- United Kingdom

- /

- Professional Services

- /

- AIM:RWS

UK Penny Stocks Spotlight: ITM Power And 2 Promising Picks

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns over global economic recovery. In such a climate, investors might consider exploring penny stocks for their potential to offer growth opportunities at a relatively low cost. Although the term "penny stocks" may seem outdated, these investments can still represent promising prospects when backed by strong financial health and strategic positioning in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.49 | £12.31M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.525 | £516.29M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.775 | £143.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.96 | £14.49M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.655 | $380.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.80 | £72.81M | ✅ 4 ⚠️ 3 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.26 | £60.86M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.075 | £171.57M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers for hydrogen production, operating in the UK, Germany, Europe, the US, Australia, and globally with a market cap of £455.62 million.

Operations: The company's revenue is derived from its Electric Equipment segment, totaling £26.04 million.

Market Cap: £455.62M

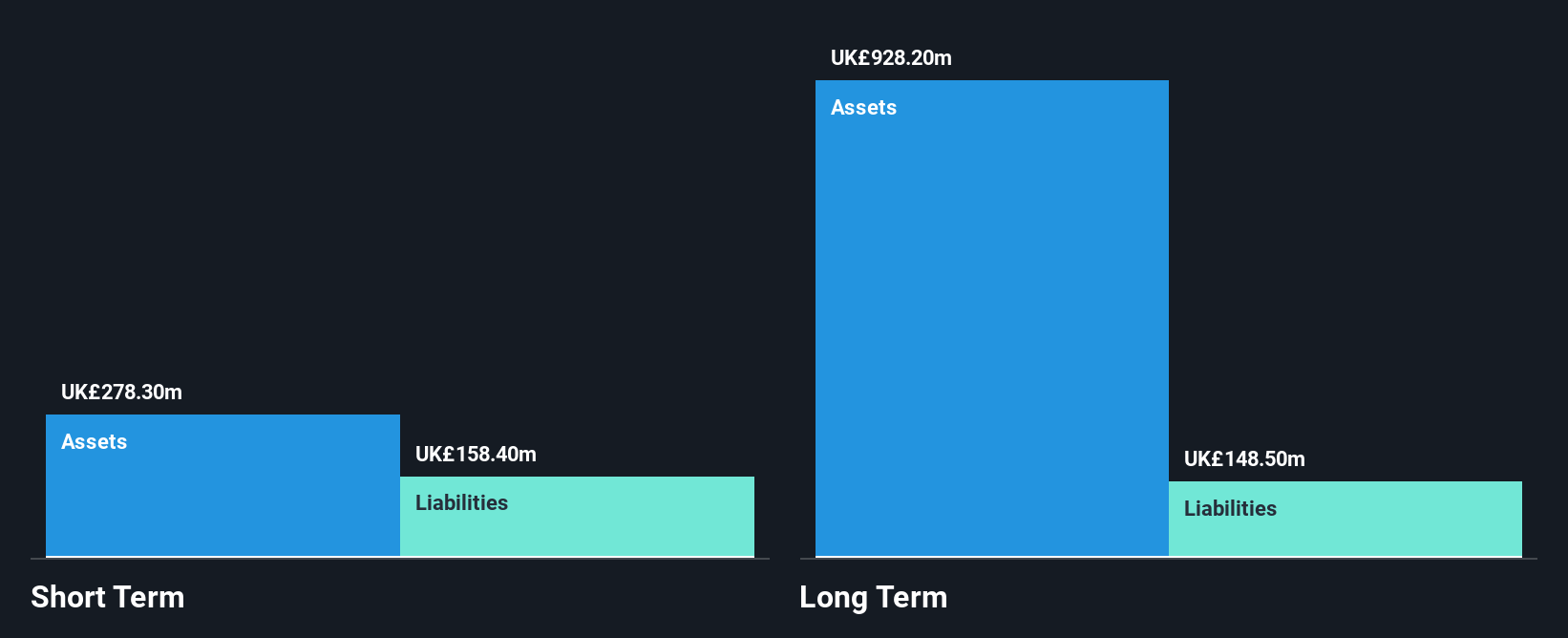

ITM Power, with a market cap of £455.62 million, is involved in significant projects like the 710 MW electrolyser capacity for Germany's Stablegrid Group and has launched the ALPHA 50 hydrogen plant. Despite being unprofitable with a negative return on equity of -20.3%, ITM remains debt-free and possesses ample short-term assets to cover liabilities. Its revenue is projected to grow by 28.29% annually, supported by agreements such as the 150MW NEPTUNE V units with RWE. However, its share price volatility remains high compared to most UK stocks, reflecting investor caution amidst growth potential.

- Navigate through the intricacies of ITM Power with our comprehensive balance sheet health report here.

- Learn about ITM Power's future growth trajectory here.

RWS Holdings (AIM:RWS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RWS Holdings plc offers technology-enabled language, content, and intellectual property services across the United Kingdom, Continental Europe, the United States, and globally with a market cap of £281.40 million.

Operations: RWS Holdings generates revenue through four main segments: IP Services (£98.2 million), Language Services (£329 million), Regulated Industries (£140.3 million), and Language & Content Technology (£144.7 million).

Market Cap: £281.4M

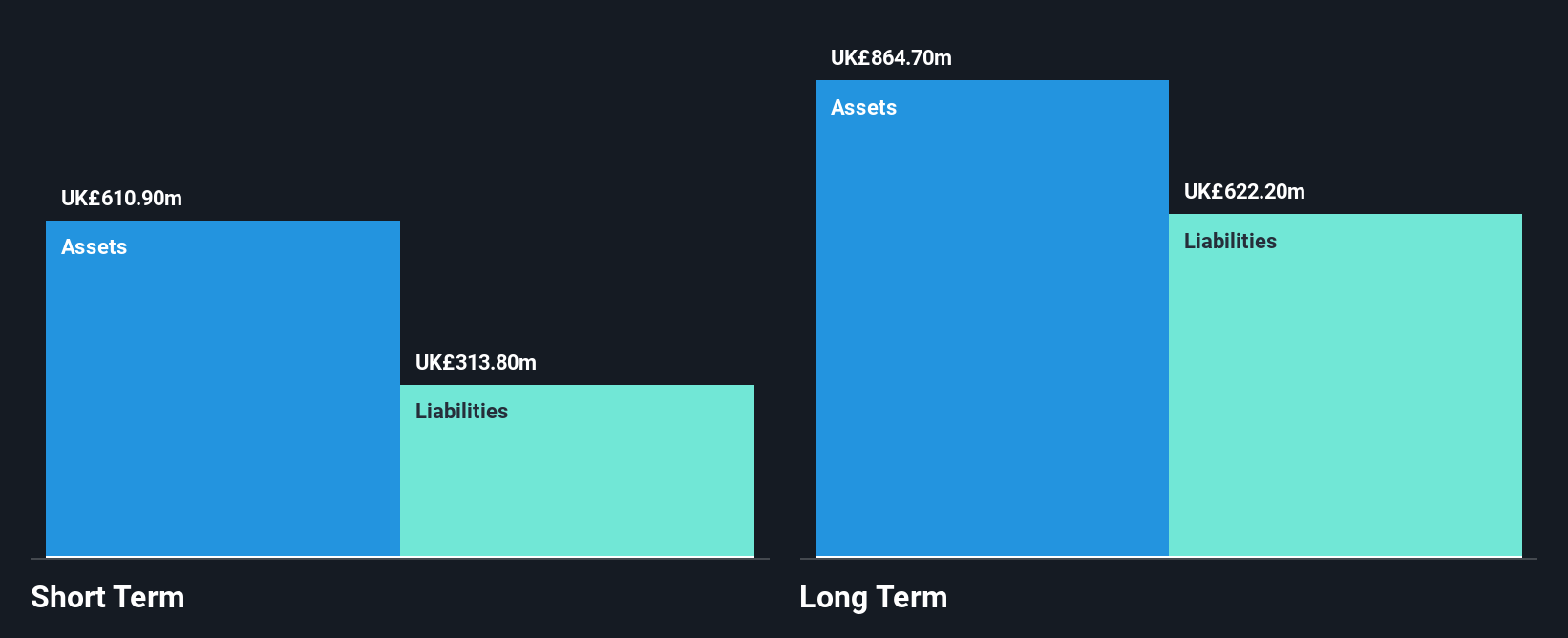

RWS Holdings, with a market cap of £281.40 million, operates across four revenue-generating segments and has recently become profitable. Despite a reported 4% decline in annual revenue to £690 million, the company's valuation is considered attractive as it trades significantly below estimated fair value. RWS's debt management is robust, with short-term assets covering both short and long-term liabilities comfortably. Recent executive changes include appointing Michael Wayne to lead AI-driven media localization efforts and Stephen Lamb as incoming CFO in 2026, reflecting strategic shifts towards enhancing its technological capabilities and financial oversight amidst evolving market dynamics.

- Click here to discover the nuances of RWS Holdings with our detailed analytical financial health report.

- Examine RWS Holdings' earnings growth report to understand how analysts expect it to perform.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States, with a market cap of £1.08 billion.

Operations: The company's revenue is derived from the US (£790.1 million) and UK & Europe (£865.9 million) markets.

Market Cap: £1.08B

Watches of Switzerland Group, with a market cap of £1.08 billion, has demonstrated financial resilience despite challenges. The company maintains a satisfactory net debt to equity ratio of 17.4%, and its interest payments are well covered by EBIT at 4.8 times coverage. However, recent earnings have been impacted by a significant one-off loss of £57.7 million, contributing to negative earnings growth over the past year and lower profit margins compared to last year (3.3% vs 3.9%). On the strategic front, Watches of Switzerland is expanding its US presence through partnerships with Roberto Coin, enhancing its luxury retail offerings in North America amidst executive board changes.

- Take a closer look at Watches of Switzerland Group's potential here in our financial health report.

- Explore Watches of Switzerland Group's analyst forecasts in our growth report.

Seize The Opportunity

- Discover the full array of 301 UK Penny Stocks right here.

- Interested In Other Possibilities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RWS

RWS Holdings

Provides technology-enabled language, content, and intellectual property (IP) services in the United Kingdom, Continental Europe, the United States, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success