- United Kingdom

- /

- Professional Services

- /

- AIM:BEG

Top UK Dividend Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of weak trade data from China, reflected in recent declines in both the FTSE 100 and FTSE 250 indices, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In such uncertain times, stocks that consistently offer reliable dividends can be particularly appealing for those looking to navigate market volatility while still generating returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.13% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.24% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.73% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.88% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.55% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.66% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.01% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.79% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.52% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK and has a market cap of £164.05 million.

Operations: Begbies Traynor Group plc generates its revenue through providing professional services across various sectors in the United Kingdom.

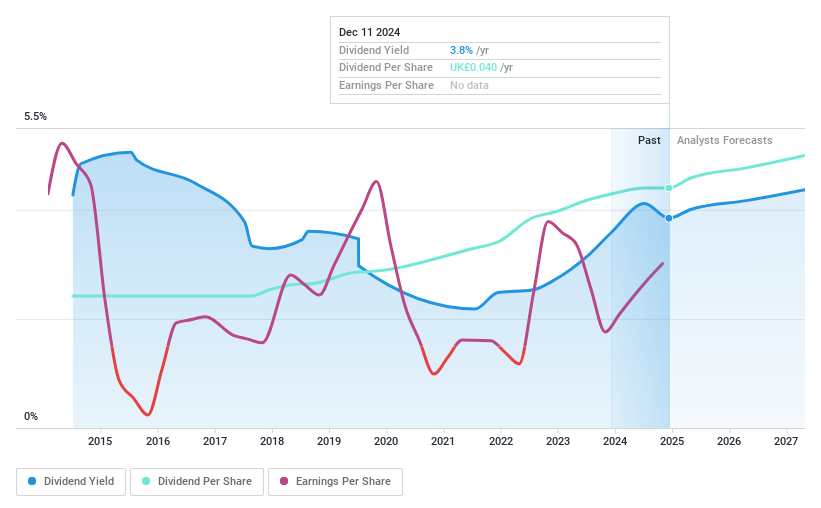

Dividend Yield: 3.8%

Begbies Traynor Group has a stable dividend history over the past decade, yet its dividend yield of 3.85% is lower than the top UK payers. Despite earnings growth and reasonable cash flow coverage, dividends are not well covered by earnings due to a high payout ratio. Recent financials show increased sales and net income for H1 2024, but significant insider selling raises concerns about future stability. The company is also undertaking share buybacks to potentially enhance shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Begbies Traynor Group.

- Insights from our recent valuation report point to the potential undervaluation of Begbies Traynor Group shares in the market.

Paragon Banking Group (LSE:PAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paragon Banking Group PLC offers financial products and services in the United Kingdom with a market cap of £1.57 billion.

Operations: Paragon Banking Group PLC generates revenue through its Mortgage Lending segment, which accounts for £280.50 million, and its Commercial Lending segment, contributing £115.20 million.

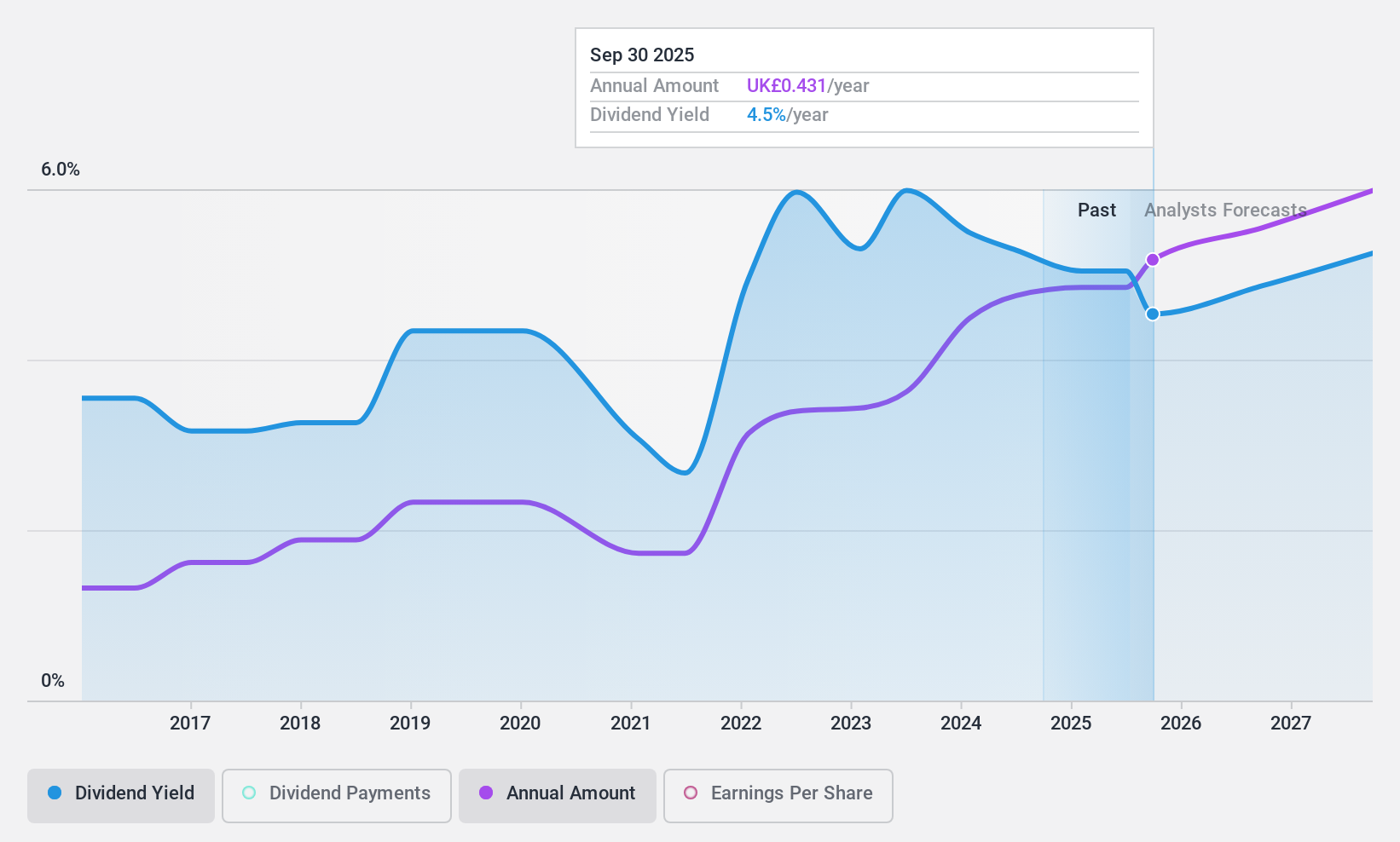

Dividend Yield: 5.2%

Paragon Banking Group's dividends are well-covered by earnings and cash flows, with a payout ratio of 45.6% and a cash payout ratio of 3.7%. Despite its volatile dividend history, recent increases show growth, with the total dividend for 2024 rising to £0.404 per share from £0.374 in 2023. The company trades below estimated fair value and reported strong earnings growth, with net income reaching £186 million for the year ended September 30, 2024.

- Click to explore a detailed breakdown of our findings in Paragon Banking Group's dividend report.

- Our valuation report here indicates Paragon Banking Group may be undervalued.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc is involved in the distribution of maintenance, repair, and operations products and service solutions across several countries including the UK, US, France, Germany, Italy, and Mexico with a market cap of £3.38 billion.

Operations: RS Group plc generates revenue from two main segments: Own-Brand Products, contributing £404.70 million, and Other Product and Service Solutions, which account for £2.53 billion.

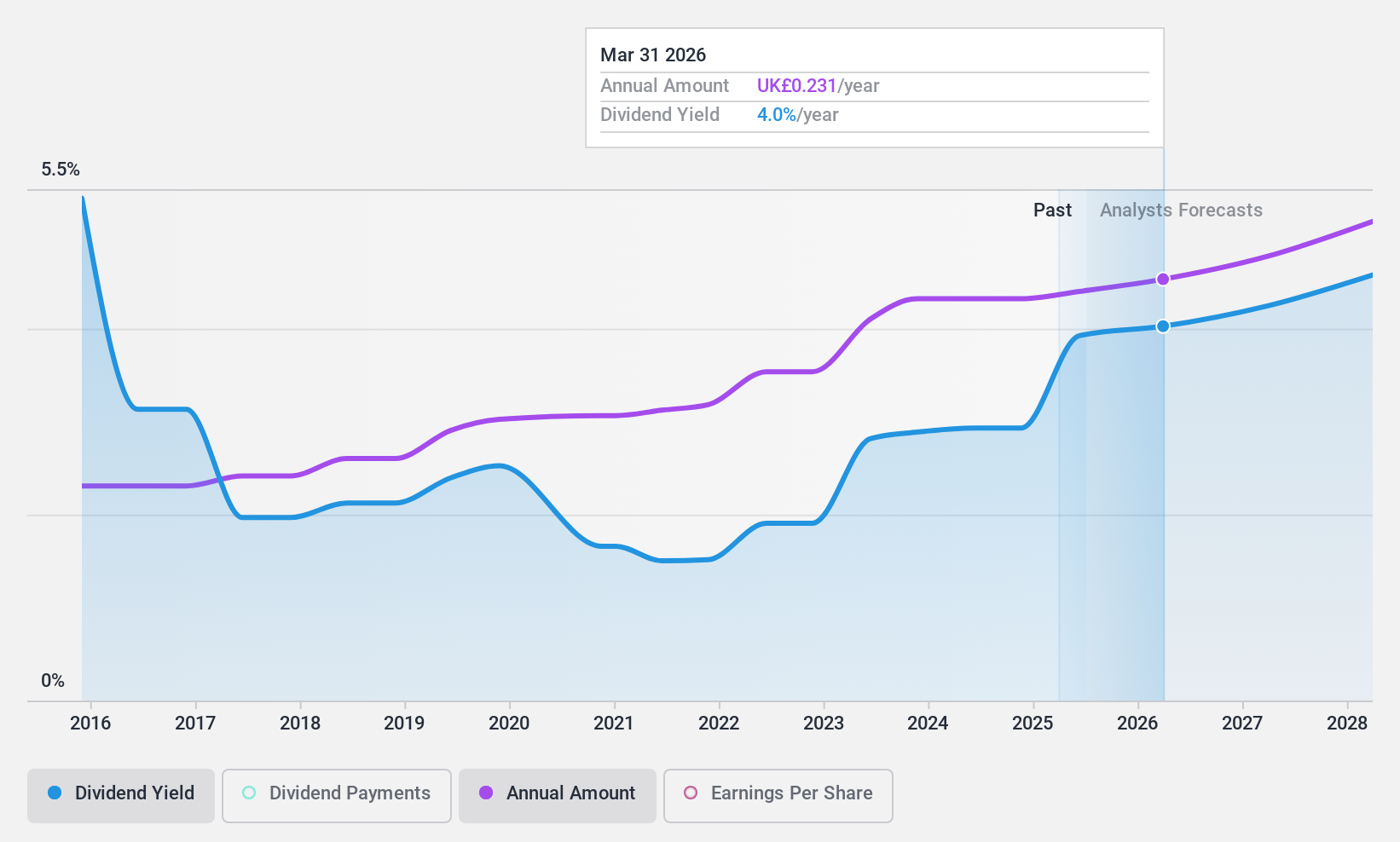

Dividend Yield: 3.1%

RS Group's dividend is reliably covered by earnings and cash flows, with a payout ratio of 61.8% and a cash payout ratio of 49.2%. Despite a modest yield of 3.11%, dividends have been stable over the past decade, showing consistent growth without volatility. Recent earnings reflect slight declines in sales and net income; however, the company remains undervalued by about 12.8% compared to estimated fair value, suggesting potential for future appreciation alongside dividend stability.

- Click here to discover the nuances of RS Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that RS Group is trading behind its estimated value.

Key Takeaways

- Click here to access our complete index of 62 Top UK Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Begbies Traynor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BEG

Begbies Traynor Group

Provides professional services to businesses, professional advisors, large corporations, and financial institutions in the United Kingdom.

Flawless balance sheet with high growth potential and pays a dividend.