- United Kingdom

- /

- Professional Services

- /

- AIM:DATA

3 UK Stocks Considered To Be Trading Below Estimated Fair Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced downturns, influenced by weak trade data from China that highlighted ongoing challenges in the global economy. As London markets navigate these pressures, investors may find opportunities in stocks perceived to be trading below their estimated fair value, especially those resilient to fluctuating international demand and capable of weathering economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.365 | £0.72 | 49.2% |

| Fevertree Drinks (AIM:FEVR) | £6.665 | £13.12 | 49.2% |

| Brickability Group (AIM:BRCK) | £0.636 | £1.26 | 49.7% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Tracsis (AIM:TRCS) | £5.06 | £9.76 | 48.2% |

| Zotefoams (LSE:ZTF) | £3.16 | £5.82 | 45.7% |

| Duke Capital (AIM:DUKE) | £0.305 | £0.58 | 47.5% |

| Victrex (LSE:VCT) | £10.66 | £19.84 | 46.3% |

| Quartix Technologies (AIM:QTX) | £1.56 | £2.93 | 46.7% |

| St. James's Place (LSE:STJ) | £8.49 | £16.52 | 48.6% |

Let's review some notable picks from our screened stocks.

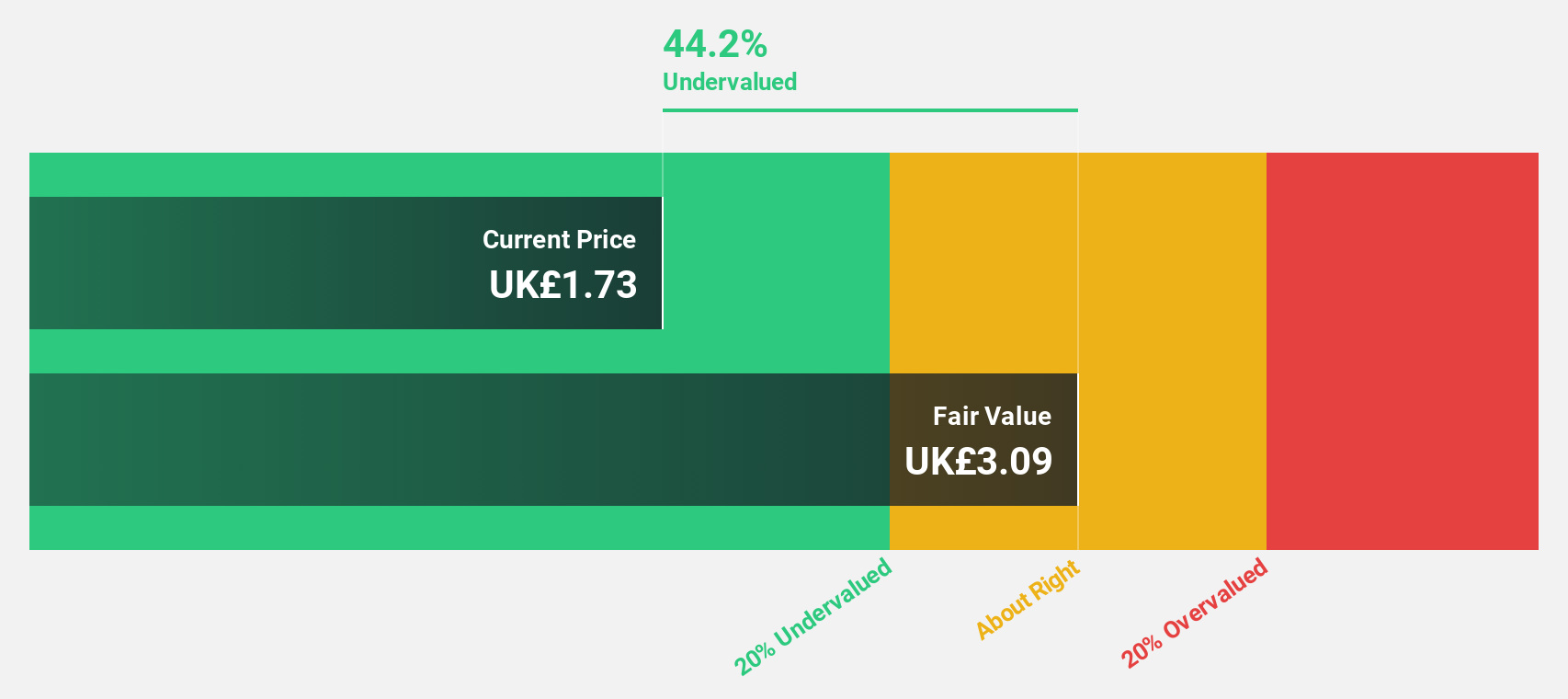

GlobalData (AIM:DATA)

Overview: GlobalData Plc, along with its subsidiaries, offers business information through proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific regions; it has a market cap of £1.49 billion.

Operations: The company generates £276.80 million in revenue from its Data, Analytics, and Insights segment across its operational regions.

Estimated Discount To Fair Value: 49.8%

GlobalData is trading at £1.88, significantly below its estimated fair value of £3.74, highlighting its undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow substantially at 27.69% annually, outpacing the UK market's growth rate of 14.8%. However, while revenue is expected to grow faster than the market at 7.5% per year, it remains below high-growth benchmarks and its dividend yield of 2.51% lacks coverage by earnings.

- Our growth report here indicates GlobalData may be poised for an improving outlook.

- Take a closer look at GlobalData's balance sheet health here in our report.

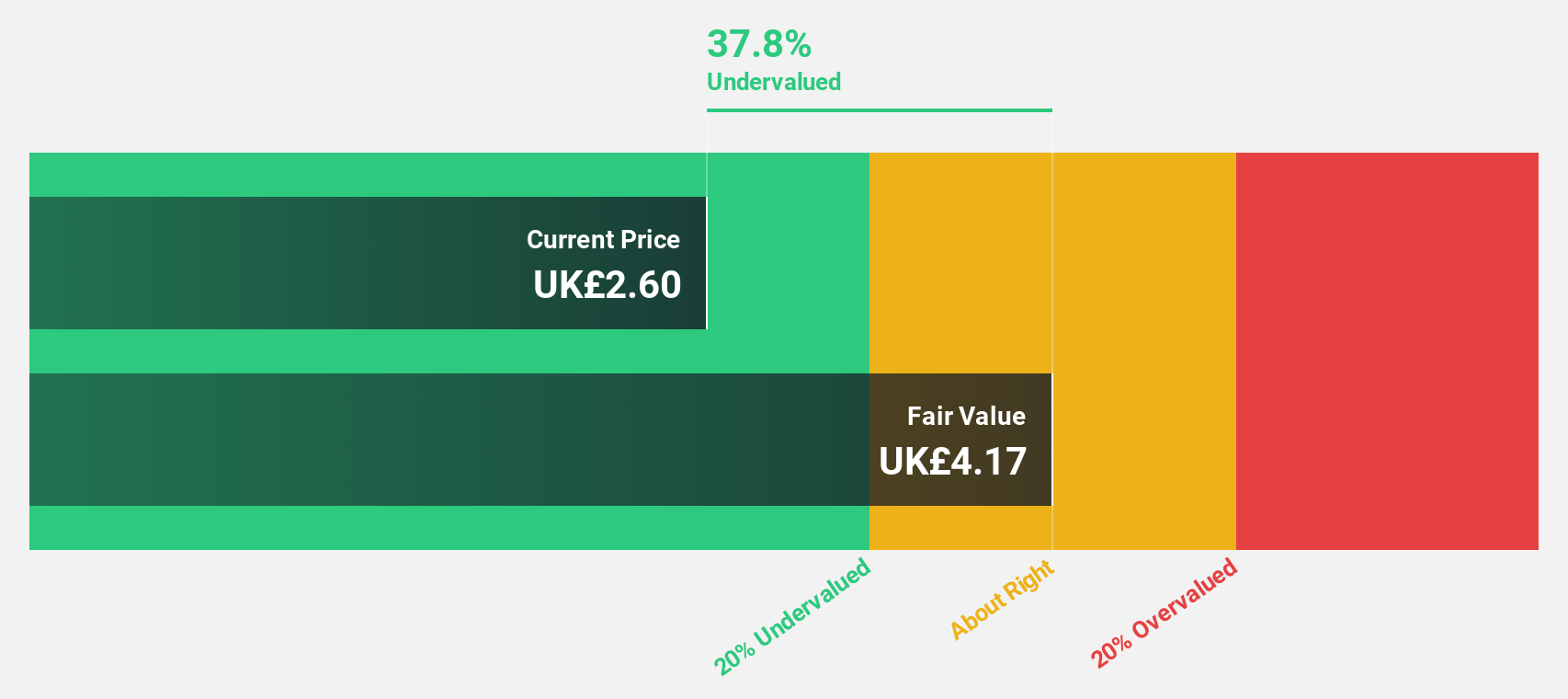

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £331.36 million, offers office and workplace services to both public and private sectors mainly in the United Kingdom.

Operations: The company's revenue is derived from Secure Lifecycle Services (£104.40 million) and Digital & Information Management (£172.50 million).

Estimated Discount To Fair Value: 27.8%

Restore is trading at £2.42, below its estimated fair value of £3.35, indicating undervaluation based on discounted cash flow analysis. Despite a flat revenue forecast due to market uncertainty, earnings are expected to grow significantly at 48.22% annually, surpassing the UK market's growth rate of 14.8%. However, interest payments and dividends remain poorly covered by earnings. Recent board changes include Patrick Butcher's appointment as a non-executive director amidst these financial dynamics.

- The growth report we've compiled suggests that Restore's future prospects could be on the up.

- Dive into the specifics of Restore here with our thorough financial health report.

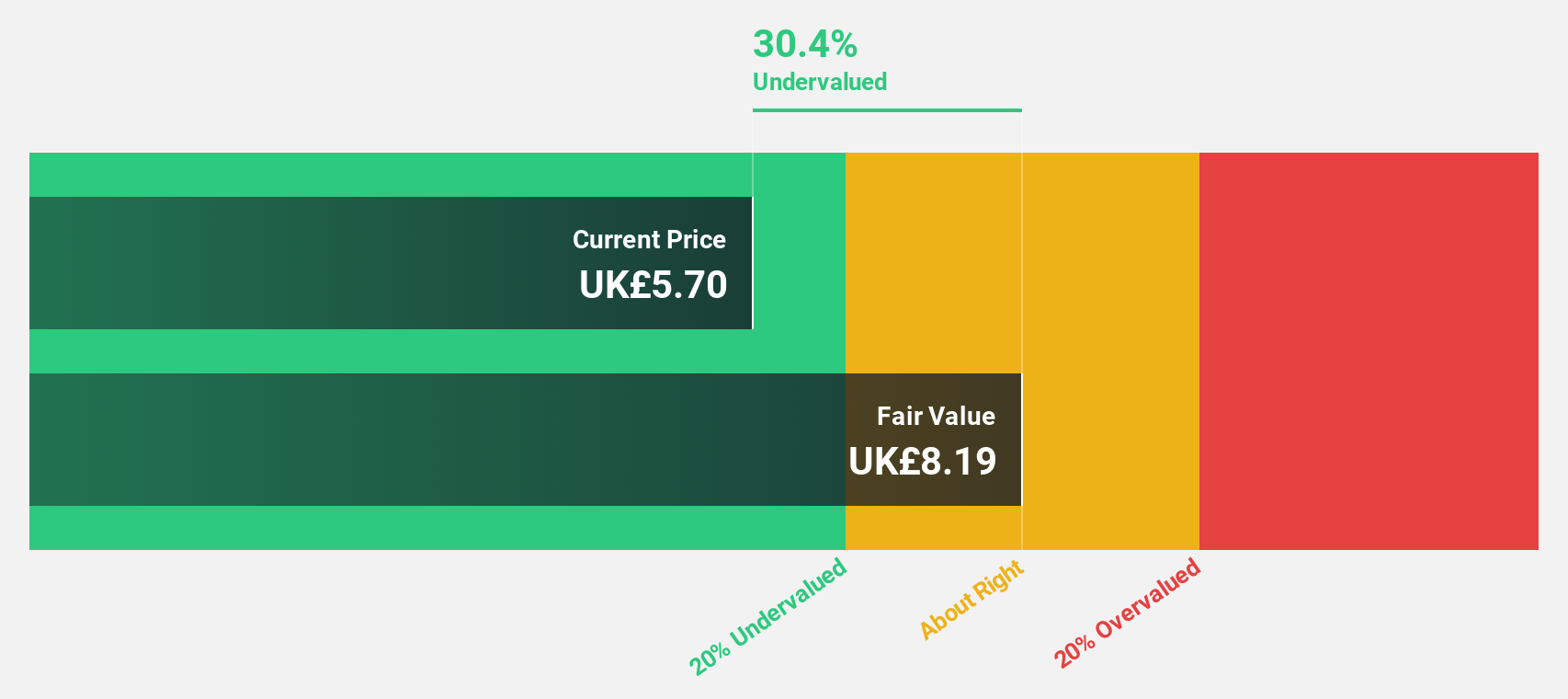

Vp (LSE:VP.)

Overview: Vp plc offers equipment rental and associated services both in the United Kingdom and internationally, with a market cap of £217.04 million.

Operations: The company generates revenue from equipment rental and services, with £339.21 million coming from the United Kingdom and £43.35 million internationally.

Estimated Discount To Fair Value: 45.2%

Vp is trading at £5.5, significantly below its estimated fair value of £10.04, highlighting undervaluation based on cash flow analysis. Earnings are projected to grow at a robust 55.72% annually, outpacing the market average. However, the company's high level of debt and unsustainable dividend coverage pose risks. Recent strategic initiatives like Vp Rail aim to enhance growth by leveraging integrated services in the rail sector, aligning with their refreshed strategy for market expansion.

- Upon reviewing our latest growth report, Vp's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Vp stock in this financial health report.

Where To Now?

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 Undervalued UK Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DATA

GlobalData

Provides business information in the form of proprietary data, analytics, and insights in Europe, North America, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives