- United Kingdom

- /

- Professional Services

- /

- AIM:STAF

Slowing Rates Of Return At Staffline Group (LON:STAF) Leave Little Room For Excitement

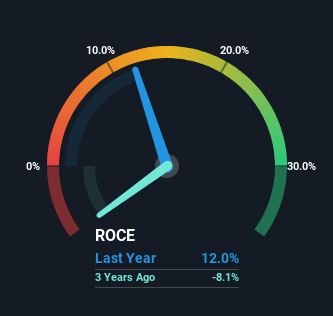

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Staffline Group (LON:STAF) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Staffline Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = UK£7.0m ÷ (UK£212m - UK£154m) (Based on the trailing twelve months to December 2023).

Therefore, Staffline Group has an ROCE of 12%. In isolation, that's a pretty standard return but against the Professional Services industry average of 19%, it's not as good.

View our latest analysis for Staffline Group

In the above chart we have measured Staffline Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Staffline Group .

How Are Returns Trending?

Over the past five years, Staffline Group's ROCE has remained relatively flat while the business is using 66% less capital than before. This indicates to us that assets are being sold and thus the business is likely shrinking, which you'll remember isn't the typical ingredients for an up-and-coming multi-bagger. You could assume that if this continues, the business will be smaller in a few year time, so probably not a multi-bagger.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 72% of total assets, this reported ROCE would probably be less than12% because total capital employed would be higher.The 12% ROCE could be even lower if current liabilities weren't 72% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

In Conclusion...

In summary, Staffline Group isn't reinvesting funds back into the business and returns aren't growing. Moreover, since the stock has crumbled 87% over the last five years, it appears investors are expecting the worst. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

If you'd like to know about the risks facing Staffline Group, we've discovered 2 warning signs that you should be aware of.

While Staffline Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STAF

Staffline Group

Provides recruitment and outsourced human resource services, and skills and employment training and support services in the United Kingdom and the Republic of Ireland.

Undervalued with excellent balance sheet.