- Denmark

- /

- Marine and Shipping

- /

- CPSE:DFDS

Three Promising Undervalued European Small Caps With Insider Buying

Reviewed by Simply Wall St

The European market has shown resilience, with the STOXX Europe 600 Index achieving its longest streak of weekly gains since 2012, driven by positive corporate results and defense stock gains despite uncertainties in U.S. trade policy. In this environment, identifying promising small-cap stocks involves looking for companies that not only exhibit strong fundamentals but also have insider confidence, as evidenced by recent insider buying activities.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.6x | 5.0x | 24.04% | ★★★★★★ |

| J D Wetherspoon | 14.4x | 0.3x | 39.65% | ★★★★★★ |

| Speedy Hire | NA | 0.2x | 23.97% | ★★★★★☆ |

| Gamma Communications | 22.6x | 2.3x | 35.18% | ★★★★☆☆ |

| 4imprint Group | 16.8x | 1.4x | 33.54% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.9x | 1.9x | 22.04% | ★★★★☆☆ |

| Franchise Brands | 38.6x | 2.0x | 26.08% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.44% | ★★★★☆☆ |

| Axactor | NA | 0.9x | 2.36% | ★★★★☆☆ |

| Elmera Group | 9.8x | 0.3x | -101.06% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

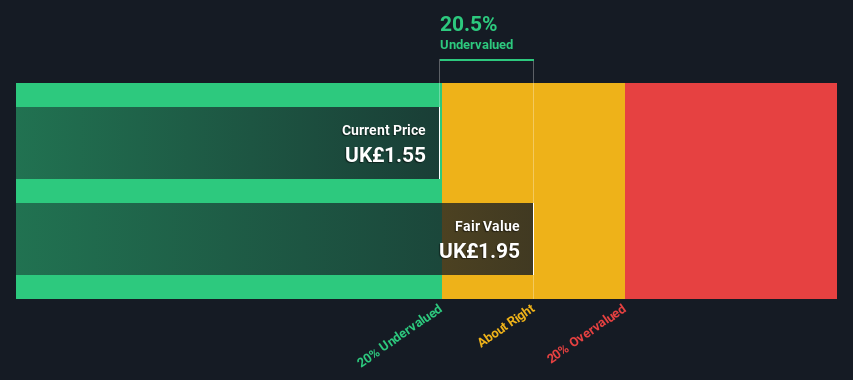

Franchise Brands (AIM:FRAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Franchise Brands is a multi-brand franchisor that operates through various segments including Azura, Pirtek, B2C Division, Filta International, and Water & Waste Services with a market capitalization of £0.45 billion.

Operations: The company generates revenue primarily from Pirtek and Water & Waste Services, with significant contributions from Filta International. As of the latest data, the gross profit margin reached 66.47%. Operating expenses are a major cost component, impacting net income margins over time.

PE: 38.6x

Franchise Brands, a company with a focus on integrating its operations under the One Franchise Brands initiative, is positioned as an undervalued stock in Europe. The recent appointment of Louise George to the board as an independent non-executive director underscores insider confidence, highlighted by their purchase of 100,000 shares for £148,000 in February 2025. Despite relying solely on external borrowing for funding and facing large one-off items impacting earnings quality, revenue is projected to grow at 7.89% annually.

- Click to explore a detailed breakdown of our findings in Franchise Brands' valuation report.

Understand Franchise Brands' track record by examining our Past report.

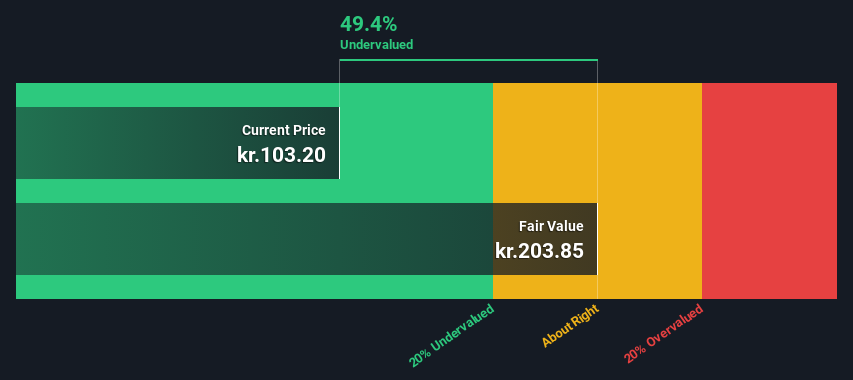

DFDS (CPSE:DFDS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: DFDS is a Danish company operating in the ferry and logistics sectors, with a market capitalization of DKK 23.56 billion.

Operations: The Ferry Division and Logistics Division are significant contributors to revenue, with the former generating DKK 17.86 billion and the latter DKK 13.35 billion. The company experienced a notable trend in its gross profit margin, which increased from 14.83% in early 2014 to a peak of 26.08% by late 2019, before declining to approximately 19.71% by the end of 2024.

PE: 10.5x

DFDS, a European transport and logistics company, faces challenges with declining profit margins, down to 1.8% from 5.6% last year, and a volatile share price over the past three months. Despite these hurdles, they have shown resilience through strategic moves like launching a new freight service between Spain and the Netherlands to boost efficiency and reduce emissions. While their earnings dropped significantly in 2024 with net income at DKK 534 million compared to DKK 1.52 billion previously, DFDS anticipates revenue growth of around 5% for 2025 with expected EBIT of DKK 1 billion. The company's restructuring efforts aim to streamline operations across Europe and Türkiye by enhancing asset utilization and volume growth amid challenging market conditions. Additionally, DFDS secured a long-term ferry operation contract for Jersey starting March 2025 which is projected to generate revenue of approximately DKK 450 million in its initial phase.

- Dive into the specifics of DFDS here with our thorough valuation report.

Gain insights into DFDS' past trends and performance with our Past report.

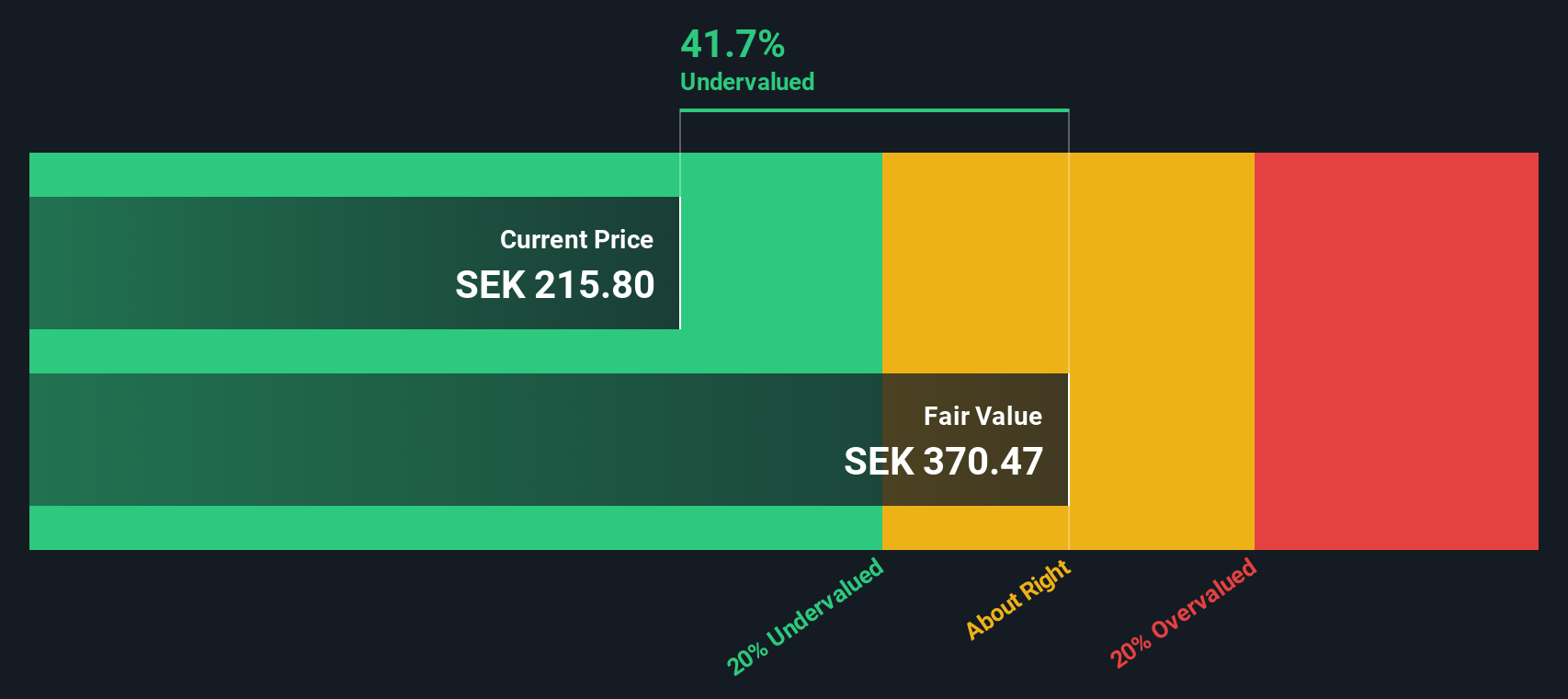

Lindab International (OM:LIAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lindab International is a company that specializes in providing ventilation and profile systems, with a market capitalization of approximately SEK 13.65 billion.

Operations: The company generates revenue primarily from its Ventilation Systems and Profile Systems segments, with Ventilation Systems contributing the majority. Over recent periods, the company's gross profit margin has shown a decreasing trend, reaching 27.70% by the end of 2024. Operating expenses have been increasing steadily, impacting net income margins which stood at 2.36% in late 2024 and early 2025.

PE: 48.0x

Lindab International, a smaller European stock, is drawing attention due to its strategic focus on sustainability and potential synergies from acquisitions. Recently, Lindab linked its SEK 4.05 billion and EUR 120 million credit facilities to ambitious sustainability targets with major banks like Handelsbanken and Nordea. Despite a fourth-quarter net loss of SEK 173 million, insider confidence remains evident through share purchases in recent months. The company aims for growth with planned acquisitions in 2025, suggesting potential for future value creation.

- Click here and access our complete valuation analysis report to understand the dynamics of Lindab International.

Assess Lindab International's past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 47 Undervalued European Small Caps With Insider Buying selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DFDS

DFDS

Provides logistics solutions and services in Denmark and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives