- United Kingdom

- /

- Professional Services

- /

- AIM:GATC

Here's Why I Think Gattaca (LON:GATC) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Gattaca (LON:GATC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Gattaca

Gattaca's Improving Profits

Over the last three years, Gattaca has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Gattaca's EPS shot from UK£0.023 to UK£0.055, over the last year. Year on year growth of 146% is certainly a sight to behold.

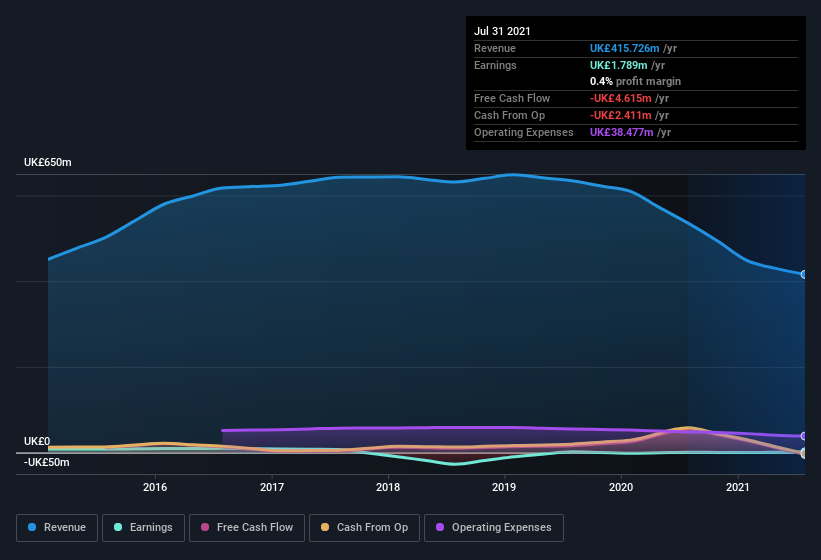

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Gattaca's EBIT margins are flat but, of some concern, its revenue is actually down. And that does make me a little more cautious of the stock.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Gattaca isn't a huge company, given its market capitalization of UK£28m. That makes it extra important to check on its balance sheet strength.

Are Gattaca Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Gattaca shareholders can gain quiet confidence from the fact that insiders shelled out UK£495k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. It is also worth noting that it was Non-Executive Deputy Chairman George Douglas Materna who made the biggest single purchase, worth UK£253k, paying UK£2.53 per share.

Along with the insider buying, another encouraging sign for Gattaca is that insiders, as a group, have a considerable shareholding. Indeed, they hold UK£9.4m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 34% of the company; visible skin in the game.

Is Gattaca Worth Keeping An Eye On?

Gattaca's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Gattaca belongs on the top of your watchlist. What about risks? Every company has them, and we've spotted 5 warning signs for Gattaca (of which 2 can't be ignored!) you should know about.

As a growth investor I do like to see insider buying. But Gattaca isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:GATC

Gattaca

A human capital resources company, provides contract and permanent recruitment services in the private and public sectors.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives