- United Kingdom

- /

- Professional Services

- /

- AIM:IPEL

Impellam Group plc's (LON:IPEL) CEO Might Not Expect Shareholders To Be So Generous This Year

The results at Impellam Group plc (LON:IPEL) have been quite disappointing recently and CEO Julia Robertson bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 29 June 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Impellam Group

Comparing Impellam Group plc's CEO Compensation With the industry

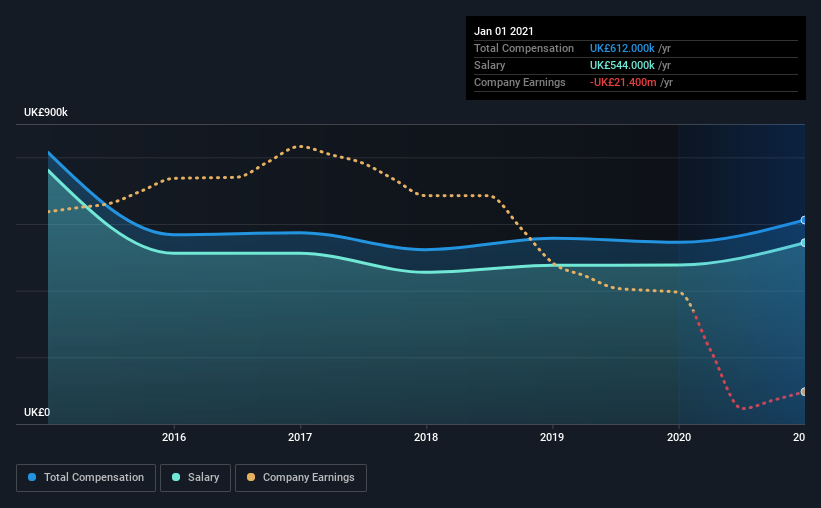

According to our data, Impellam Group plc has a market capitalization of UK£129m, and paid its CEO total annual compensation worth UK£612k over the year to January 2021. We note that's an increase of 12% above last year. Notably, the salary which is UK£544.0k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between UK£72m and UK£286m, we discovered that the median CEO total compensation of that group was UK£357k. This suggests that Julia Robertson is paid more than the median for the industry. What's more, Julia Robertson holds UK£436k worth of shares in the company in their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£544k | UK£477k | 89% |

| Other | UK£68k | UK£68k | 11% |

| Total Compensation | UK£612k | UK£545k | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Impellam Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Impellam Group plc's Growth Numbers

Impellam Group plc has reduced its earnings per share by 113% a year over the last three years. Its revenue is down 11% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Impellam Group plc Been A Good Investment?

The return of -34% over three years would not have pleased Impellam Group plc shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Impellam Group you should be aware of, and 1 of them shouldn't be ignored.

Important note: Impellam Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Impellam Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IPEL

Impellam Group

Impellam Group plc provides staffing solutions, human capital management, and outsourced people-related services in the United Kingdom, rest of Europe, North America, and the Asia Pacific.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026