- United Kingdom

- /

- Media

- /

- AIM:SAA

UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In the current climate, the UK market has been experiencing challenges, with indices like the FTSE 100 and FTSE 250 reflecting global economic pressures, particularly from China's faltering trade data. Amidst these fluctuations, growth companies with high insider ownership can offer a unique perspective on potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 108.1% |

| Helios Underwriting (AIM:HUW) | 23.8% | 23.1% |

| Foresight Group Holdings (LSE:FSG) | 34.9% | 27% |

| LSL Property Services (LSE:LSL) | 10.4% | 26.9% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| RUA Life Sciences (AIM:RUA) | 13.4% | 61.7% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 24.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, along with its subsidiaries, develops, licenses, and supports computer software for the healthcare industry in the United States and has a market cap of £672.35 million.

Operations: Craneware's revenue segments include the development, licensing, and support of healthcare industry software in the United States.

Insider Ownership: 16.5%

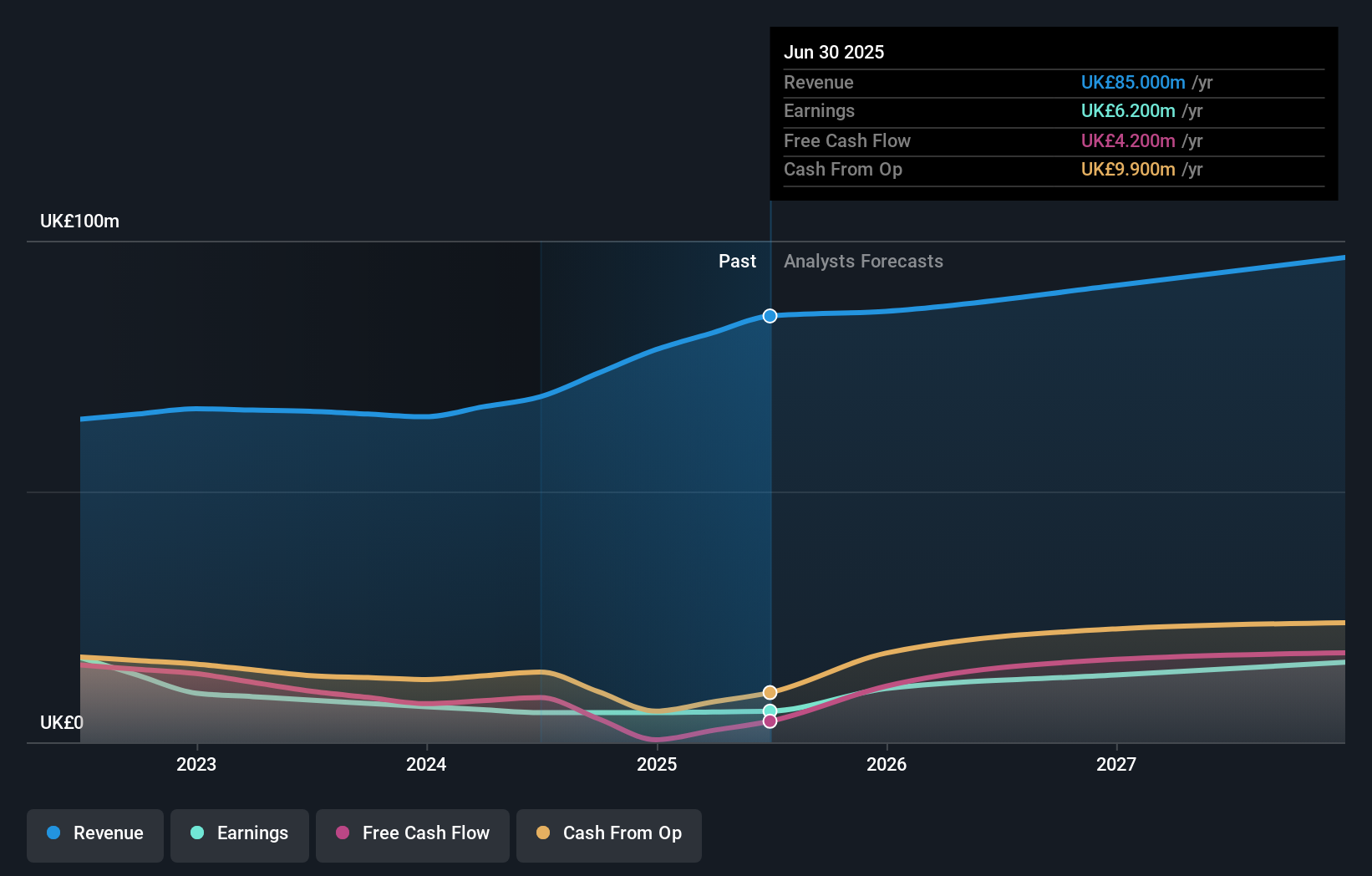

Craneware, a UK-based company, is experiencing significant earnings growth with forecasts of 29.6% annually over the next three years, outpacing the UK market's average. Revenue is expected to grow at 8.4% per year, faster than the market but slower than some high-growth peers. Recent board changes include appointing Susan Nelson and Tamra Minnier as Non-Executive Directors, bringing substantial healthcare industry expertise which may enhance strategic decision-making and operational performance.

- Click here to discover the nuances of Craneware with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Craneware's share price might be too optimistic.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £275.59 million.

Operations: The company generates revenue through three main segments: Research & Fintech (£24.20 million), Distribution Channels (£21.40 million), and Intermediary Services (£23.30 million).

Insider Ownership: 29.1%

Fintel is trading at a significant discount, 40.3% below its estimated fair value, indicating potential undervaluation. Despite a decline in profit margins from 12.7% to 8.6%, Fintel's earnings are projected to grow substantially at 31.69% annually over the next three years, surpassing UK market growth rates of 14.8%. However, revenue growth is slower than high-growth peers but still exceeds the market average. A recent £51 million equity offering may impact shareholder value and capital structure stability.

- Unlock comprehensive insights into our analysis of Fintel stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Fintel shares in the market.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £228.62 million.

Operations: M&C Saatchi plc generates revenue through its advertising and marketing communications services across various regions, including the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

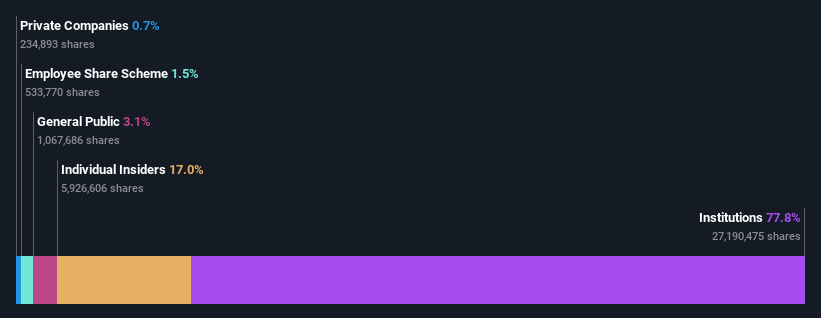

Insider Ownership: 15.5%

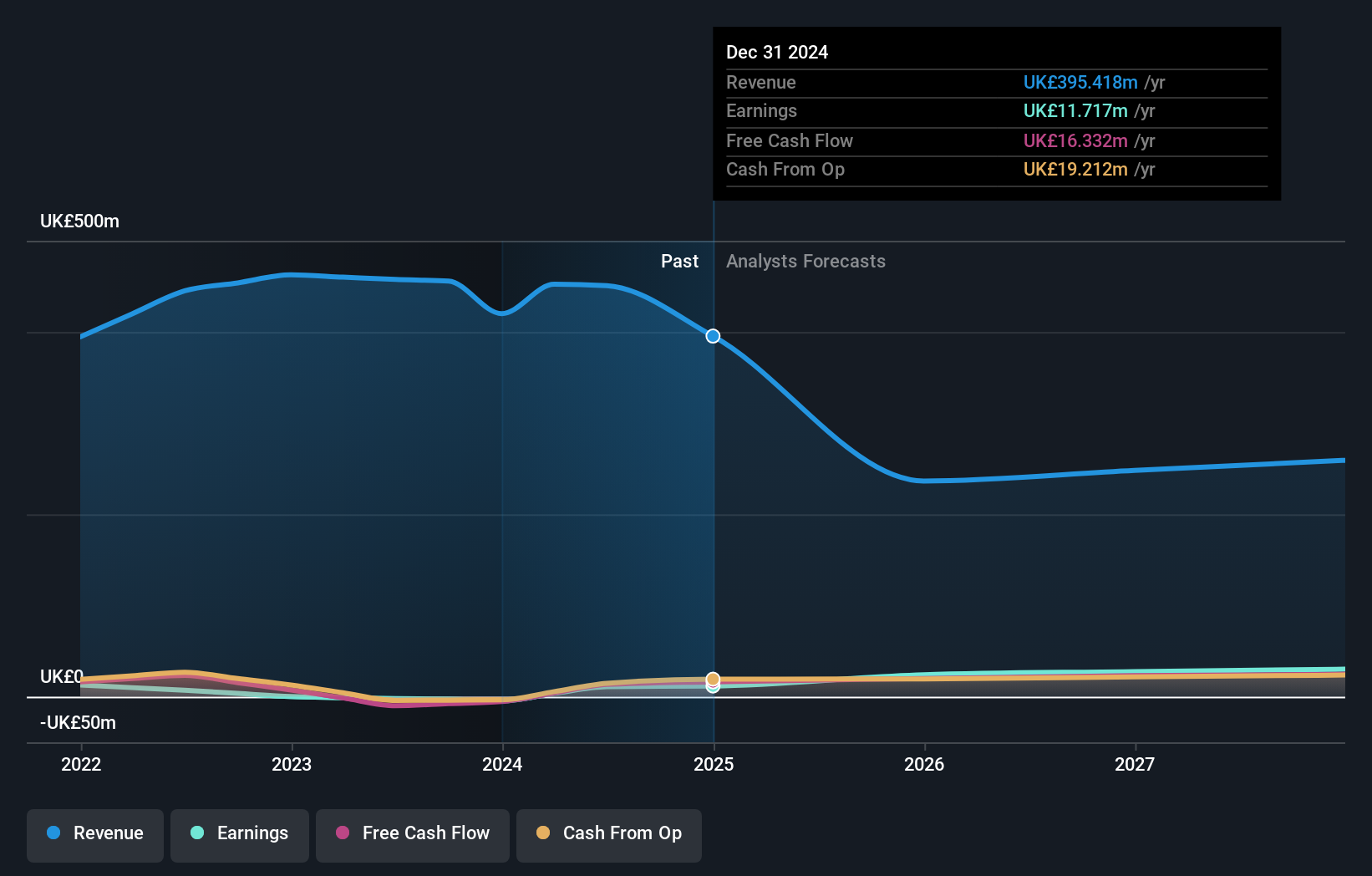

M&C Saatchi's earnings are forecast to grow significantly at 27.4% annually over the next three years, outpacing the UK market average of 14.8%. Despite anticipated revenue declines of 15.4% per year, the company remains profitable and trades at a substantial discount, 64.7% below its estimated fair value. Recent leadership changes aim to drive U.S. growth and integration across agencies, while full-year results show stable net revenue growth supported by diverse operations and efficiency initiatives.

- Dive into the specifics of M&C Saatchi here with our thorough growth forecast report.

- Our expertly prepared valuation report M&C Saatchi implies its share price may be lower than expected.

Summing It All Up

- Unlock more gems! Our Fast Growing UK Companies With High Insider Ownership screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 Fast Growing UK Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAA

M&C Saatchi

Provides advertising and marketing communications services in the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives