- United Kingdom

- /

- Commercial Services

- /

- AIM:INSE

Inspired Plc (LON:INSE) Stock Rockets 26% But Many Are Still Ignoring The Company

Inspired Plc (LON:INSE) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

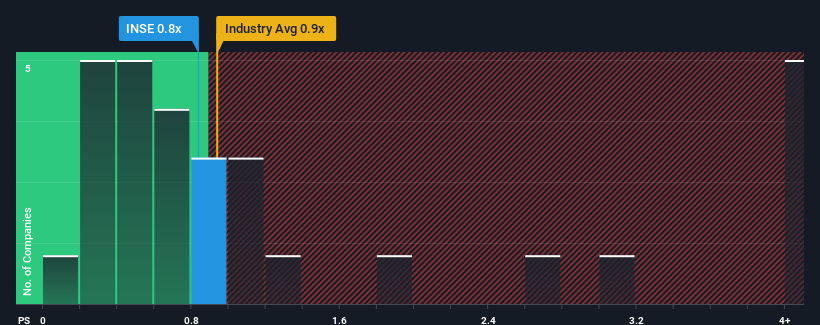

Although its price has surged higher, you could still be forgiven for feeling indifferent about Inspired's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in the United Kingdom is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Inspired

What Does Inspired's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Inspired has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Inspired will help you uncover what's on the horizon.How Is Inspired's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Inspired's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 114% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 16% per year over the next three years. That's shaping up to be materially higher than the 4.4% each year growth forecast for the broader industry.

With this information, we find it interesting that Inspired is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Inspired's P/S Mean For Investors?

Its shares have lifted substantially and now Inspired's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Inspired's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Inspired you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:INSE

Inspired

Provides energy consultancy services to corporate business energy users in the United Kingdom and Ireland.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives