- United Kingdom

- /

- Professional Services

- /

- AIM:RBGP

Revenues Working Against RBG Holdings plc's (LON:RBGP) Share Price Following 38% Dive

Unfortunately for some shareholders, the RBG Holdings plc (LON:RBGP) share price has dived 38% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

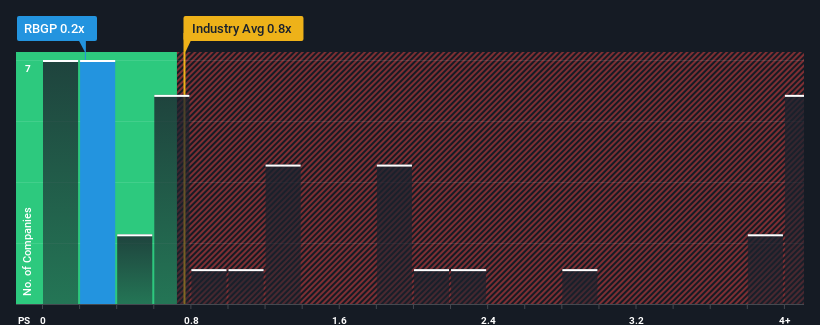

Since its price has dipped substantially, considering around half the companies operating in the United Kingdom's Professional Services industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider RBG Holdings as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RBG Holdings

How Has RBG Holdings Performed Recently?

RBG Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think RBG Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is RBG Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as RBG Holdings' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 75% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.8% as estimated by the dual analysts watching the company. With the industry predicted to deliver 4.8% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that RBG Holdings' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On RBG Holdings' P/S

RBG Holdings' P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that RBG Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for RBG Holdings you should be aware of, and 1 of them is a bit unpleasant.

If these risks are making you reconsider your opinion on RBG Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RBGP

RBG Holdings

Provides legal and professional services to companies, banks, entrepreneurs, and individuals in the United Kingdom, Europe, North America, and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives