- United Kingdom

- /

- Professional Services

- /

- LSE:EXPN

Experian plc (LON:EXPN) Just Reported Half-Year Earnings: Have Analysts Changed Their Mind On The Stock?

Shareholders might have noticed that Experian plc (LON:EXPN) filed its half-yearly result this time last week. The early response was not positive, with shares down 7.5% to UK£29.33 in the past week. Experian reported in line with analyst predictions, delivering revenues of US$2.5b and statutory earnings per share of US$0.74, suggesting the business is executing well and in line with its plan. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Experian

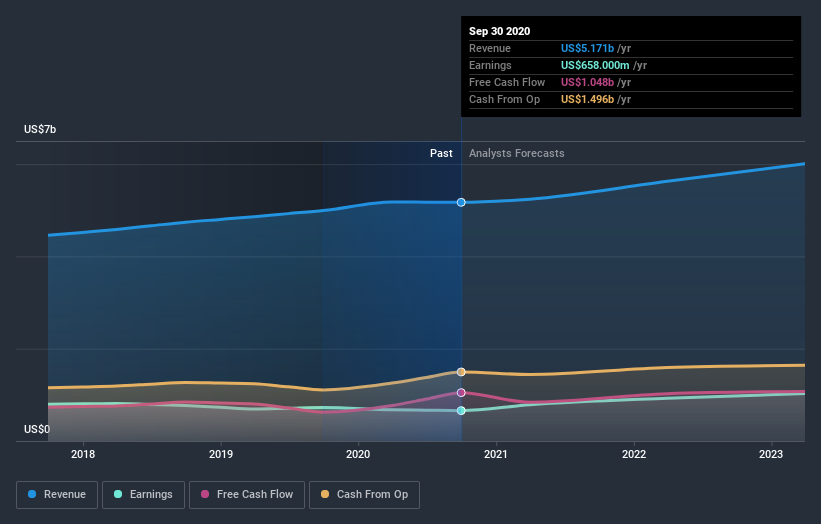

Following last week's earnings report, Experian's 14 analysts are forecasting 2021 revenues to be US$5.24b, approximately in line with the last 12 months. Statutory earnings per share are predicted to shoot up 30% to US$0.95. In the lead-up to this report, the analysts had been modelling revenues of US$5.18b and earnings per share (EPS) of US$0.89 in 2021. So the consensus seems to have become somewhat more optimistic on Experian's earnings potential following these results.

The consensus price target was unchanged at US$39.79, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Experian, with the most bullish analyst valuing it at US$36.44 and the most bearish at US$18.86 per share. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Experian's revenue growth will slow down substantially, with revenues next year expected to grow 1.3%, compared to a historical growth rate of 4.4% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 6.2% next year. Factoring in the forecast slowdown in growth, it seems obvious that Experian is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Experian following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Experian's revenues are expected to perform worse than the wider industry. The consensus price target held steady at US$39.79, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Experian. Long-term earnings power is much more important than next year's profits. We have forecasts for Experian going out to 2023, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Experian that you should be aware of.

If you decide to trade Experian, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Experian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:EXPN

Experian

Operates as a data and technology company in North America, Latin America, the United Kingdom, Ireland, Europe, the Middle East, Africa, and the Asia Pacific.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives