- United Kingdom

- /

- Entertainment

- /

- AIM:OMIP

Discover UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, notably reflected in the recent performance of the FTSE 100 and FTSE 250 indices, investors are keenly observing potential opportunities amidst uncertainty. Penny stocks, though often considered niche investments, continue to offer intriguing possibilities for those seeking growth at lower price points. These smaller or newer companies can present a unique blend of value and growth potential when supported by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.295 | £864.67M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.70 | £198.24M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.45 | £355.58M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.885 | £67.03M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.25 | £106.71M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.308 | £201.73M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4295 | $249.68M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.47 | £444.03M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.35 | £207.28M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gattaca (AIM:GATC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gattaca plc is a human capital resources company that offers contract and permanent recruitment services across private and public sectors, with a market cap of £27.43 million.

Operations: The company's revenue is primarily derived from Infrastructure (£149.25 million), Defence (£92.08 million), Energy (£37.79 million), Mobility (£33.42 million), Technology, Media & Telecoms (£31.63 million), International operations (£3.28 million), and Gattaca Projects (£11.36 million).

Market Cap: £27.43M

Gattaca plc, a human capital resources company, has shown steady revenue growth with sales reaching £389.53 million for the year ending July 31, 2024. Despite this growth, the company faces challenges with declining net profit margins and earnings per share compared to the previous year. The absence of debt is a positive aspect, reducing financial risk and interest payment concerns. However, its dividend sustainability is questionable due to insufficient earnings coverage. Gattaca's management team has moderate experience but lacks long-term stability on its board of directors. Revenue is projected to grow annually by 8.66%, reflecting potential future expansion opportunities.

- Click to explore a detailed breakdown of our findings in Gattaca's financial health report.

- Assess Gattaca's future earnings estimates with our detailed growth reports.

One Media iP Group (AIM:OMIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: One Media iP Group Plc focuses on acquiring and exploiting mixed media intellectual property rights for distribution through digital and traditional media outlets globally, with a market cap of £8.90 million.

Operations: The company's revenue is derived from two main segments: Tcat, contributing £0.30 million, and Licenses, generating £5.08 million.

Market Cap: £8.9M

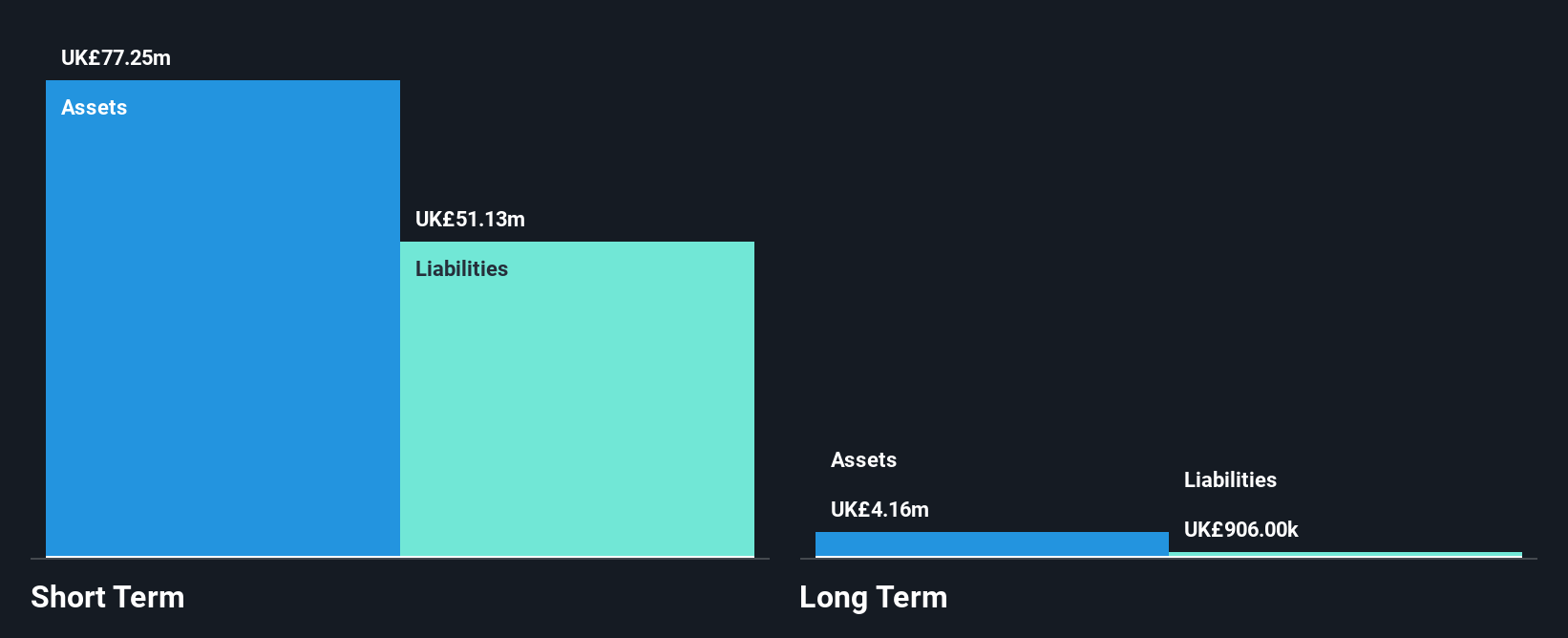

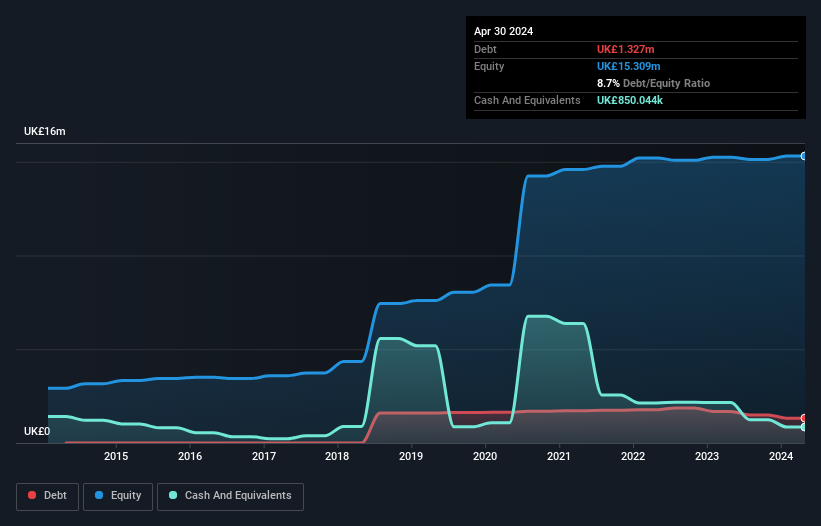

One Media iP Group, with a market cap of £8.90 million, derives revenue primarily from its Licenses segment (£5.08 million) and Tcat (£0.30 million). The company has high-quality earnings and its debt is well covered by operating cash flow at 118.2%. Despite stable weekly volatility over the past year, the share price remains highly volatile in recent months. While short-term assets exceed both short- and long-term liabilities, earnings have declined by 16.3% annually over five years. Although net profit margins decreased to 3%, interest payments are well covered by EBIT at 3.5 times coverage, indicating manageable financial health amidst challenges in profit growth acceleration.

- Get an in-depth perspective on One Media iP Group's performance by reading our balance sheet health report here.

- Evaluate One Media iP Group's prospects by accessing our earnings growth report.

Atrato Onsite Energy (LSE:ROOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atrato Onsite Energy plc is an investment company that offers onsite clean energy generation services in the United Kingdom and the Republic of Ireland, with a market cap of £116.85 million.

Operations: The company generates revenue of £4.84 million from its investment in renewable energy infrastructure assets.

Market Cap: £116.85M

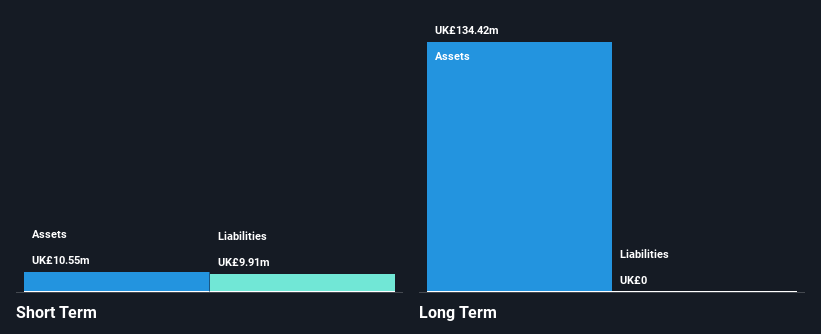

Atrato Onsite Energy, with a market cap of £116.85 million, generates £4.84 million in revenue from renewable energy infrastructure investments. The company is debt-free and has no long-term liabilities, ensuring financial stability despite declining revenue by 8.5% over the past year. Short-term assets (£10.5M) exceed short-term liabilities (£9.9M), providing liquidity support, but negative earnings growth (-25%) and low return on equity (1.5%) present challenges for future profitability improvements. While dividends at 6.42% are not well covered by earnings or free cash flow, the board's average tenure of 3.1 years suggests experienced governance amidst these dynamics.

- Click here and access our complete financial health analysis report to understand the dynamics of Atrato Onsite Energy.

- Gain insights into Atrato Onsite Energy's historical outcomes by reviewing our past performance report.

Summing It All Up

- Dive into all 467 of the UK Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:OMIP

One Media iP Group

Engages in the acquisition and exploitation of mixed media intellectual property rights for distribution through the digital medium and traditional media outlets in the United Kingdom, rest of Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.