- United Kingdom

- /

- Professional Services

- /

- LSE:EXPN

Experian (LSE:EXPN) Leverages Generative AI and Cloud Investments to Drive Q4 Growth and Client Engagement

Reviewed by Simply Wall St

Experian (LSE:EXPN) is currently navigating a dynamic period marked by both growth and challenges. Recent developments include strong organic growth in FY '24 and strategic investments in generative AI, contrasted with concerns over high valuation and a challenging macro environment in the UK. In the discussion that follows, we will explore Experian's core strengths, critical weaknesses, growth opportunities, and potential threats to provide a comprehensive overview of the company's current business situation.

Get an in-depth perspective on Experian's performance by reading our analysis here.

Strengths: Core Advantages Driving Sustained Success For Experian

Experian has demonstrated strong organic growth, particularly in FY '24, with a solid finish in Q4, as highlighted by CEO Brian Cassin. The company's diverse portfolio, coupled with contributions from newer products, has enabled it to navigate challenging market conditions effectively. Client engagement remains high, evidenced by a five-year streak of improved Net Promoter Scores (NPS). Financially, Experian is in a strong position with a 97% cash conversion rate, underscoring its operational efficiency. Additionally, the company has successfully completed several acquisitions, strengthening its foundations and advancing its technology infrastructure with significant investments in cloud-native technologies and generative AI.

To gain deeper insights into Experian's historical performance, explore our detailed analysis of past performance.Weaknesses: Critical Issues Affecting Experian's Performance and Areas For Growth

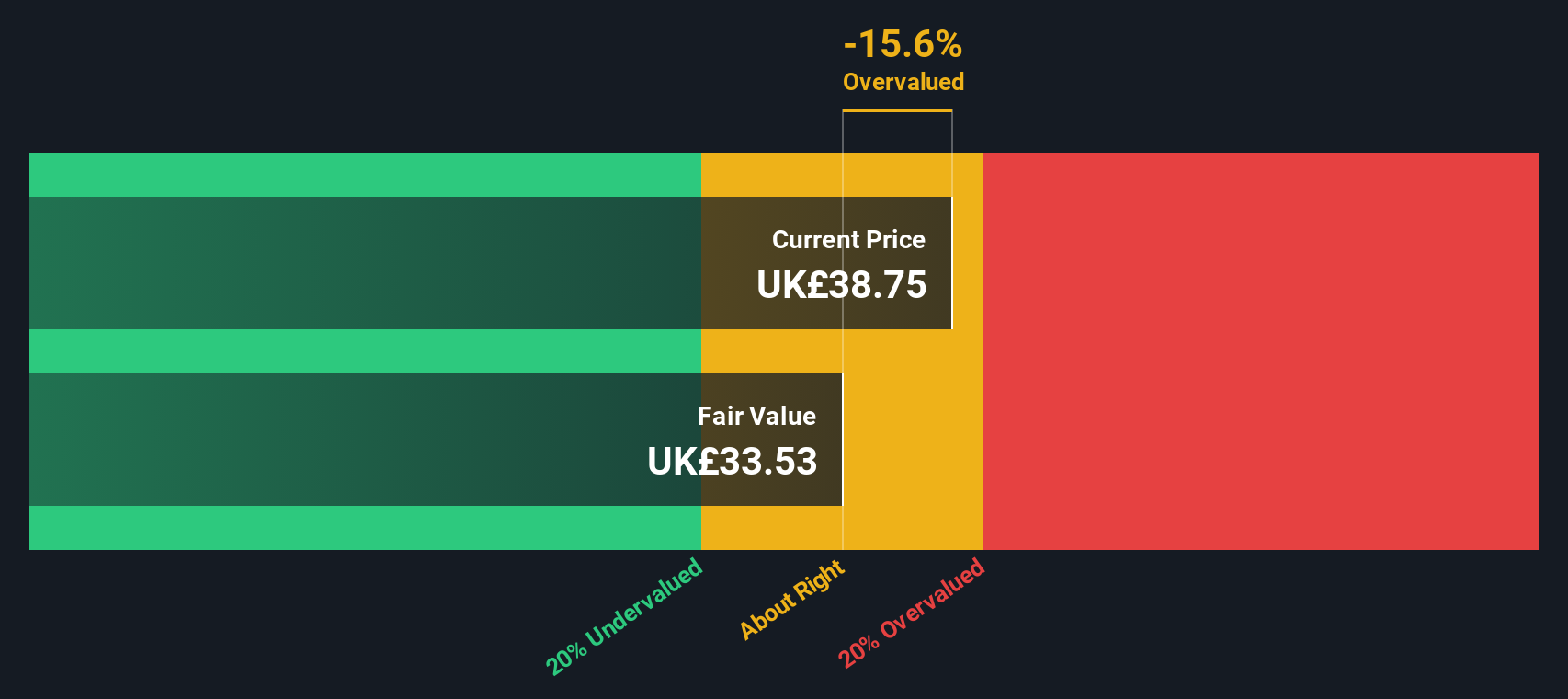

Experian faces several challenges. The company is considered expensive based on its Price-To-Earnings Ratio (39.9x) compared to the peer average (33.3x) and the UK Professional Services industry average (23x). Market challenges persist, with weak like-for-like volumes in credit services, although new client wins and market segment expansions have mitigated some of these issues. The tight supply of unsecured credit remains a concern, albeit the pace of tightening has slowed. In the UK, the macro environment has been particularly weak, resulting in only 2% organic revenue growth. Additionally, the current credit environment shows little sign of improvement, impacting lending volumes.

To dive deeper into how Experian's valuation metrics are shaping its market position, check out our detailed analysis of Experian's Valuation.Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Experian is well-positioned to capitalize on several growth opportunities. The company is making strategic progress with market expansion into new verticals. The insurance marketplace has had a stellar year, reaching an inflection point that could drive future growth. Investments in generative AI are expected to unlock new revenue streams and enhance client engagement. A strong roadmap for new product introductions in FY '25 further bolsters growth prospects. Experian's ability to leverage its large consumer membership bases for cross-selling opportunities demonstrates its potential to achieve rapid scale in new categories.

Threats: Key Risks and Challenges That Could Impact Experian's Success

Experian faces several external threats that could impact its growth. Economic factors remain a slight headwind, as noted by Brian Cassin. The competitive environment is intense, with significant outperformance required to stay ahead. Regulatory challenges also pose a risk, as ongoing competition reviews for acquisitions could delay or complicate strategic plans. Operational risks are evident, with the softness in core lending markets acting as a temporary headwind to group margins, as highlighted by CFO Lloyd Pitchford. Additionally, the company's high level of debt could constrain financial flexibility and increase vulnerability to market fluctuations.

Conclusion

Experian's strong organic growth, high client engagement, and financial efficiency underscore its operational resilience and strategic acumen. However, its high Price-To-Earnings Ratio relative to peers and the industry suggests that the market has high expectations for its future performance, which could be challenging to meet given current economic headwinds and market conditions. Despite these valuation concerns, Experian's strategic initiatives in new verticals, technological investments, and product innovations position it well for future growth. Investors should weigh these strengths against the risks of a competitive and regulatory environment, as well as the company's debt levels, when considering its future performance.

Where To Now?

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Experian might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:EXPN

Experian

Operates as a data and technology company in North America, Latin America, the United Kingdom, Ireland, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)