- United Kingdom

- /

- Professional Services

- /

- LSE:WIL

Undiscovered Gems: Promising UK Stocks for August 2024

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China and broader global economic concerns. Despite these headwinds, there remain promising opportunities within the small-cap sector for discerning investors. Identifying strong fundamentals and growth potential in such stocks can be key to uncovering hidden gems in today's volatile market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 16.96% | 18.36% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc, with a market cap of £265.28 million, provides management consultancy services through its subsidiaries in the United Kingdom, the United States, and internationally.

Operations: Elixirr International generates £85.89 million in revenue from management consulting services. The company has a market cap of £265.28 million.

Elixirr International, a promising player in the UK market, has shown impressive earnings growth of 33.9% over the past year, outpacing its industry’s -3.9%. Trading at 62.9% below estimated fair value, it offers good relative value compared to peers. Despite significant insider selling recently, Elixirr remains debt-free and forecasts an annual earnings growth of 8.97%. The company will hold its Annual General Meeting on June 25, 2024.

- Navigate through the intricacies of Elixirr International with our comprehensive health report here.

London Security (AIM:LSC)

Simply Wall St Value Rating: ★★★★★★

Overview: London Security plc, with a market cap of £478.14 million, is an investment holding company that manufactures, sells, and rents fire protection equipment across the United Kingdom and several European countries including Belgium, the Netherlands, Austria, France, Germany, Denmark, and Luxembourg.

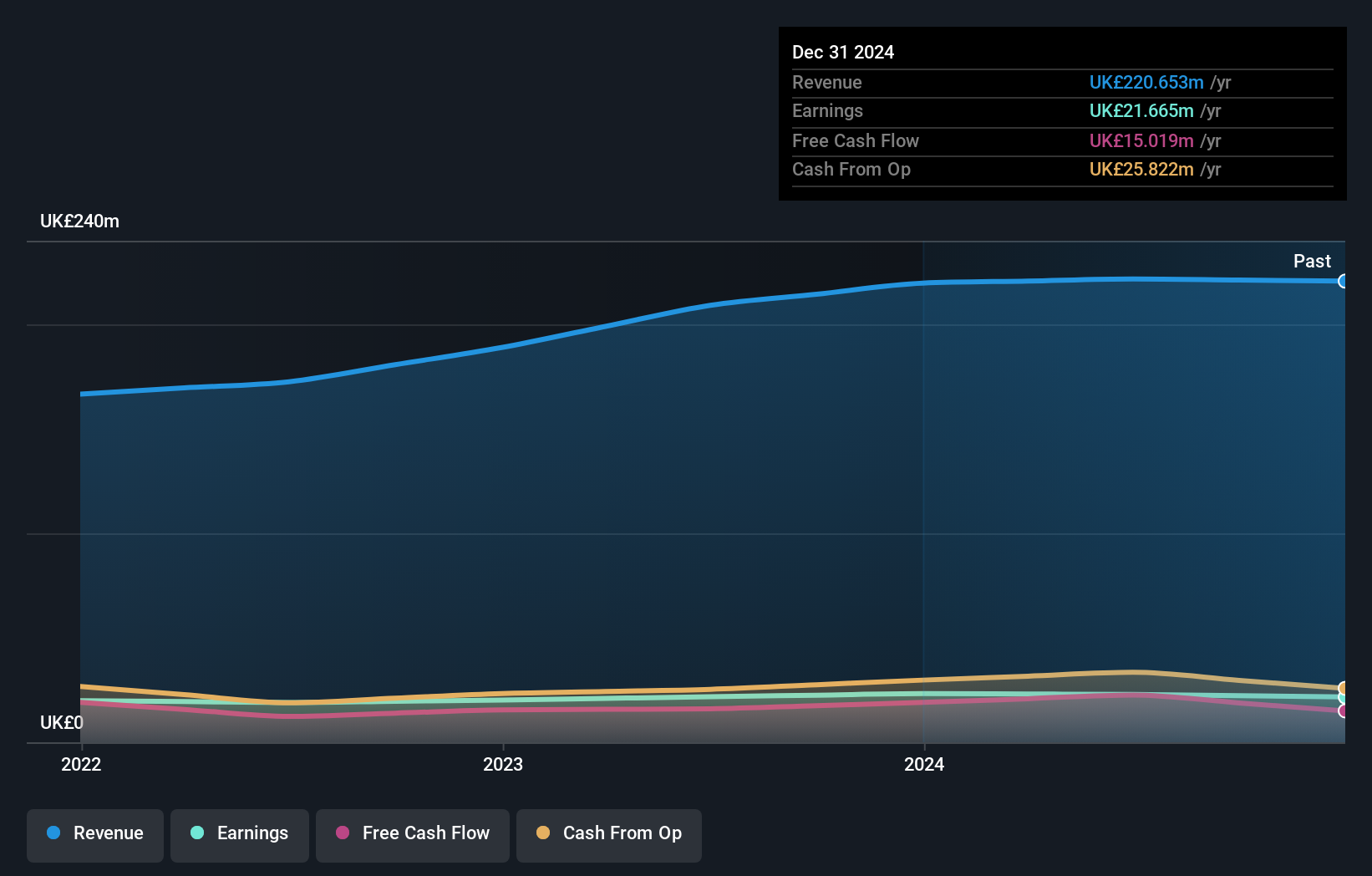

Operations: The company's primary revenue stream is from the provision and maintenance of fire protection and security equipment, generating £219.71 million.

London Security, a small cap in the UK, showcases impressive financial health. Over five years, its debt to equity ratio dropped from 8.6% to 0.3%, and it has more cash than total debt. Earnings growth of 15.1% last year outpaced the Machinery industry’s -10.1%. Additionally, interest payments are well covered by EBIT at 717x coverage and free cash flow remains positive at £19M as of December 2024.

- Unlock comprehensive insights into our analysis of London Security stock in this health report.

Understand London Security's track record by examining our Past report.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc, with a market cap of £356.87 million, offers information, data, training, and education solutions to professional markets across the UK, Europe, North America, and internationally.

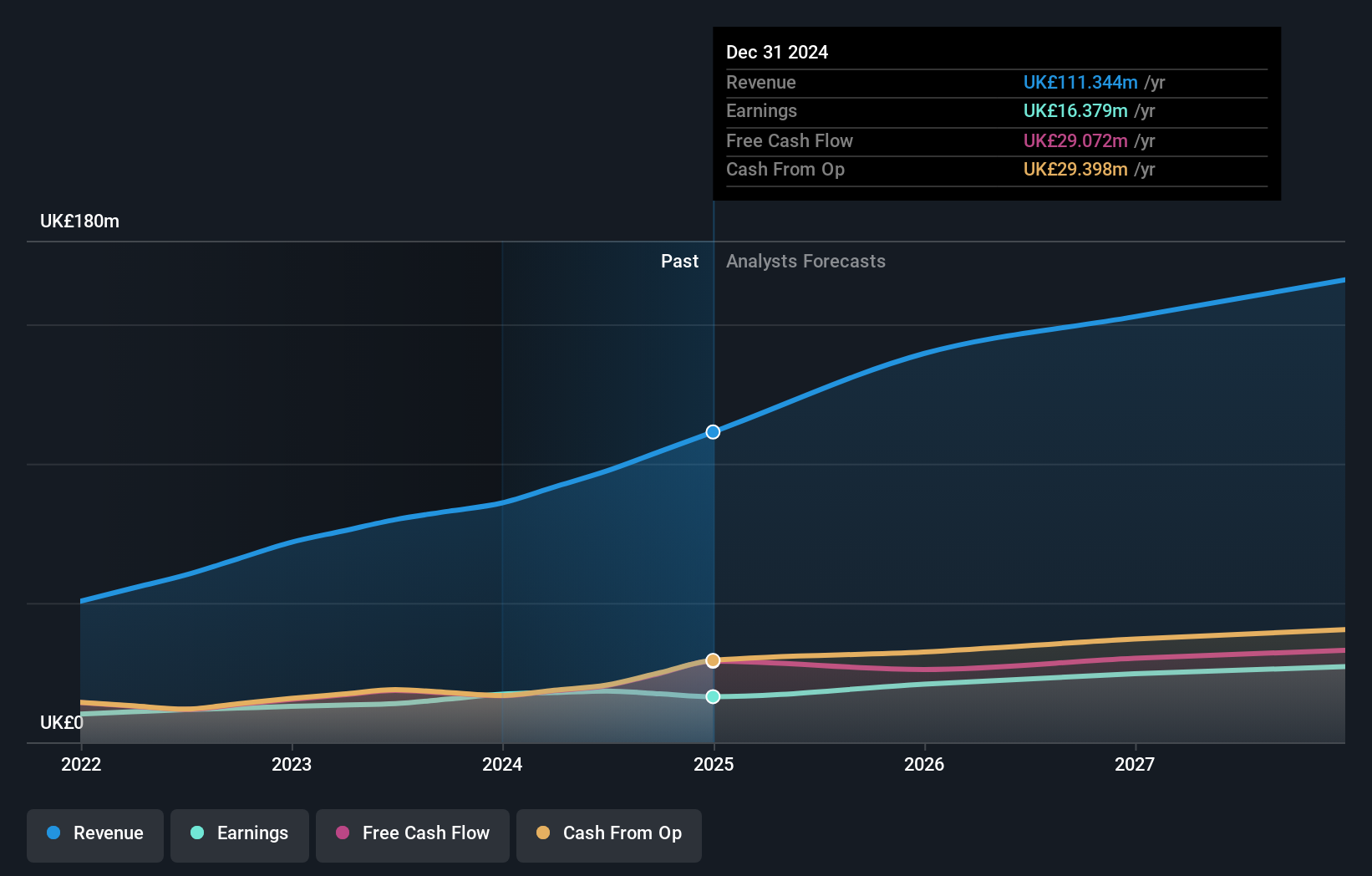

Operations: Wilmington generates revenue primarily from its Intelligence segment (£57.86 million) and Training & Education segment (£67.13 million).

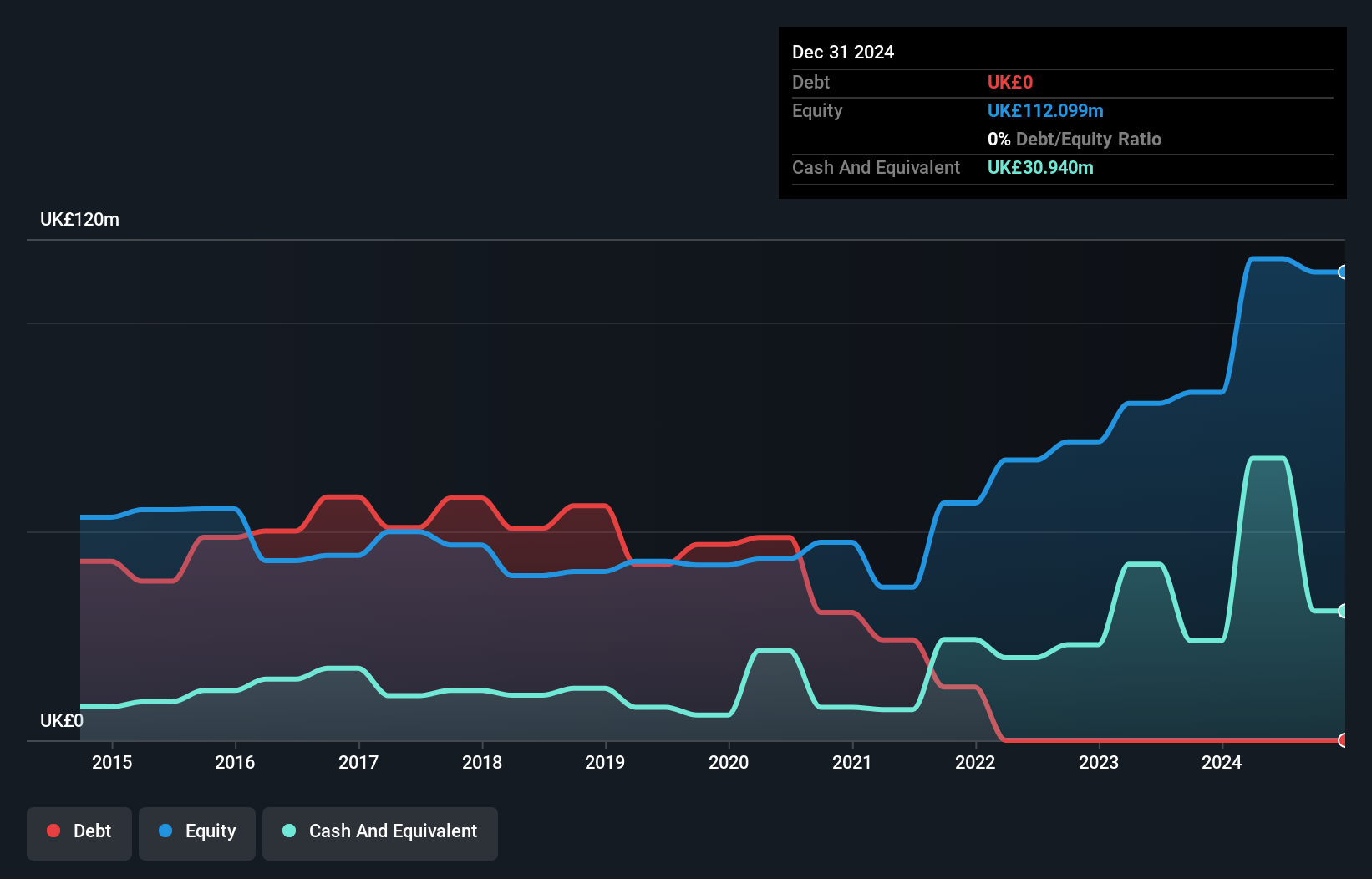

Wilmington, a smaller player in the UK market, has shown impressive financial discipline. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 139%. Recent earnings growth of 4.4% outpaced the Professional Services industry average of -3.9%. Additionally, Wilmington trades at 36.3% below its estimated fair value, suggesting potential undervaluation. Despite forecasts indicating a 6.6% annual decline in earnings over the next three years, its high-quality past earnings and positive free cash flow provide some reassurance for investors looking at long-term stability.

- Delve into the full analysis health report here for a deeper understanding of Wilmington.

Assess Wilmington's past performance with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 79 UK Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wilmington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WIL

Wilmington

Provides data, information, training, and education solutions to professional markets in the United Kingdom, the United States, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026