- United Kingdom

- /

- Commercial Services

- /

- AIM:CPP

Capital Investments At CPPGroup (LON:CPP) Point To A Promising Future

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of CPPGroup (LON:CPP) looks attractive right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for CPPGroup:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = UK£4.8m ÷ (UK£60m - UK£40m) (Based on the trailing twelve months to December 2022).

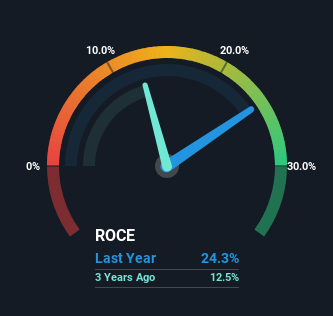

So, CPPGroup has an ROCE of 24%. That's a fantastic return and not only that, it outpaces the average of 9.1% earned by companies in a similar industry.

See our latest analysis for CPPGroup

Above you can see how the current ROCE for CPPGroup compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering CPPGroup here for free.

What The Trend Of ROCE Can Tell Us

In terms of CPPGroup's history of ROCE, it's quite impressive. Over the past five years, ROCE has remained relatively flat at around 24% and the business has deployed 23% more capital into its operations. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. If these trends can continue, it wouldn't surprise us if the company became a multi-bagger.

On a separate but related note, it's important to know that CPPGroup has a current liabilities to total assets ratio of 67%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

In Conclusion...

In summary, we're delighted to see that CPPGroup has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. What's surprising though is that the stock has collapsed 80% over the last five years, so there might be other areas of the business hurting its prospects. That's why it's worth looking further into this stock because while these fundamentals look good, there could be other issues with the business.

CPPGroup does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those can't be ignored...

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CPP

CPPGroup

Engages in creating embedded and ancillary real-time assistance products and resolution service in the India, Turkey, and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion