Senior plc's (LON:SNR) investors are due to receive a payment of £0.0075 per share on 15th of November. Although the dividend is now higher, the yield is only 1.5%, which is below the industry average.

View our latest analysis for Senior

Senior's Future Dividend Projections Appear Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Senior's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to rise by 80.7% over the next year. If the dividend continues on this path, the payout ratio could be 16% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

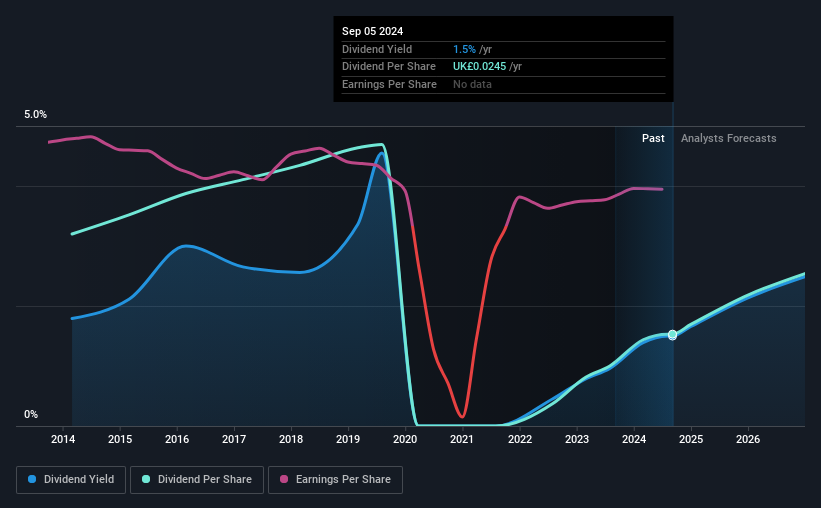

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from £0.0512 total annually to £0.0245. The dividend has shrunk at around 7.1% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Come By

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. Senior has seen earnings per share falling at 9.3% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Senior's payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 3 analysts we track are forecasting for the future. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SNR

Senior

Designs, manufactures, and sells high-technology components and systems for the original equipment manufacturers in the aerospace, defense, land vehicle, and power and energy markets in North America, the United Kingdom, South Africa, India, China, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives