- United Kingdom

- /

- Electrical

- /

- AIM:VLX

UK Growth Companies With High Insider Ownership In June 2024

Reviewed by Simply Wall St

As the FTSE 100 faces a challenging period with its fifth consecutive weekly loss, the broader financial landscape in the United Kingdom remains a topic of keen interest and speculation. Amidst these market conditions, companies with high insider ownership can be particularly compelling as they often demonstrate a strong alignment between management’s interests and those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

We'll examine a selection from our screener results.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property (IP) services with a market capitalization of approximately £0.75 billion.

Operations: The company operates primarily in technology-enabled language, content, and intellectual property services.

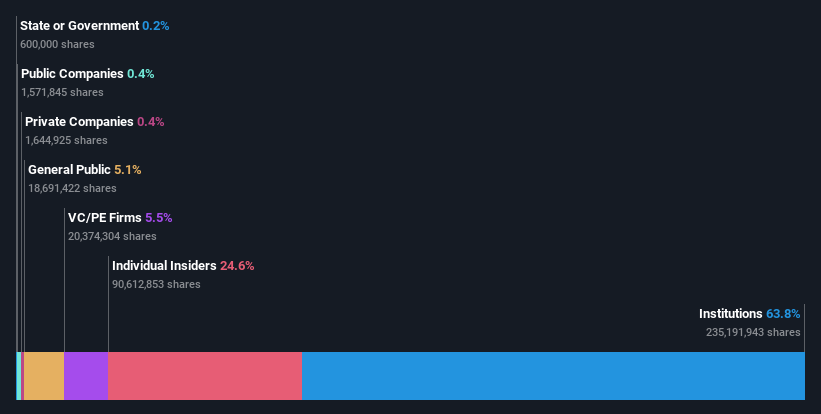

Insider Ownership: 24.6%

RWS Holdings, a UK-based growth company with significant insider ownership, is navigating a challenging phase with its share price highly volatile in recent months and trading 60% below the estimated fair value. Despite a recent dip in net income and sales as reported in their latest half-year earnings, RWS is optimistic about future profitability, expected to materialize within three years. The firm continues to innovate, launching HAI—a digital translation platform—and maintaining robust dividend increases amidst these transitions.

- Dive into the specifics of RWS Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that RWS Holdings' current price could be quite moderate.

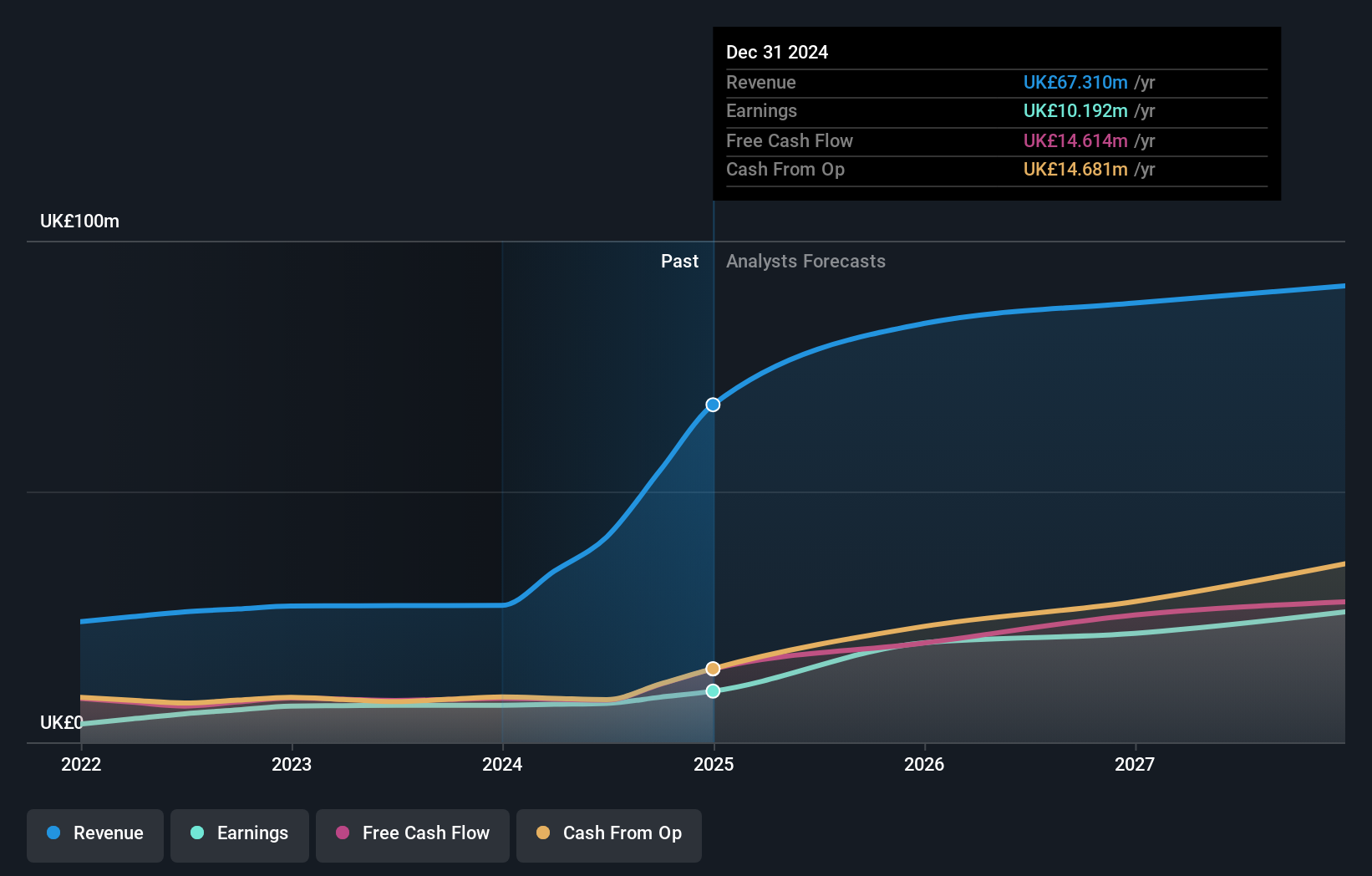

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, focuses on managing and leasing residential real estate properties with a market capitalization of approximately £280.48 million.

Operations: The company generates revenue through two primary segments: Financial Services, which contributes £1.50 million, and Property Franchising, which brings in £25.78 million.

Insider Ownership: 12.7%

Property Franchise Group, a UK-based entity, is trading at £53.7% below its estimated fair value, presenting a potential opportunity despite substantial shareholder dilution over the past year. The company's revenue and earnings are expected to grow at 44.7% and 36.71% per year respectively, outpacing the UK market significantly. However, its Return on Equity is forecasted to be low at 13% in three years' time. Recent executive changes include CFO David Raggett announcing his retirement by end of 2025, ensuring an orderly transition post two recent acquisitions.

- Click here and access our complete growth analysis report to understand the dynamics of Property Franchise Group.

- Insights from our recent valuation report point to the potential overvaluation of Property Franchise Group shares in the market.

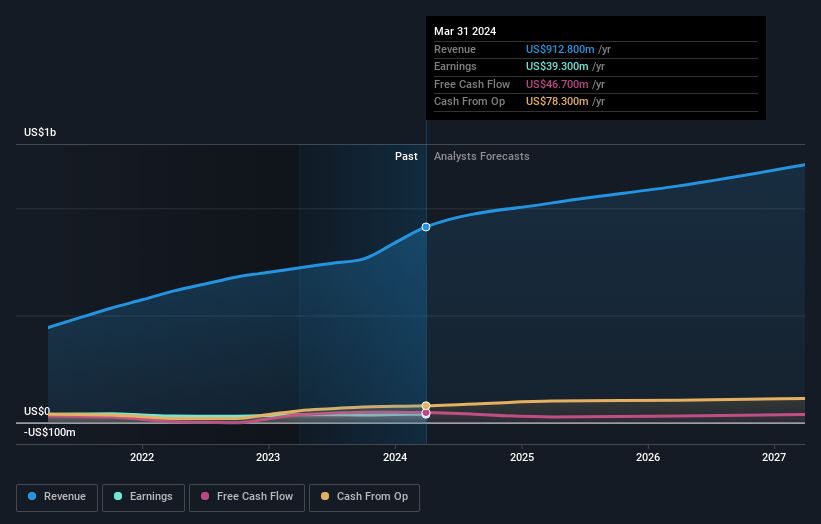

Volex (AIM:VLX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Volex plc is a manufacturer and supplier of power products and cable assemblies, operating across North America, Europe, and Asia, with a market capitalization of approximately £628.07 million.

Operations: The firm operates across three key geographical regions, generating revenue from the manufacture and supply of power products and cable assemblies.

Insider Ownership: 26.9%

Volex, a UK-based company, reported a significant revenue update with expectations to reach at least £900 million for FY 2024, up by over 25%, boosted by the Murat Ticaret acquisition. While its debt level is high, earnings are anticipated to grow robustly at 20.16% annually. However, shareholder dilution occurred last year and the forecasted Return on Equity in three years is relatively low at 15.6%. Analysts predict a potential stock price increase of 22.8%.

- Navigate through the intricacies of Volex with our comprehensive analyst estimates report here.

- Our valuation report here indicates Volex may be undervalued.

Seize The Opportunity

- Discover the full array of 67 Fast Growing UK Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLX

Volex

Manufactures and sells power and data cables in North America, Europe, and Asia.

Undervalued with proven track record.

Market Insights

Community Narratives