Kier Group plc (LON:KIE) just reported healthy earnings but the stock price didn't move much. We think that investors have missed some encouraging factors underlying the profit figures.

Check out our latest analysis for Kier Group

Examining Cashflow Against Kier Group's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

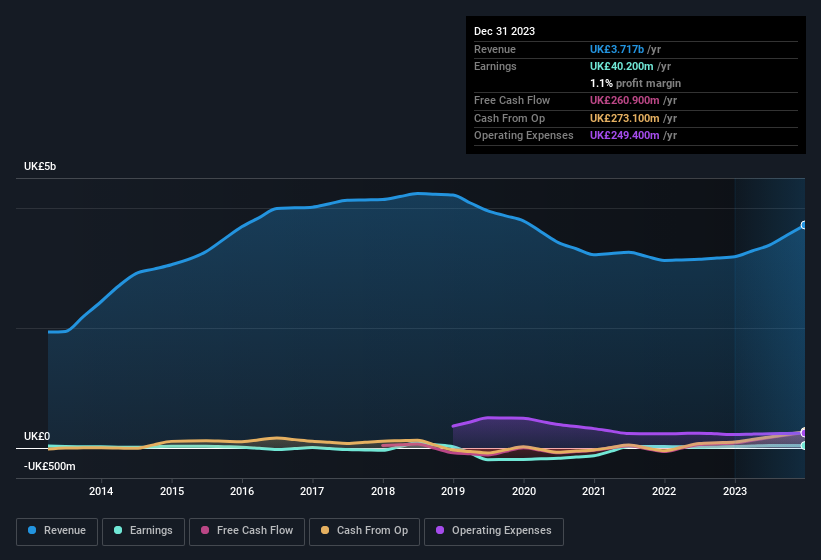

Kier Group has an accrual ratio of -0.39 for the year to December 2023. Therefore, its statutory earnings were very significantly less than its free cashflow. To wit, it produced free cash flow of UK£261m during the period, dwarfing its reported profit of UK£40.2m. Kier Group shareholders are no doubt pleased that free cash flow improved over the last twelve months. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Surprisingly, given Kier Group's accrual ratio implied strong cash conversion, its paper profit was actually boosted by UK£12m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Kier Group's Profit Performance

In conclusion, Kier Group's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Based on these factors, we think that Kier Group's profits are a reasonably conservative guide to its underlying profitability. So while earnings quality is important, it's equally important to consider the risks facing Kier Group at this point in time. Case in point: We've spotted 2 warning signs for Kier Group you should be aware of.

Our examination of Kier Group has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Kier Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:KIE

Kier Group

Primarily engages in the construction business in the United Kingdom and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives