- United Kingdom

- /

- Professional Services

- /

- AIM:BUC

The Market Lifts Aukett Swanke Group Plc (LON:AUK) Shares 41% But It Can Do More

Aukett Swanke Group Plc (LON:AUK) shares have continued their recent momentum with a 41% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

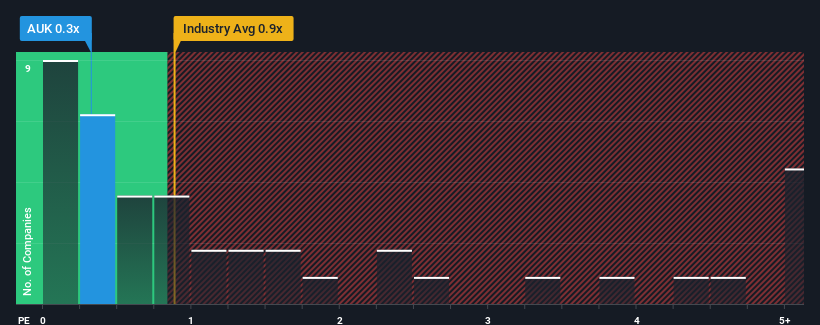

Even after such a large jump in price, Aukett Swanke Group's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Professional Services industry in the United Kingdom, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Aukett Swanke Group

What Does Aukett Swanke Group's P/S Mean For Shareholders?

Aukett Swanke Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Aukett Swanke Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Aukett Swanke Group?

In order to justify its P/S ratio, Aukett Swanke Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 98% gain to the company's top line. As a result, it also grew revenue by 24% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 6.1% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Aukett Swanke Group's P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Aukett Swanke Group's P/S

The latest share price surge wasn't enough to lift Aukett Swanke Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Aukett Swanke Group revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

It is also worth noting that we have found 5 warning signs for Aukett Swanke Group (1 doesn't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Built Cybernetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:BUC

Built Cybernetics

Provides integrated professional design services in the United Kingdom and Turkey.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives