- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

3 UK Growth Companies With Insider Ownership Up To 25%

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has risen 1.5%, driven by gains in the Consumer Staples and Financials sectors of 2.5% and 1.8%. Over the past 12 months, the market is up 6.2% with earnings forecast to grow by 13% annually. In this favorable environment, companies with strong growth potential and significant insider ownership can be particularly attractive as they often align management's interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 34.2% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Filtronic (AIM:FTC) | 28.6% | 69.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

Underneath we present a selection of stocks filtered out by our screen.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RWS Holdings plc, with a market cap of £667.32 million, offers technology-enabled language, content, and intellectual property (IP) services.

Operations: The company's revenue segments include IP Services (£105.10 million), Language Services (£325.40 million), Regulated Industry (£149.40 million), and Language & Content Technology (L&CT) (£137.90 million).

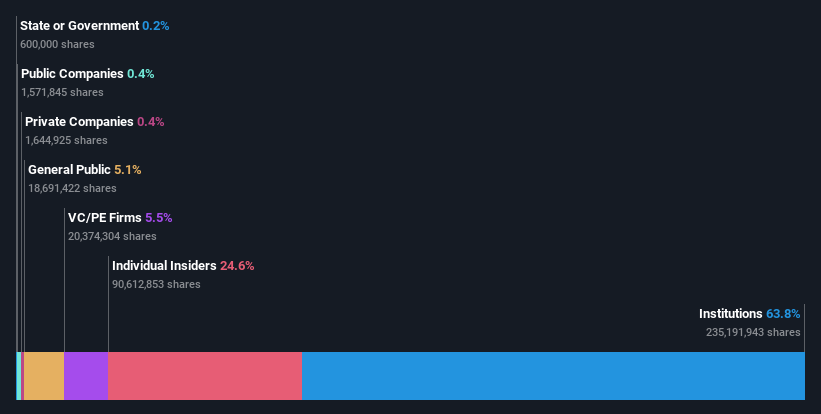

Insider Ownership: 24.6%

RWS Holdings, a growth company with high insider ownership in the UK, has recently launched several AI-enhanced products like Trados Studio 2024 and Tridion Docs 15.1 to bolster productivity and accessibility. Despite reporting a dip in half-year revenues to £350.3 million and net income to £11.1 million, its earnings are forecasted to grow significantly at 67.35% per year. The stock trades well below estimated fair value, with analysts predicting substantial price appreciation.

- Unlock comprehensive insights into our analysis of RWS Holdings stock in this growth report.

- The valuation report we've compiled suggests that RWS Holdings' current price could be quite moderate.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.76 billion, provides workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue segments are as follows: £1.05 billion from the Americas, £1.32 billion from Europe, the Middle East, and Africa (EMEA), £273 million from Asia Pacific, and £319 million from Worka.

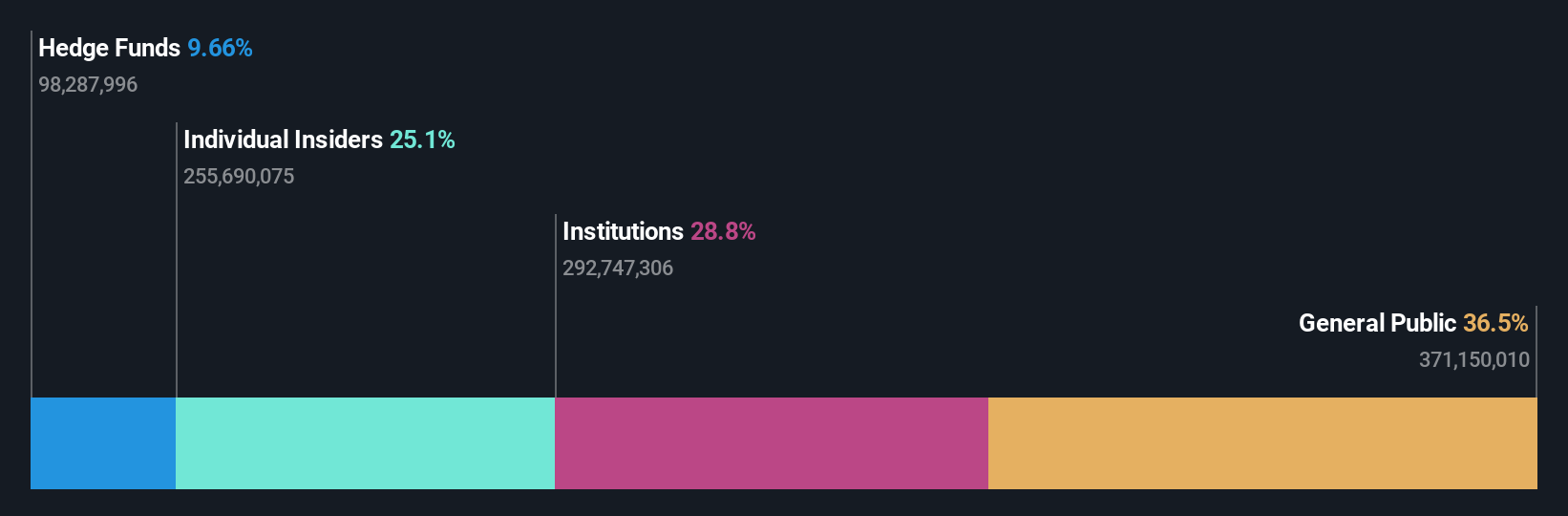

Insider Ownership: 25.2%

International Workplace Group, recently renamed from IWG plc, has been active in debt financing, securing a €575 million bond and a $720 million revolving credit facility to extend debt maturity and reduce convertible bond obligations. Insiders have shown confidence with more shares bought than sold in the past three months. Although revenue growth is forecasted at 7.8% per year, below high-growth benchmarks, earnings are expected to grow significantly at 108.16% annually over the next three years.

- Navigate through the intricacies of International Workplace Group with our comprehensive analyst estimates report here.

- The analysis detailed in our International Workplace Group valuation report hints at an deflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.68 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: The company generates revenue through banking, leasing, insurance, brokerage, and card processing services provided to corporate and individual customers across Georgia, Azerbaijan, and Uzbekistan.

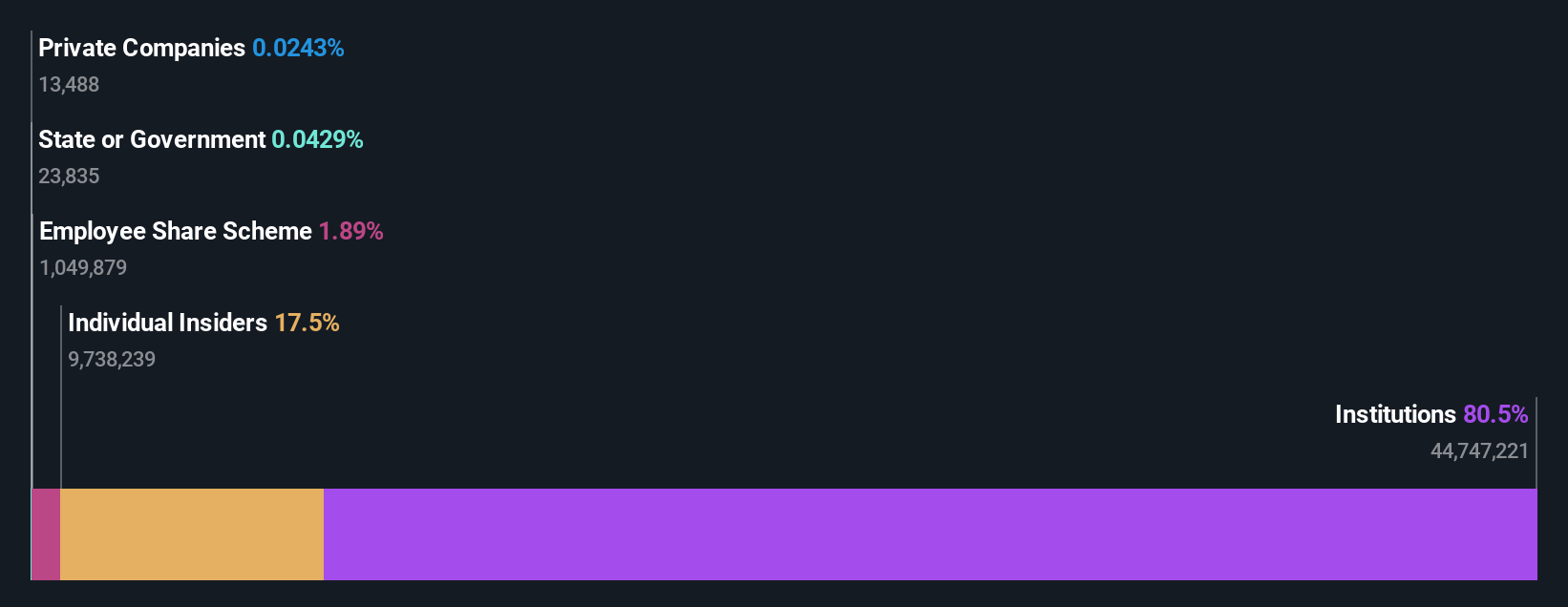

Insider Ownership: 17.7%

TBC Bank Group has shown solid growth with a 14.6% increase in earnings over the past year and net income rising to GEL 292.81 million in Q1 2024. The company is executing a share repurchase program worth GEL 75 million, aiming to reduce share capital and enhance shareholder value. Despite high bad loans at 2.1%, TBCG's revenue is forecasted to grow at 18.5% per year, outpacing the UK market average of 3.5%.

- Dive into the specifics of TBC Bank Group here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that TBC Bank Group is priced lower than what may be justified by its financials.

Taking Advantage

- Reveal the 63 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Good value with reasonable growth potential.