- United Kingdom

- /

- Machinery

- /

- LSE:ROR

With EPS Growth And More, Rotork (LON:ROR) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Rotork (LON:ROR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Rotork with the means to add long-term value to shareholders.

Check out our latest analysis for Rotork

How Quickly Is Rotork Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Rotork managed to grow EPS by 10% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

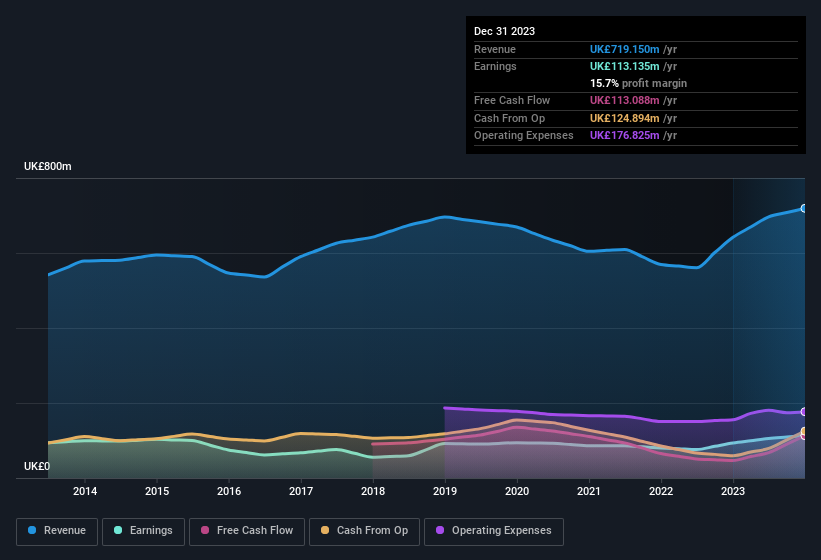

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Rotork achieved similar EBIT margins to last year, revenue grew by a solid 12% to UK£719m. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Rotork's forecast profits?

Are Rotork Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between UK£1.6b and UK£5.0b, like Rotork, the median CEO pay is around UK£1.9m.

Rotork offered total compensation worth UK£1.6m to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Rotork Deserve A Spot On Your Watchlist?

One important encouraging feature of Rotork is that it is growing profits. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. All things considered, Rotork is definitely worth taking a deeper dive into. However, before you get too excited we've discovered 1 warning sign for Rotork that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of British companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ROR

Rotork

Designs, manufactures, and markets industrial flow control and instrumentation solutions for the oil and gas, water and wastewater, power, chemical process, and industrial markets in the United Kingdom, Asia Pacific, the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives