- United Kingdom

- /

- Hospitality

- /

- AIM:LGRS

Three High Growth UK Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China and declining commodity prices. In such uncertain market conditions, growth companies with significant insider ownership can offer a unique investment perspective as insiders' substantial stakes often align their interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Plant Health Care (AIM:PHC) | 34.4% | 121.3% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.2% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franchise Brands plc, with a market cap of £334.47 million, operates through its subsidiaries in franchising and related activities across the United Kingdom, North America, and Europe.

Operations: Franchise Brands plc generates revenue from several segments, including Azura (£0.75 million), Pirtek (£41.95 million), B2C Division (£6.11 million), Water & Waste (£48.88 million), and Filta International (£27.12 million).

Insider Ownership: 29.8%

Revenue Growth Forecast: 11.5% p.a.

Franchise Brands is a growth company with substantial insider ownership, reflected in significant insider buying over the past three months. Analysts forecast robust revenue growth of 11.5% per year, outpacing the UK market's 3.6%. Earnings are projected to grow at 40.65% annually, significantly higher than the market average of 13.5%. Despite recent executive changes and lower profit margins compared to last year, the stock trades at a notable discount to its estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of Franchise Brands.

- The analysis detailed in our Franchise Brands valuation report hints at an deflated share price compared to its estimated value.

Loungers (AIM:LGRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loungers plc operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales, with a market cap of £287.66 million.

Operations: Loungers generates £353.49 million in revenue from operating café bars and café restaurants under the Lounge and Cosy Club brands in England and Wales.

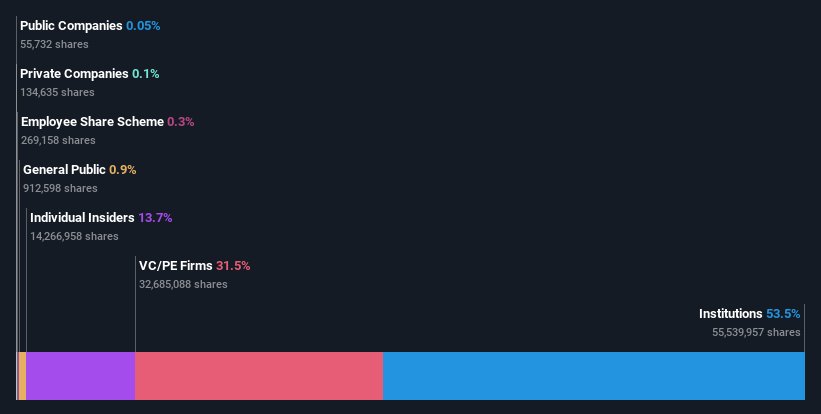

Insider Ownership: 13.7%

Revenue Growth Forecast: 12.2% p.a.

Loungers has demonstrated strong growth with a 24.67% increase in sales to £353.49 million and a rise in net income to £9.12 million for the year ended April 16, 2024. Analysts forecast revenue growth at 12.2% annually, outpacing the UK market's average of 3.6%, while earnings are expected to grow significantly at 22.8% per year. Despite this, its Return on Equity is projected to remain low at around 11%.

- Get an in-depth perspective on Loungers' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Loungers' shares may be trading at a discount.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom, with a market cap of £282.97 million.

Operations: The company's revenue segments include £1.50 million from Financial Services and £25.78 million from Property Franchising.

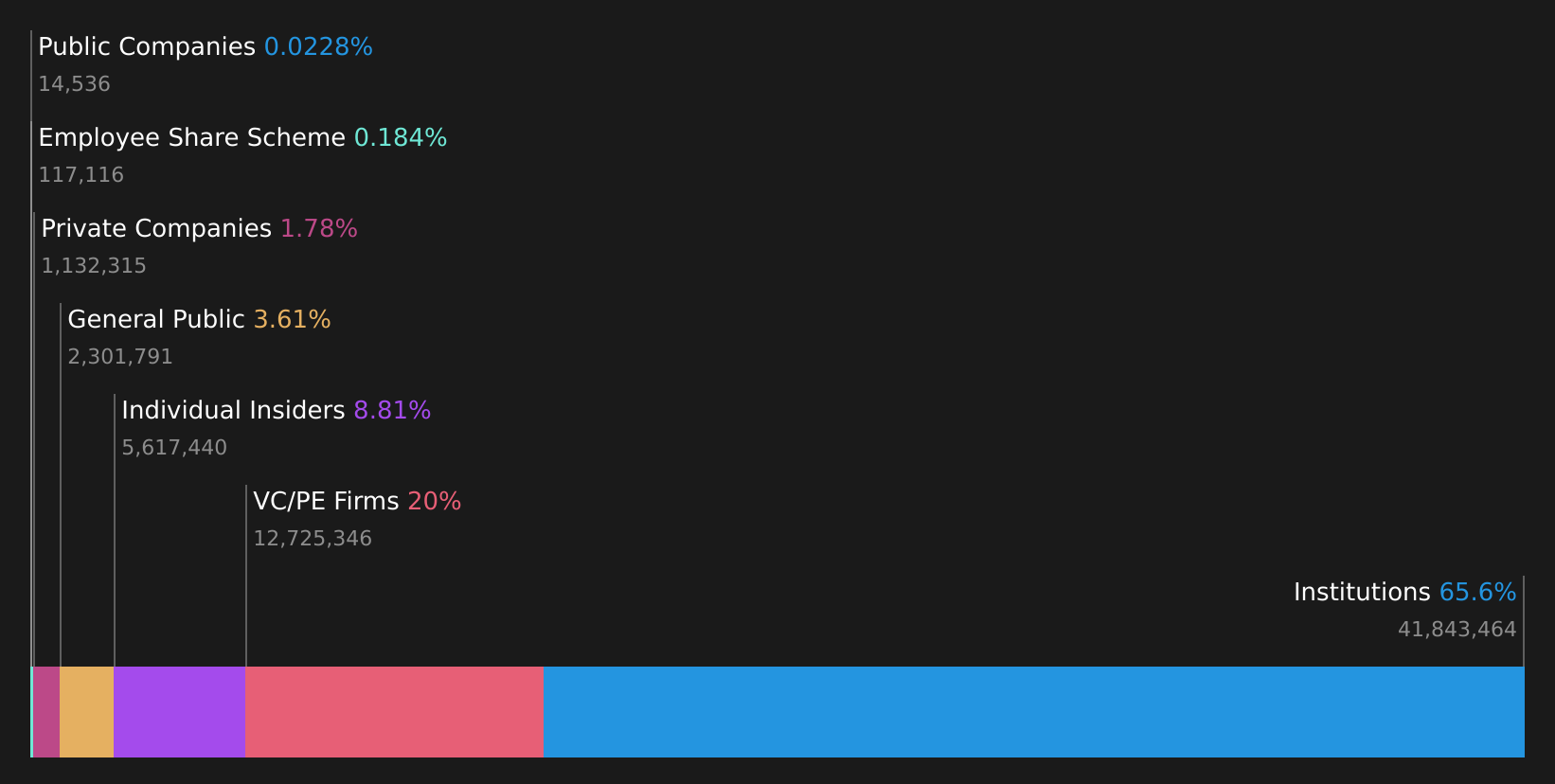

Insider Ownership: 13.5%

Revenue Growth Forecast: 44.7% p.a.

Property Franchise Group is expected to see significant earnings growth at 36.7% annually, outpacing the UK market's 13.5%. Revenue is also forecasted to grow substantially at 44.7% per year, well above the market average of 3.6%. Despite trading at a substantial discount to its estimated fair value, the company has faced shareholder dilution over the past year and maintains an unstable dividend track record. Recent executive changes include CFO David Raggett's planned retirement by end-2025.

- Unlock comprehensive insights into our analysis of Property Franchise Group stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Property Franchise Group shares in the market.

Next Steps

- Click here to access our complete index of 66 Fast Growing UK Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LGRS

Loungers

Operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales.

Reasonable growth potential with proven track record.