- United Kingdom

- /

- Professional Services

- /

- AIM:RTC

Discover UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure due to weak trade data from China, investors are increasingly looking for alternative opportunities in the UK market. Penny stocks, though often considered a relic of past trading days, remain relevant as they offer potential growth at lower price points. By focusing on companies with strong financials and solid fundamentals, investors can uncover hidden value in this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.02 | £761.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £153.63M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.395 | £177.66M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £420.84M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.085 | £92.7M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.04 | £192.68M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.26 | £194.33M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.18 | £155.53M | ★★★★★☆ |

Click here to see the full list of 440 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

RTC Group (AIM:RTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RTC Group plc, with a market cap of £13.27 million, operates through its subsidiaries to provide recruitment services in the United Kingdom, the United States, and the Middle East.

Operations: The company's revenue is derived from UK Recruitment (£94.78 million), UK Central Services (£2.09 million), and International Recruitment (£5.38 million).

Market Cap: £13.27M

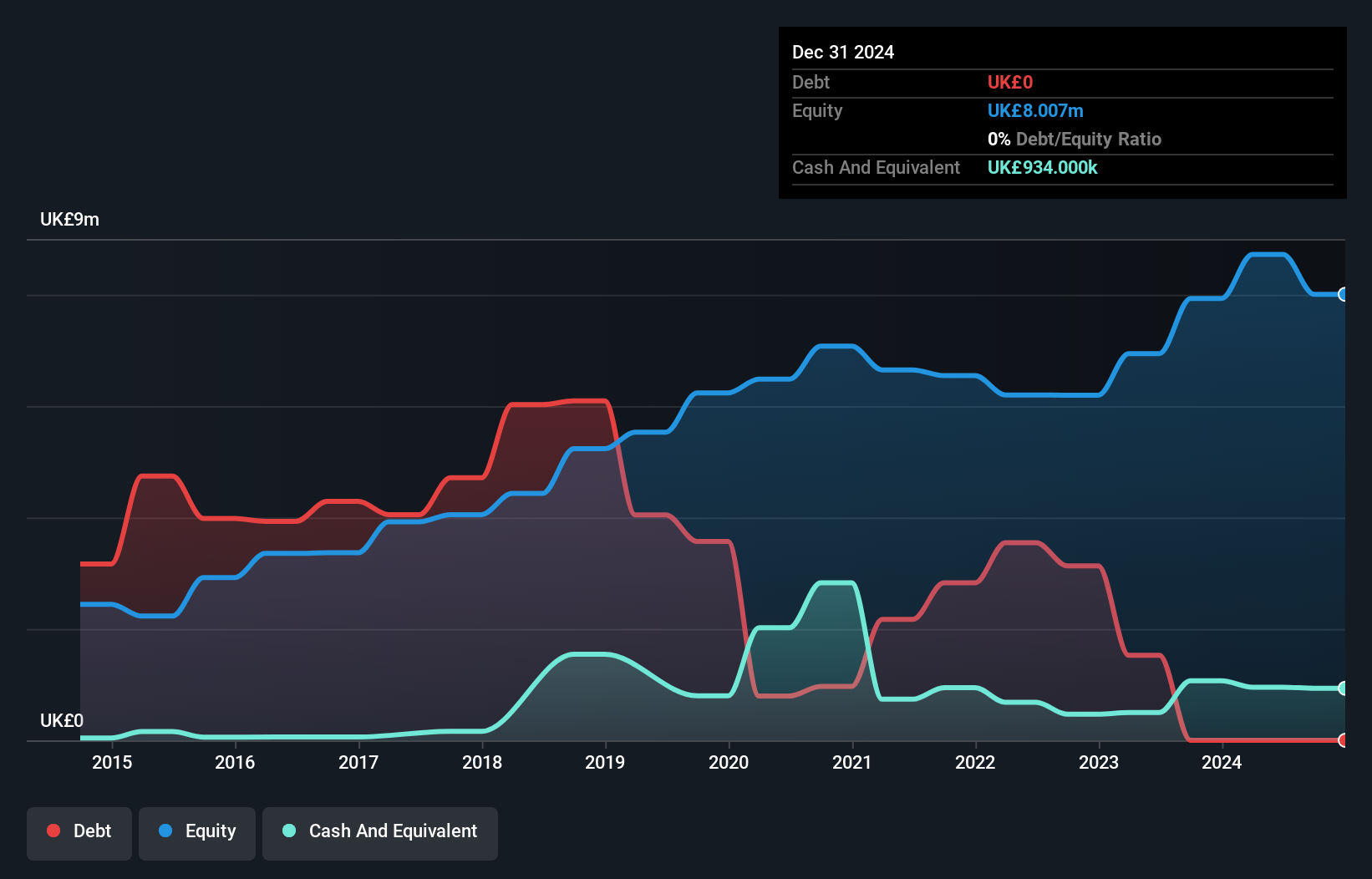

RTC Group plc, with a market cap of £13.27 million, presents a mixed picture for investors interested in penny stocks. The company has shown impressive earnings growth of 165.9% over the past year, significantly outpacing the industry average. It boasts high-quality earnings and a strong return on equity at 22.7%. Additionally, RTC is debt-free and its short-term assets comfortably cover both short-term and long-term liabilities. However, its dividend track record is unstable and the board lacks experience with an average tenure of only 0.5 years, which could pose governance challenges moving forward.

- Jump into the full analysis health report here for a deeper understanding of RTC Group.

- Gain insights into RTC Group's past trends and performance with our report on the company's historical track record.

Vianet Group (AIM:VNET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vianet Group plc offers smart, cloud-based, and Internet of Things solutions for the hospitality, unattended retail vending, and remote asset management sectors across the UK, Europe, the US, and Canada with a market cap of £32.49 million.

Operations: The company generates revenue from two primary segments: Smart Zones, contributing £8.92 million, and Smart Machines, accounting for £6.75 million.

Market Cap: £32.49M

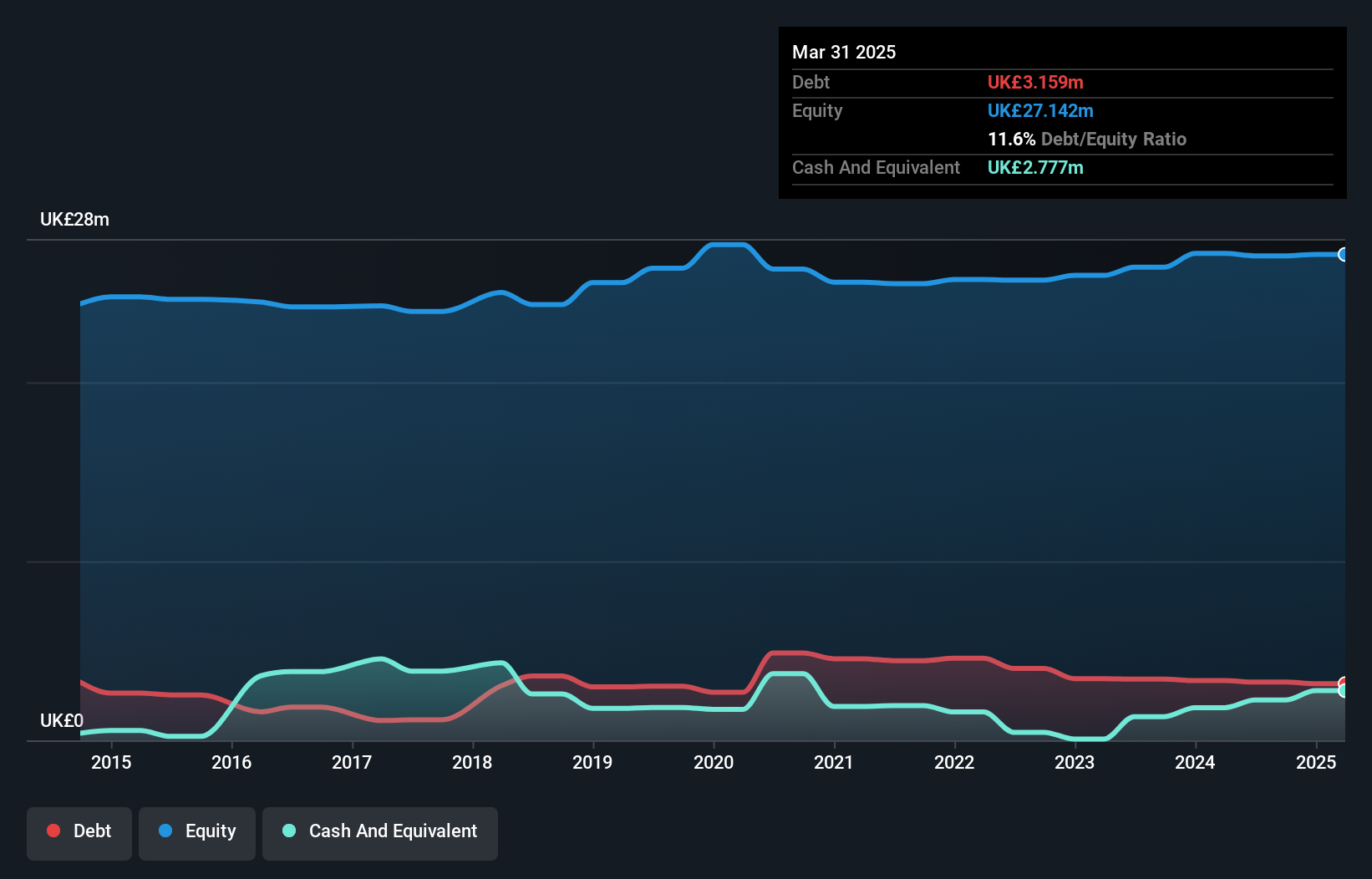

Vianet Group plc, with a market cap of £32.49 million, offers potential appeal in the penny stock space due to its strong financial position and recent strategic moves. The company has demonstrated robust earnings growth over the past year, significantly outpacing its historical performance and industry averages. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Additionally, Vianet's debt is well covered by operating cash flow, reflecting prudent financial oversight. Recent announcements include a share repurchase program aimed at reducing share capital using existing cash resources, potentially enhancing shareholder value through improved EPS metrics.

- Get an in-depth perspective on Vianet Group's performance by reading our balance sheet health report here.

- Evaluate Vianet Group's prospects by accessing our earnings growth report.

Worldsec (LSE:WSL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Worldsec Limited is a closed-ended investment company that focuses on investing in small and medium-sized trading companies in the Greater China and South East Asian regions, with a market cap of £1.70 million.

Operations: The company's revenue segment is primarily from investment holding, which reported -$0.21 million.

Market Cap: £1.7M

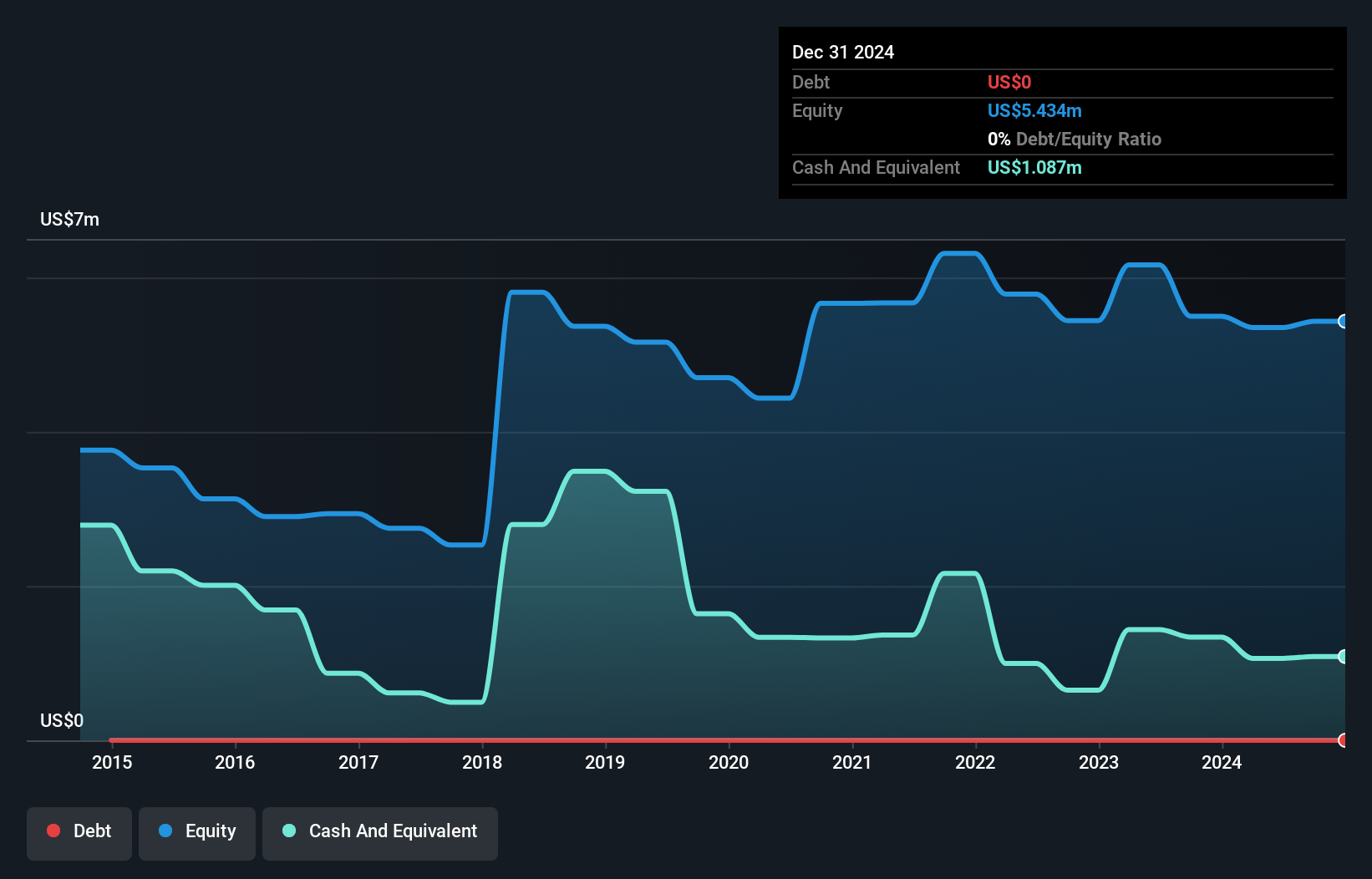

Worldsec Limited, with a market cap of £1.70 million, presents a mixed picture in the penny stock arena. The company is pre-revenue with less than US$1 million in earnings and remains unprofitable, although it has managed to reduce losses by 2.1% annually over five years. It maintains a solid financial footing with no debt and short-term assets exceeding liabilities significantly. Despite a volatile share price and negative return on equity, Worldsec's cash runway extends beyond three years if current free cash flow levels are maintained, supported by an experienced board averaging 11.5 years of tenure.

- Click here to discover the nuances of Worldsec with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Worldsec's track record.

Taking Advantage

- Explore the 440 names from our UK Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RTC

RTC Group

Through its subsidiaries, provides recruitment services in the United Kingdom, the United States, and the Middle East.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives