share by 1.3% a year over the last three years. In the last year, its revenue changed by just 0.7%.

Its a bit disappointing to see that the company has failed to grow its EPS. And the flat revenue is seriously uninspiring. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Intertek Group plc Been A Good Investment?

Intertek Group plc has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we noted earlier, Intertek Group pays its CEO in line with similar-sized companies belonging to the same industry. Intertek Group has had a poor showing when it comes to EPS growth, and it's tough to say that shareholder returns have done much to excite us. These figures do not go well against CEO compensation, which is more or less equal to the industry median. We would stop short of the compensation is inappropriate, but we can't say the executive is underpaid.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Intertek Group that investors should think about before committing capital to this stock.

Switching gears from Intertek Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Intertek Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:ITRK

Intertek Group

Provides quality assurance solutions to various industries in the United Kingdom, the United States, China, Australia, and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives