- United Kingdom

- /

- Capital Markets

- /

- LSE:PBEE

UK Penny Stock Spotlight: Hollywood Bowl Group And 2 Other Promising Picks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors can still find opportunities by focusing on stocks that demonstrate strong financial fundamentals. Penny stocks, though often associated with smaller or newer companies, can offer unique value and growth potential when backed by solid balance sheets and clear growth strategies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.84 | £552.59M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.16 | £174.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.40 | £116.23M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.915 | £13.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.17 | £16.1M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.25 | £28.55M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £253.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.42 | £68.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.13 | £180.35M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally, with a market cap of £462.18 million.

Operations: The company generates revenue primarily from its recreational activities, amounting to £240.46 million.

Market Cap: £462.18M

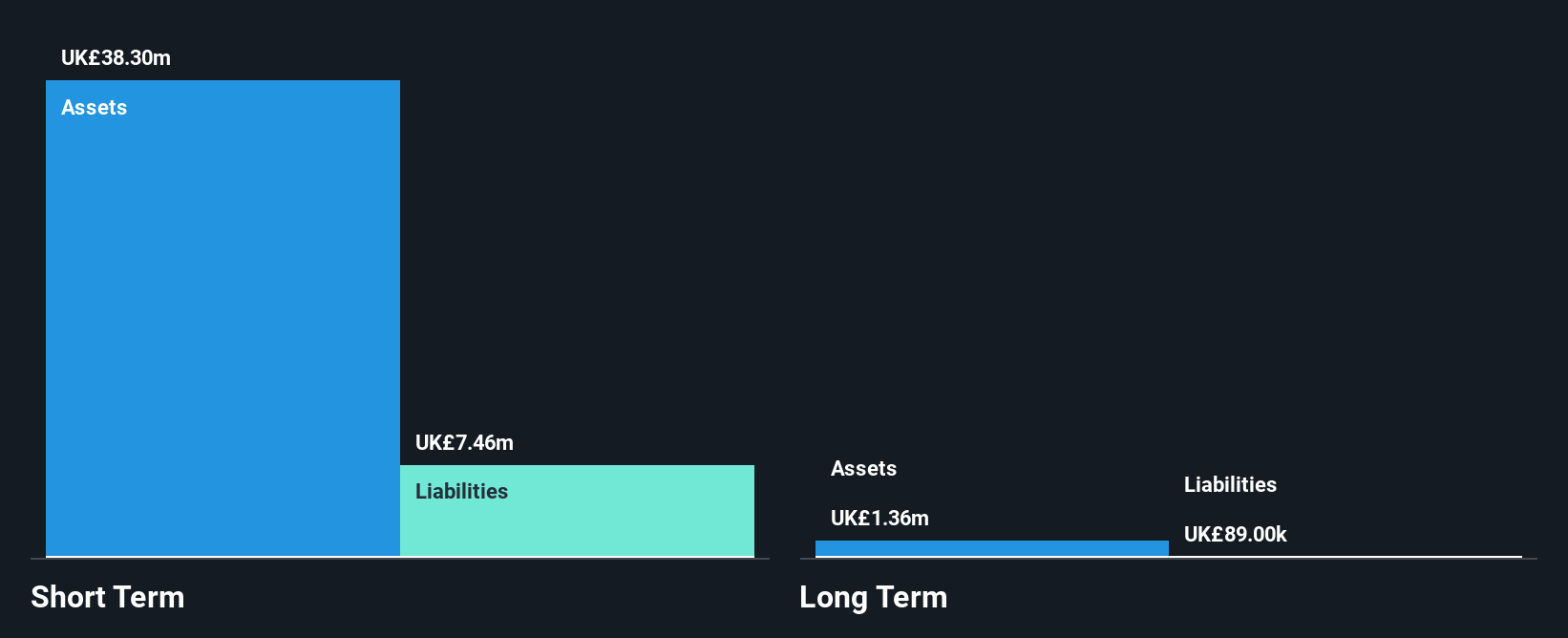

Hollywood Bowl Group, with a market cap of £462.18 million and revenue of £240.46 million, has shown significant earnings growth over the past five years at 29.9% annually. Despite being debt-free and trading below its estimated fair value by 47.4%, the company faces challenges such as lower net profit margins compared to last year and short-term assets not covering liabilities (£33.3M vs £45.3M). Although recent earnings growth has been negative, analysts forecast a 12.83% annual growth rate moving forward, supported by an experienced management team and board of directors.

- Jump into the full analysis health report here for a deeper understanding of Hollywood Bowl Group.

- Understand Hollywood Bowl Group's earnings outlook by examining our growth report.

PensionBee Group (LSE:PBEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £382.98 million.

Operations: The company generates revenue of £36.69 million from its Internet Information Providers segment.

Market Cap: £382.98M

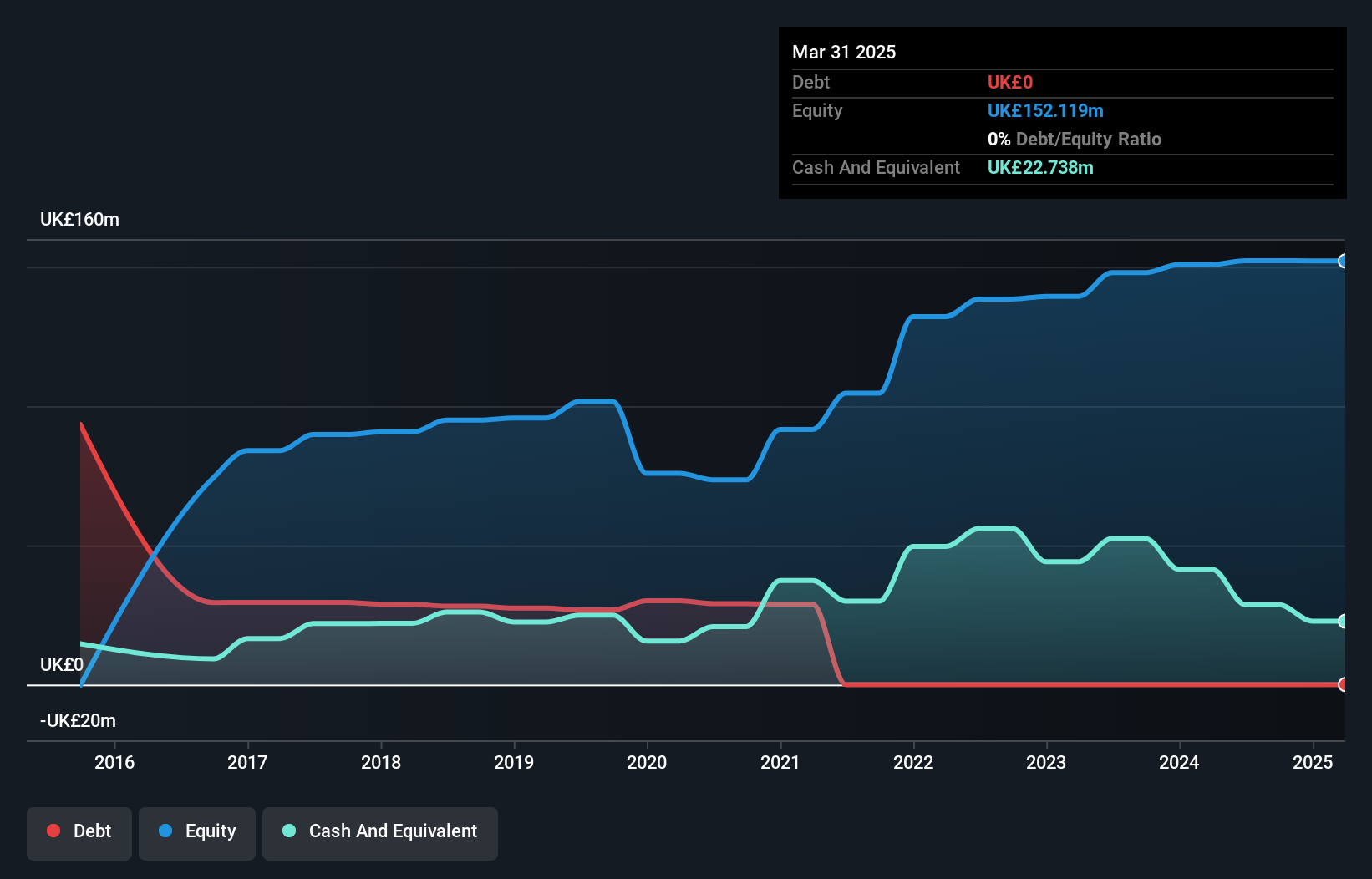

PensionBee Group, with a market cap of £382.98 million and revenue of £36.69 million, is focusing on expanding its retirement savings services in the U.S., highlighted by its recent 1% match program to consolidate old 401(k)s and IRAs. This initiative aims to tackle the issue of orphaned retirement accounts while incentivizing participation through financial rewards. Despite being unprofitable, PensionBee has maintained a stable cash runway for over three years due to positive free cash flow growth. The company is debt-free, has experienced leadership, and no significant shareholder dilution occurred recently, although it continues to operate at a loss.

- Take a closer look at PensionBee Group's potential here in our financial health report.

- Examine PensionBee Group's earnings growth report to understand how analysts expect it to perform.

Trifast (LSE:TRI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trifast plc, with a market cap of £103.93 million, designs, engineers, manufactures, and supplies industrial fasteners and category C components across the United Kingdom, Ireland, Europe, North America, and Asia.

Operations: The company's revenue is primarily derived from its industrial fasteners and category C components segment, generating £223.47 million.

Market Cap: £103.93M

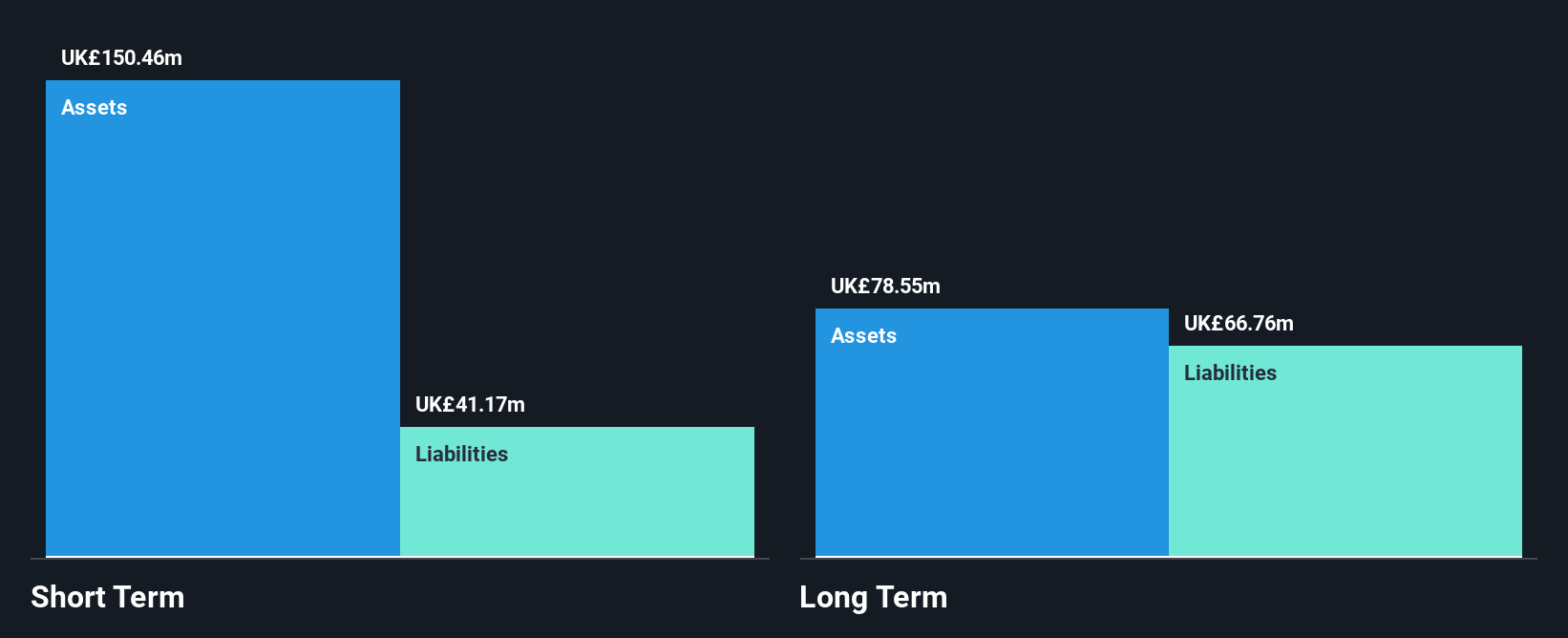

Trifast plc, with a market cap of £103.93 million, has demonstrated financial resilience by becoming profitable this year and maintaining stable weekly volatility at 7%. Its short-term assets significantly exceed both short-term (£41.2M) and long-term liabilities (£66.8M), indicating strong liquidity. While its dividend yield of 2.34% is not well covered by earnings, the company has reduced its debt to equity ratio from 37.9% to 34.4% over five years, with satisfactory net debt levels at 14.3%. Despite low Return on Equity (0.9%), Trifast trades below estimated fair value and forecasts suggest robust earnings growth ahead.

- Dive into the specifics of Trifast here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Trifast's future.

Where To Now?

- Take a closer look at our UK Penny Stocks list of 292 companies by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PBEE

PensionBee Group

Provides online retirements saving services in the United Kingdom and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives