- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

3 UK Stocks Estimated To Be Undervalued By Up To 44.5%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, driven by weak trade data from China and global economic uncertainties. Despite these challenges, there are opportunities to identify undervalued stocks that may offer significant potential for investors.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.99 | £1.96 | 49.6% |

| Energean (LSE:ENOG) | £9.885 | £18.74 | 47.2% |

| WPP (LSE:WPP) | £7.496 | £14.26 | 47.4% |

| LSL Property Services (LSE:LSL) | £3.45 | £6.35 | 45.7% |

| Ibstock (LSE:IBST) | £1.86 | £3.40 | 45.3% |

| Forterra (LSE:FORT) | £1.724 | £3.32 | 48.1% |

| Velocity Composites (AIM:VEL) | £0.43 | £0.81 | 46.9% |

| Accsys Technologies (AIM:AXS) | £0.549 | £1.04 | 47.3% |

| Franchise Brands (AIM:FRAN) | £1.725 | £3.16 | 45.5% |

| M&C Saatchi (AIM:SAA) | £2.10 | £4.02 | 47.7% |

Underneath we present a selection of stocks filtered out by our screen.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £327.14 million.

Operations: Revenue segments for Fintel Plc include Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Estimated Discount To Fair Value: 11.1%

Fintel is trading at £3.14, slightly below its estimated fair value of £3.53, making it undervalued based on discounted cash flows. Earnings are projected to grow significantly at 23.88% annually over the next three years, outpacing the UK market's growth rate of 13.1%. However, insider selling has been significant in the past three months and Return on Equity is forecasted to be relatively low at 12.8% in three years time.

- According our earnings growth report, there's an indication that Fintel might be ready to expand.

- Dive into the specifics of Fintel here with our thorough financial health report.

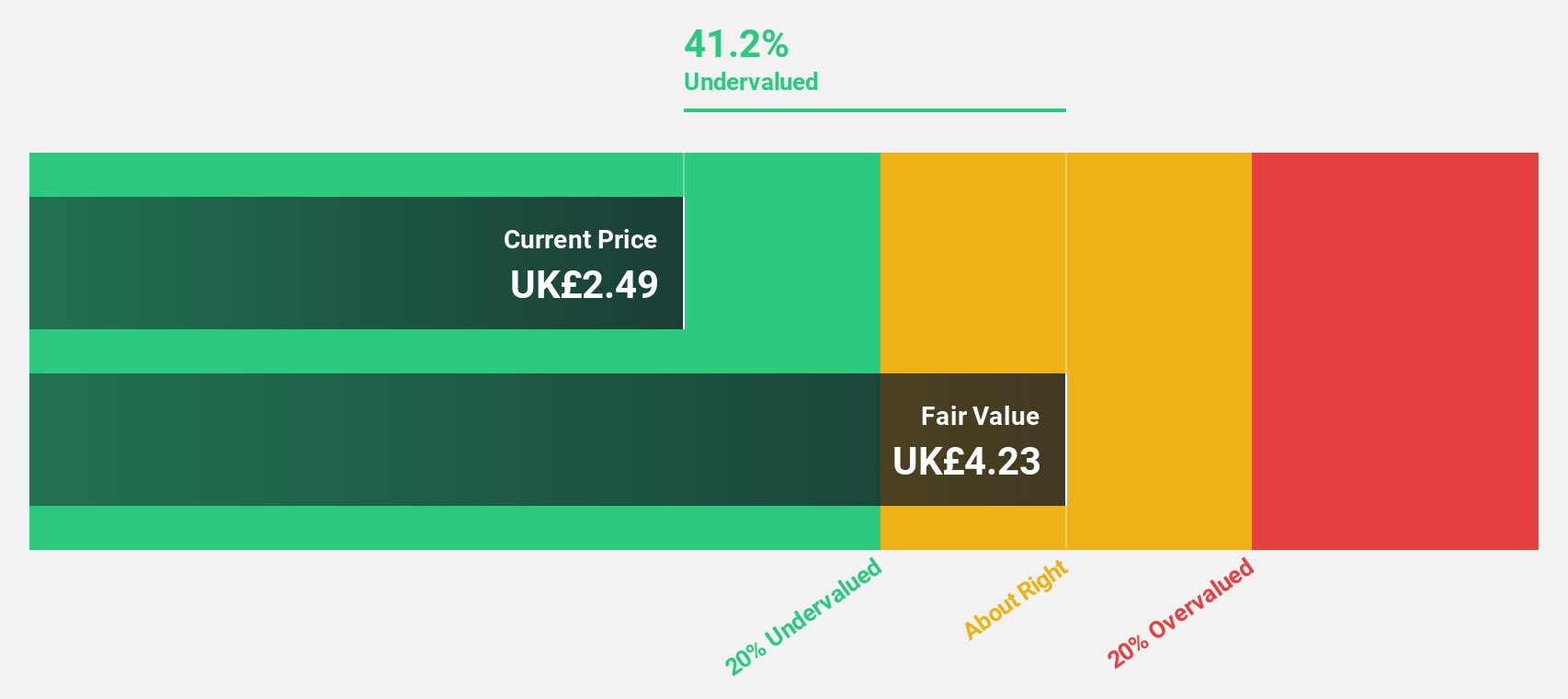

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across multiple countries including the United Kingdom, Ireland, France, and others, with a market cap of approximately £2.03 billion.

Operations: The company's revenue primarily comes from the operation of an on-demand food delivery platform, generating £2.03 billion.

Estimated Discount To Fair Value: 44.5%

Deliveroo is trading at £1.30, significantly below its estimated fair value of £2.34, indicating it is undervalued based on cash flows. Earnings have grown 12.1% annually over the past five years and are forecast to grow 2.08% per year, with profitability expected within three years—above average market growth rates. Recent takeover interest from DoorDash boosted shares temporarily but talks ended due to valuation disagreements, potentially signaling future acquisition interest.

- Upon reviewing our latest growth report, Deliveroo's projected financial performance appears quite optimistic.

- Take a closer look at Deliveroo's balance sheet health here in our report.

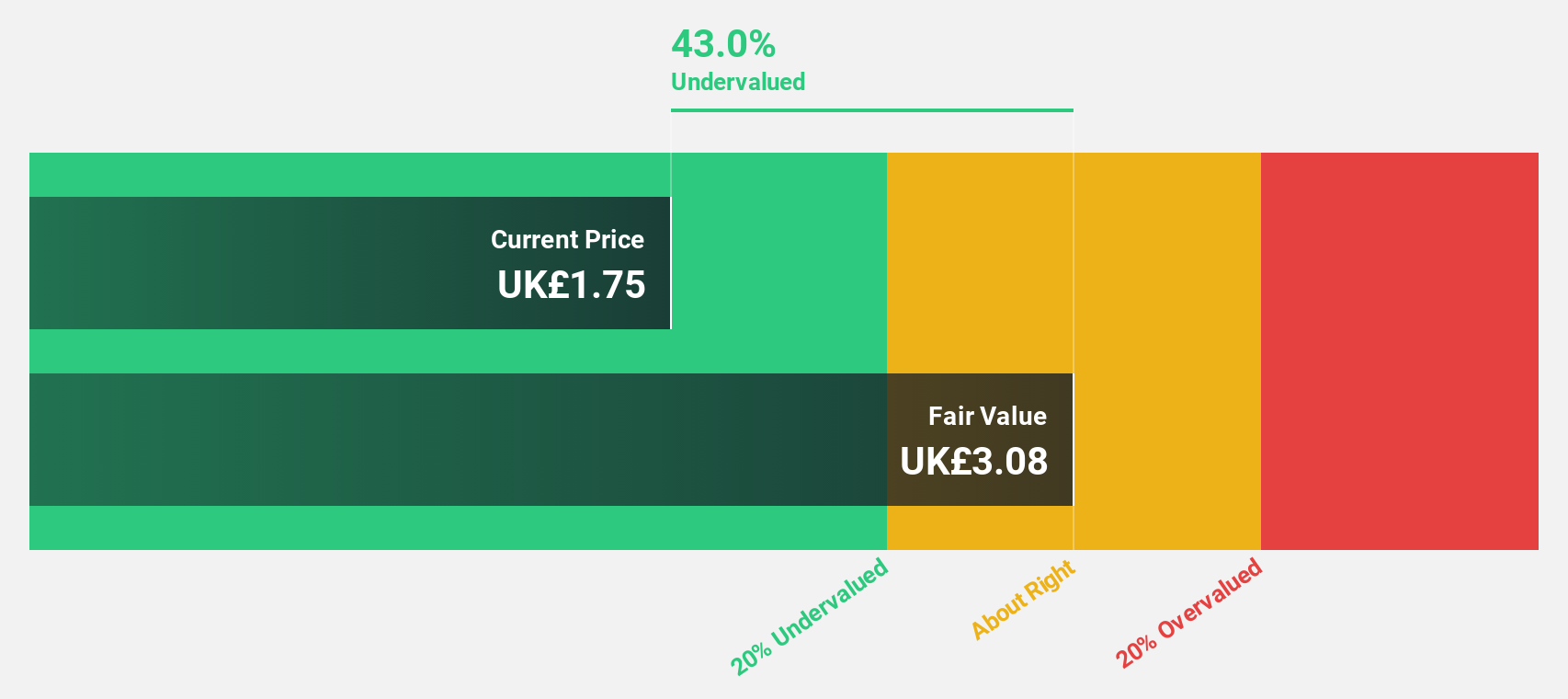

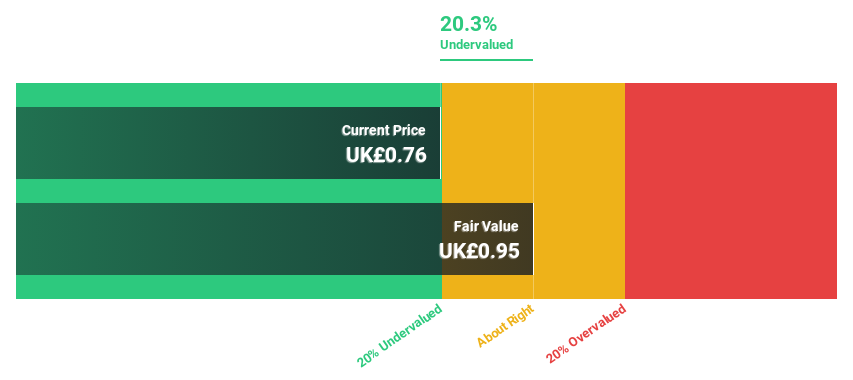

Supermarket Income REIT (LSE:SUPR)

Overview: Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust focused on investing in grocery properties essential to the UK's food supply chain, with a market cap of £930.94 million.

Operations: Supermarket Income REIT generates its revenue from real estate investment, amounting to £106.29 million.

Estimated Discount To Fair Value: 13.1%

Supermarket Income REIT recently completed a £170 million refinancing, enhancing its financial stability. Trading at £0.75, it is undervalued compared to its estimated fair value of £0.86. Despite an unstable dividend track record, earnings are expected to grow significantly at 90.24% annually over the next three years, outpacing the UK market's growth rate. However, debt coverage by operating cash flow remains a concern despite improved liquidity from recent debt restructuring and acquisitions.

- The growth report we've compiled suggests that Supermarket Income REIT's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Supermarket Income REIT's balance sheet health report.

Seize The Opportunity

- Embark on your investment journey to our 58 Undervalued UK Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Excellent balance sheet with reasonable growth potential.