- United Kingdom

- /

- Building

- /

- AIM:JHD

Undiscovered Gems In The United Kingdom To Watch March 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China, highlighting global economic interdependencies, investors are increasingly turning their attention to smaller companies that may offer unique opportunities in a challenging market environment. In this climate, identifying stocks with strong fundamentals and resilience amidst broader market volatility becomes crucial for those seeking potential growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.93% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

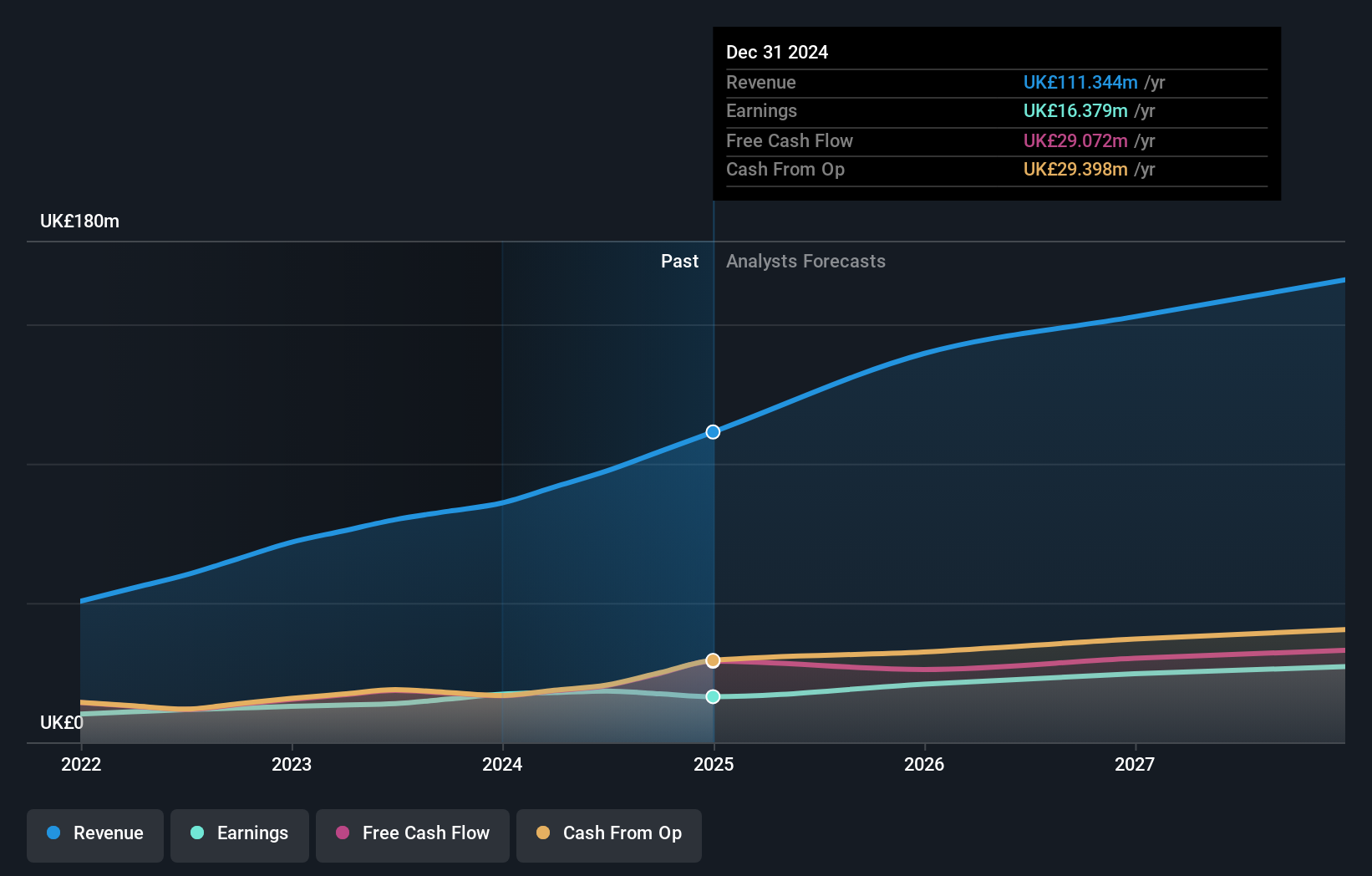

Overview: Elixirr International plc operates as a management consultancy firm with subsidiaries offering services in the United Kingdom, the United States, and internationally, and has a market capitalization of £365.71 million.

Operations: Elixirr International generates revenue primarily from its management consulting services, amounting to £97.37 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Elixirr International stands out with its robust financial health, being debt-free for the past five years and showcasing high-quality earnings. In 2024, the company projected revenue exceeding £111 million, surpassing market expectations. Its earnings growth of 32.8% over the past year significantly outpaced the industry average of 2%, highlighting strong performance in professional services. Trading at approximately 55.9% below estimated fair value suggests potential undervaluation compared to peers and industry standards. Despite recent insider selling, Elixirr remains free cash flow positive with a forecasted annual earnings growth rate of nearly 13%, indicating promising future prospects.

- Navigate through the intricacies of Elixirr International with our comprehensive health report here.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

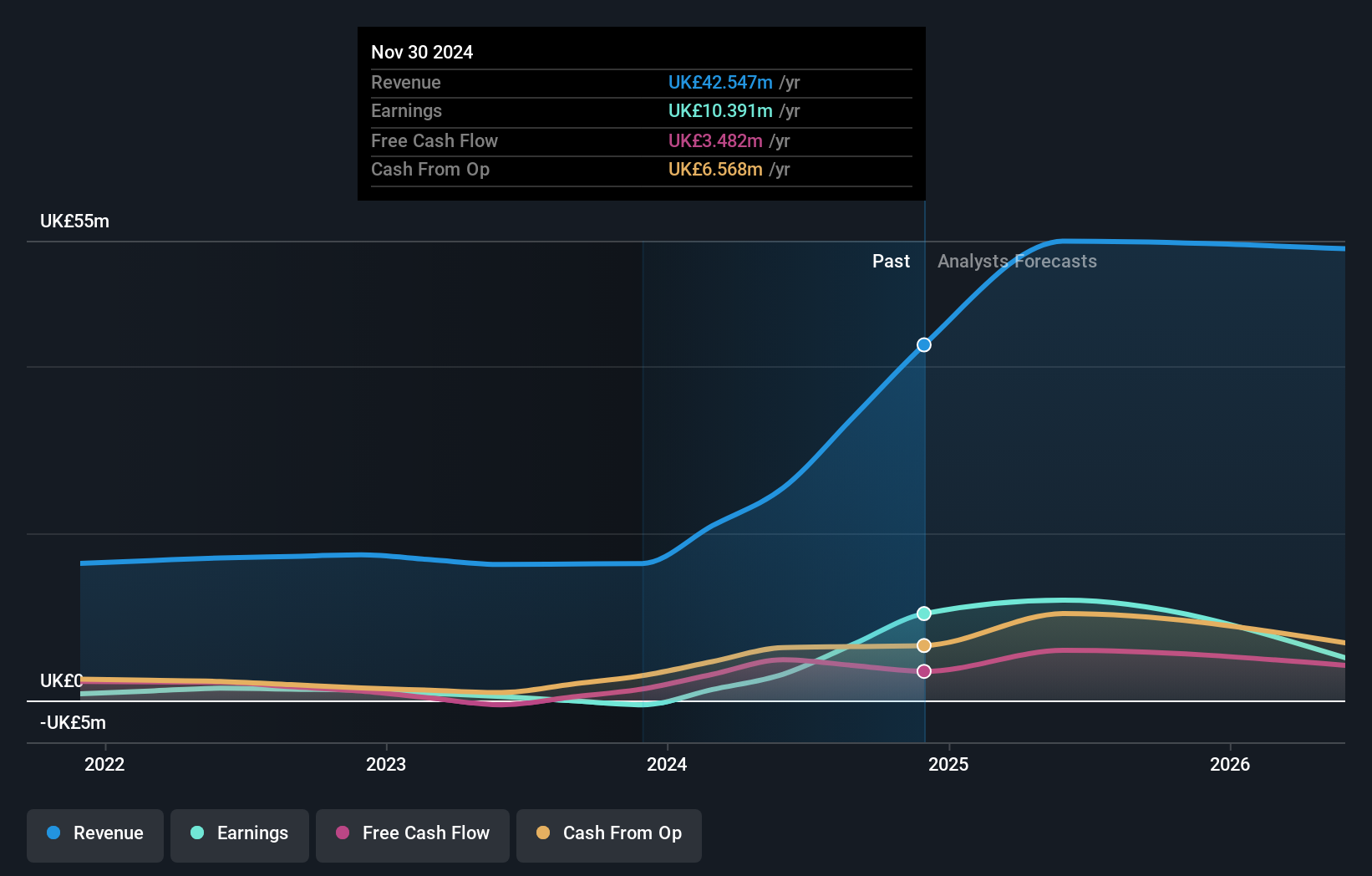

Overview: Filtronic plc specializes in the design, development, manufacturing, and sale of radio frequency (RF) technology across various global markets with a market capitalization of £223.36 million.

Operations: The company generates revenue primarily from its wireless communications equipment segment, which accounts for £42.55 million.

Filtronic, a notable player in radio frequency and microwave solutions, has recently turned profitable, marking a significant shift from its previous financial performance. The company reported half-year sales of £25.6 million, up from £8.48 million the prior year, with net income reaching £6.73 million compared to a loss of £0.522 million previously. Its price-to-earnings ratio stands at 21x, below the industry average of 26x, suggesting potential value for investors. Filtronic's new contract with SpaceX worth $20.9 million (PS16.8 million) and the appointment of Antonino Spatola as Chief Commercial Officer are strategic moves aimed at bolstering growth and market presence in key sectors like Space and Defence.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

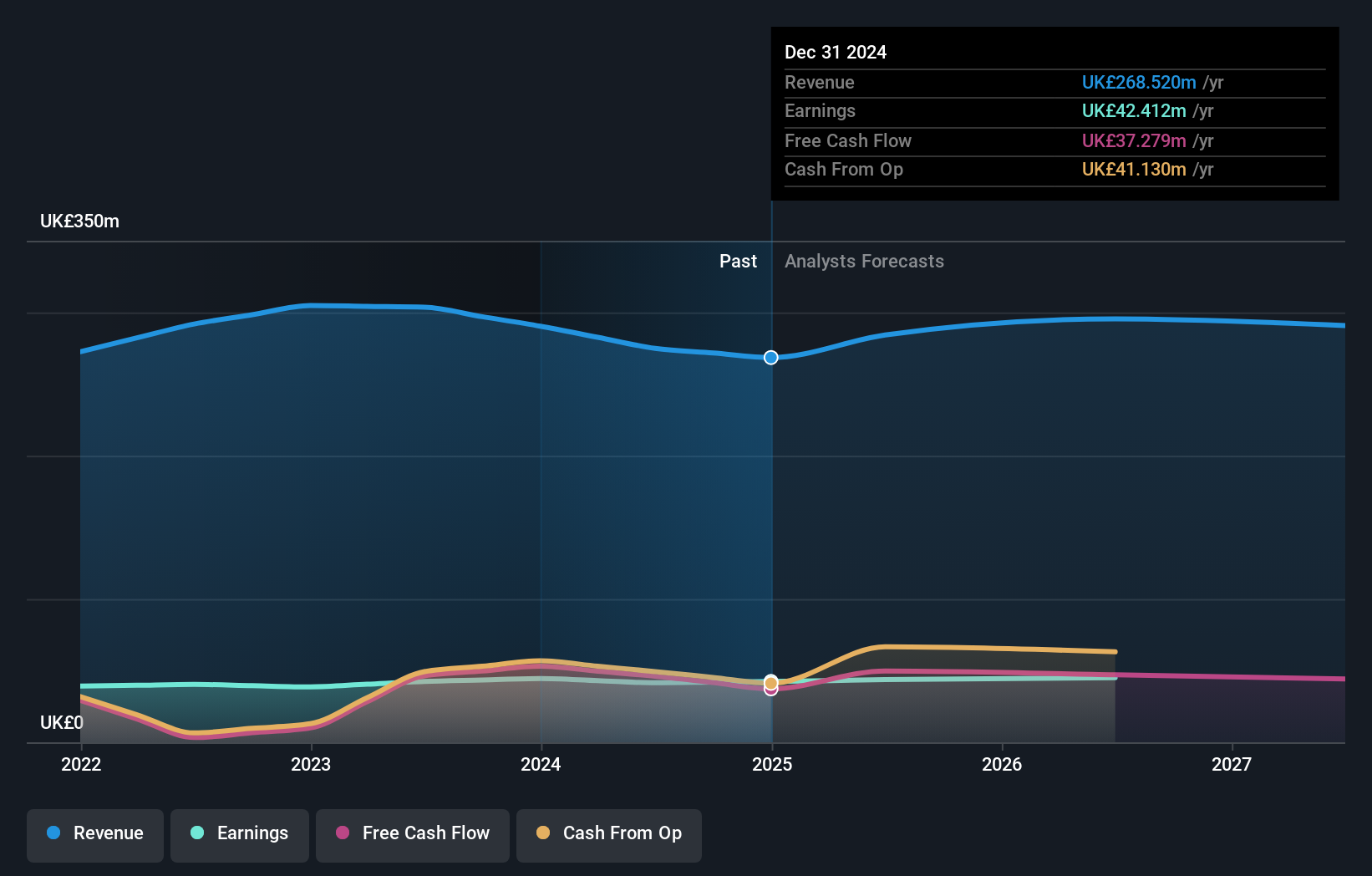

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across various international markets, with a market cap of £614.76 million.

Operations: The company generates revenue primarily from the manufacture and distribution of flooring products, amounting to £274.88 million.

James Halstead, a notable player in the UK flooring industry, showcases financial resilience with a debt-to-equity ratio dropping from 0.2 to 0.1 over five years. The company trades at an attractive 16.8% below estimated fair value, hinting at potential undervaluation. Despite facing negative earnings growth of -2.1% last year against the building industry's average of 1%, its high-quality earnings and positive free cash flow reinforce stability. With more cash than total debt and interest coverage not being an issue, James Halstead seems well-positioned for future growth prospects with forecasted annual earnings growth of 4%.

- Take a closer look at James Halstead's potential here in our health report.

Understand James Halstead's track record by examining our Past report.

Seize The Opportunity

- Reveal the 62 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives