- United Kingdom

- /

- Insurance

- /

- LSE:LGEN

3 UK Stocks That Could Be Trading Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and falling commodity prices affecting major companies. In such a fluctuating environment, identifying stocks that might be trading below their estimated intrinsic values can offer potential opportunities for investors seeking to navigate these uncertain conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.92 | £1.70 | 45.9% |

| Coats Group (LSE:COA) | £0.913 | £1.65 | 44.7% |

| Hercules Site Services (AIM:HERC) | £0.495 | £0.93 | 46.8% |

| Brickability Group (AIM:BRCK) | £0.556 | £1.10 | 49.6% |

| On the Beach Group (LSE:OTB) | £2.52 | £4.95 | 49.1% |

| Gaming Realms (AIM:GMR) | £0.37 | £0.72 | 48.5% |

| GlobalData (AIM:DATA) | £1.82 | £3.55 | 48.8% |

| Victrex (LSE:VCT) | £9.93 | £19.55 | 49.2% |

| Duke Capital (AIM:DUKE) | £0.291 | £0.57 | 48.6% |

| Deliveroo (LSE:ROO) | £1.356 | £2.60 | 47.9% |

Here's a peek at a few of the choices from the screener.

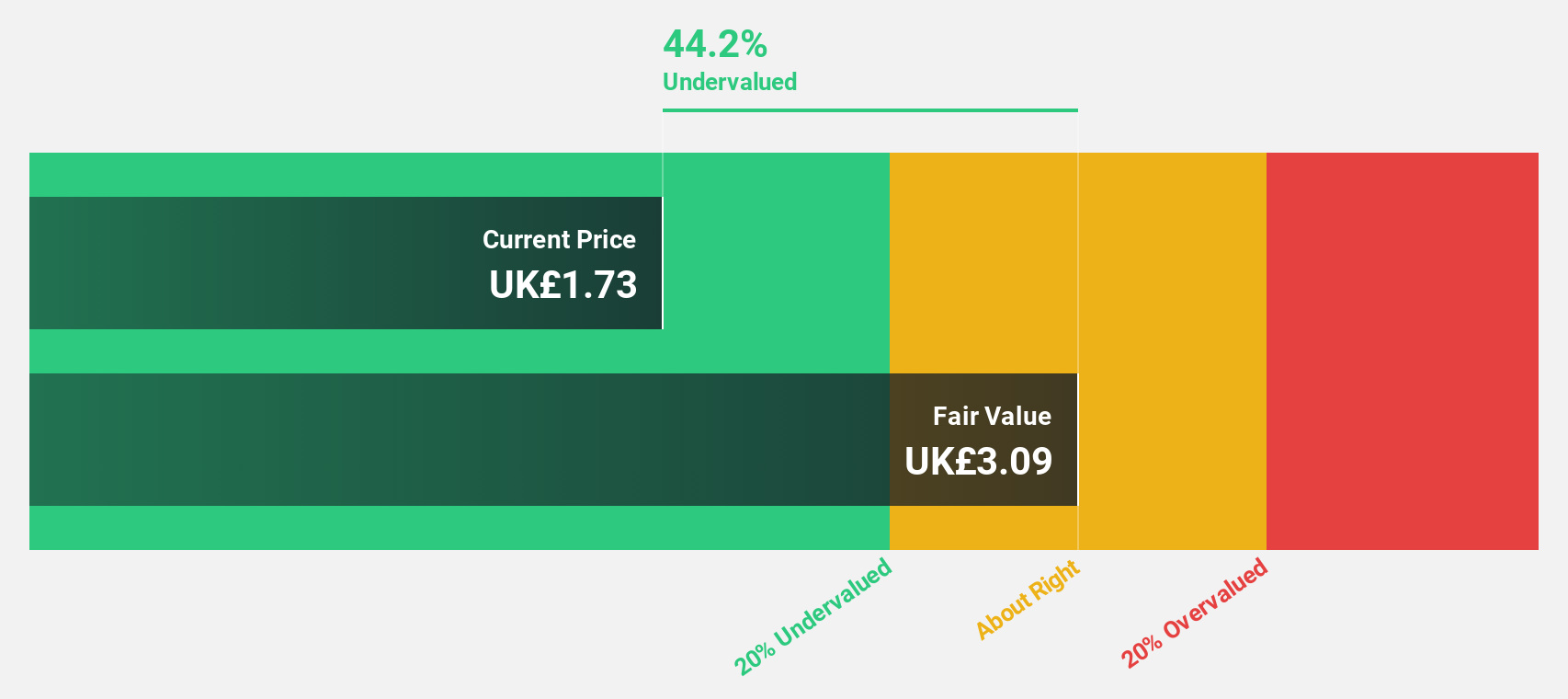

GlobalData (AIM:DATA)

Overview: GlobalData Plc, along with its subsidiaries, offers business information through proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific regions with a market cap of £1.43 billion.

Operations: The company's revenue is primarily derived from its Data, Analytics, and Insights segment, which generated £276.80 million.

Estimated Discount To Fair Value: 48.8%

GlobalData is trading at £1.82, significantly below its estimated fair value of £3.55, indicating it may be undervalued based on cash flows. The company forecasts revenue growth of 11.7% annually, outpacing the UK market's 3.6%, with earnings expected to grow significantly at 25.8%. Despite a dividend yield of 2.58% not being well-covered by earnings, analysts anticipate a stock price increase of nearly 46%. Recent guidance suggests steady revenue growth for the fiscal year 2024.

- Our comprehensive growth report raises the possibility that GlobalData is poised for substantial financial growth.

- Navigate through the intricacies of GlobalData with our comprehensive financial health report here.

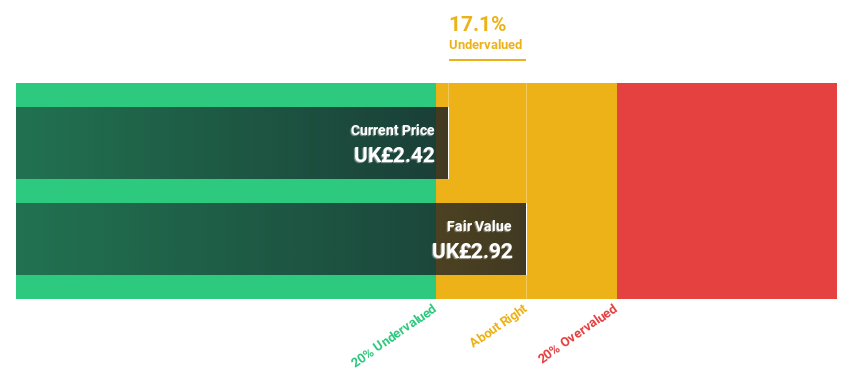

Legal & General Group (LSE:LGEN)

Overview: Legal & General Group Plc offers a range of insurance products and services across the UK, the US, and internationally, with a market cap of £13.81 billion.

Operations: The company's revenue segments include Insurance (£3.20 billion) and Retail Retirement (£1.55 billion).

Estimated Discount To Fair Value: 23.2%

Legal & General Group is trading at £2.36, over 20% below its estimated fair value of £3.07, highlighting potential undervaluation based on cash flows. Despite expected revenue decline of 0.6% annually over three years, earnings are forecast to grow significantly at 25.2%, outpacing the UK market's growth rate of 14.9%. However, a dividend yield of 8.75% is not well covered by earnings, and debt coverage by operating cash flow remains a concern amidst recent board changes for strategic growth focus.

- According our earnings growth report, there's an indication that Legal & General Group might be ready to expand.

- Click here to discover the nuances of Legal & General Group with our detailed financial health report.

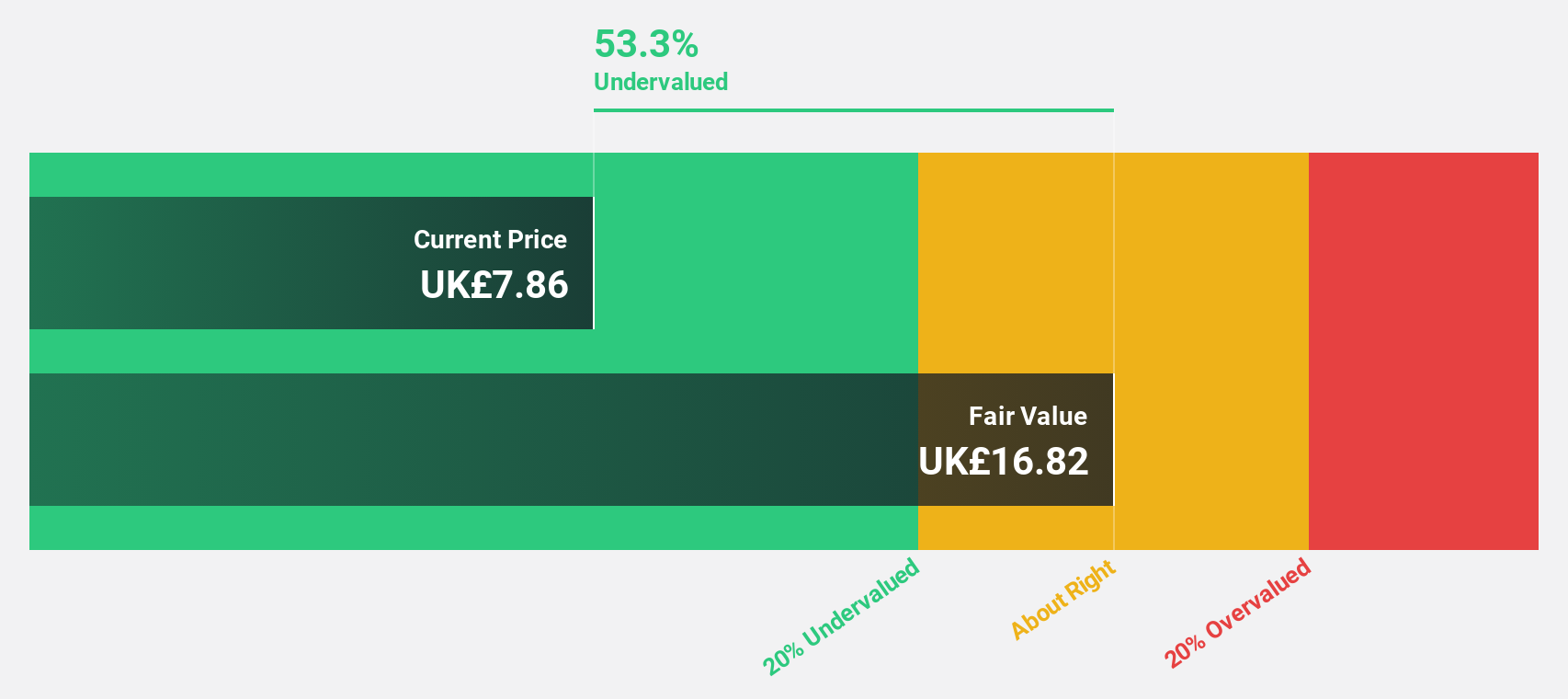

Victrex (LSE:VCT)

Overview: Victrex plc, with a market cap of £849.59 million, is involved in the global manufacture and sale of polymer solutions through its subsidiaries.

Operations: The company's revenue segments include £53 million from Medical and £240.60 million from Sustainable Solutions.

Estimated Discount To Fair Value: 49.2%

Victrex is trading at £9.93, significantly below its estimated fair value of £19.55, suggesting potential undervaluation based on cash flows. Despite a challenging year with net income dropping to £17.2 million from £61.7 million, earnings are forecast to grow significantly at 29.37% annually, surpassing the UK market's growth rate of 14.6%. However, the dividend yield of 6% lacks coverage by earnings or free cash flows, and profit margins have decreased from last year’s figures.

- Our growth report here indicates Victrex may be poised for an improving outlook.

- Dive into the specifics of Victrex here with our thorough financial health report.

Key Takeaways

- Navigate through the entire inventory of 47 Undervalued UK Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LGEN

Legal & General Group

Provides various insurance products and services in the United Kingdom, the United States, and internationally.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives