Exploring Assura And Two Other Undervalued Small Caps With Insider Actions In The United Kingdom

Reviewed by Simply Wall St

In the United Kingdom, market sentiment is cautiously optimistic as investors digest the implications of recent political changes and economic indicators. With a new government in place and fewer businesses planning price increases, there may be subtle shifts in market dynamics that could highlight opportunities among undervalued small-cap stocks like Assura. Understanding what makes a good stock involves considering how well-positioned a company is to navigate current economic conditions, including its ability to adapt to political and economic shifts within the UK.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ultimate Products | 9.5x | 0.7x | 19.85% | ★★★★★☆ |

| Norcros | 7.9x | 0.5x | 43.59% | ★★★★★☆ |

| THG | NA | 0.4x | 41.80% | ★★★★★☆ |

| CVS Group | 21.0x | 1.2x | 41.78% | ★★★★☆☆ |

| M&C Saatchi | NA | 0.5x | 49.04% | ★★★★☆☆ |

| Bytes Technology Group | 28.4x | 6.4x | -12.42% | ★★★☆☆☆ |

| Robert Walters | 20.3x | 0.3x | 38.84% | ★★★☆☆☆ |

| Trifast | NA | 0.4x | -46.32% | ★★★☆☆☆ |

| GB Group | NA | 3.3x | 19.93% | ★★★☆☆☆ |

| Hochschild Mining | NA | 1.8x | 37.72% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

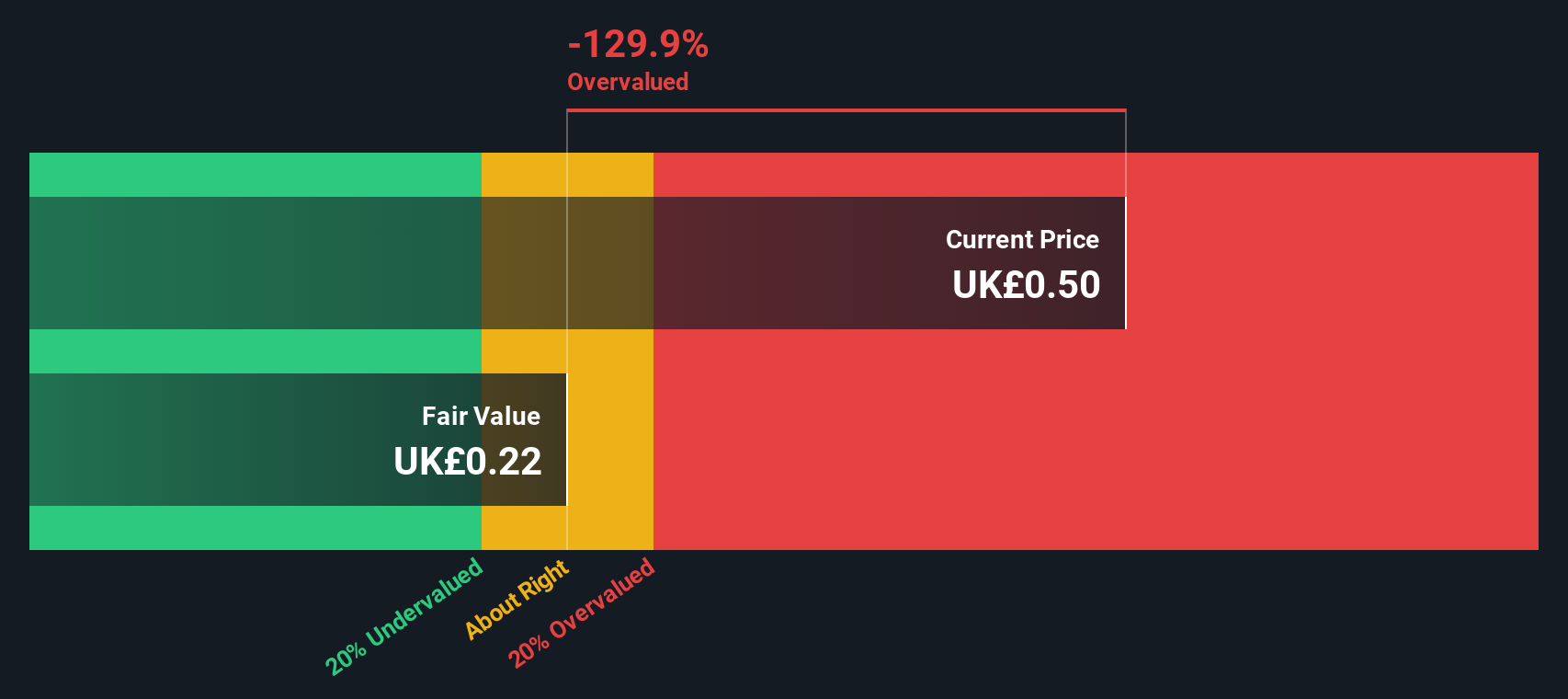

Assura (LSE:AGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Assura is a healthcare real estate investment trust that focuses on the acquisition, development, and management of primary care facilities across the UK, with a market capitalization of approximately £1.74 billion.

Operations: The entity has demonstrated a consistently high gross profit margin, averaging approximately 92.4% over recent periods, with the latest figure at 90.81%. This reflects efficient cost management relative to its revenue generation, which stood at £157.8 million in the most recent reporting period.

PE: -43.8x

Assura, a specialist in healthcare property investment, recently showcased significant insider confidence with purchases made by executives. This move underscores a robust belief in the company's prospects amidst its strategic expansion into essential NHS infrastructure. With earnings forecasted to grow 40.91% annually and a notable reduction in net loss from GBP 119.2 million to GBP 28.8 million year-over-year, Assura's financial recovery appears well underway. The firm also announced a dividend increase and has entered into a GBP 250 million joint venture to enhance NHS community healthcare facilities, reflecting its commitment to long-term growth in this sector.

- Delve into the full analysis valuation report here for a deeper understanding of Assura.

Examine Assura's past performance report to understand how it has performed in the past.

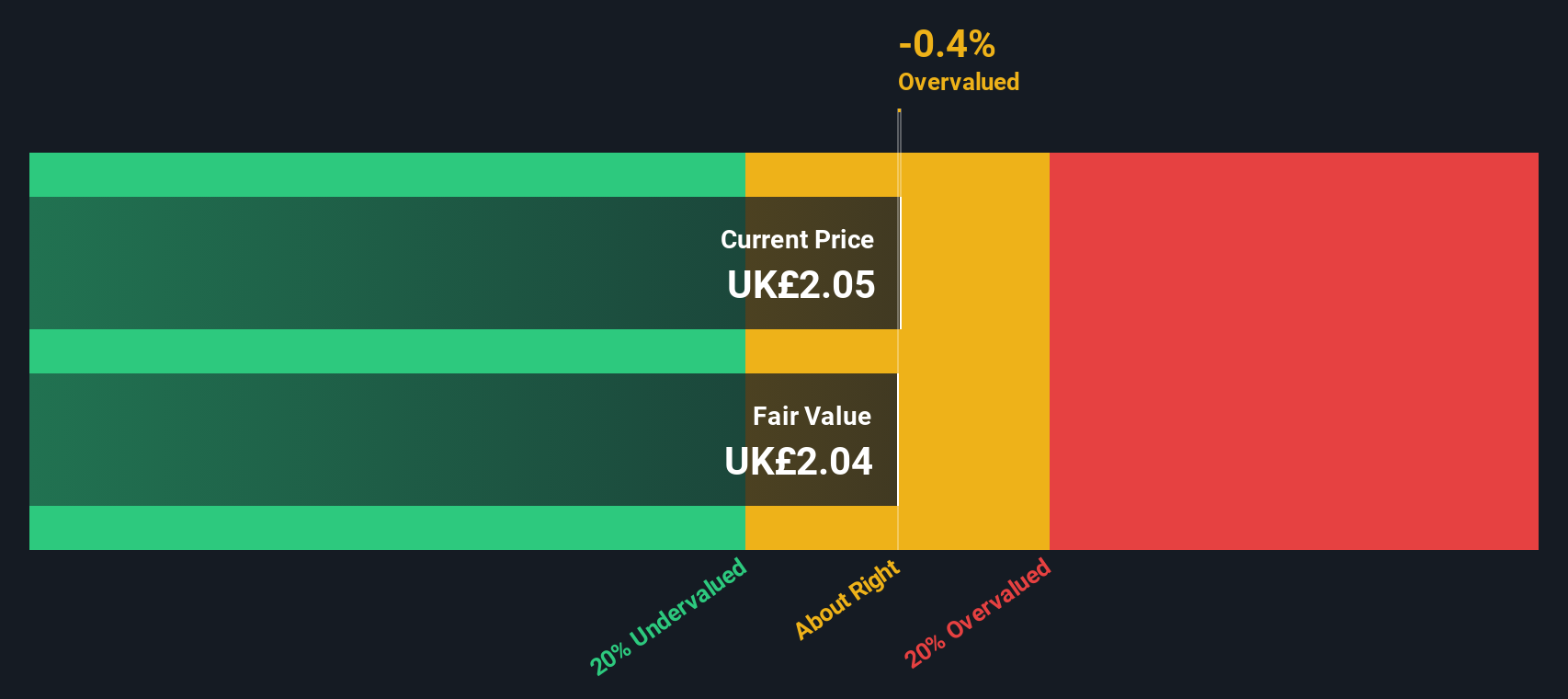

Kier Group (LSE:KIE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a construction and infrastructure services provider with operations primarily in building and civil engineering, supporting a market capitalization of approximately £241 million.

Operations: The company generates substantial revenue from Construction and Infrastructure Services, with respective segments contributing £1.86 billion and £1.87 billion. Gross profit margin has shown variability over recent periods, trending at approximately 0.087% as of the latest reported quarter.

PE: 16.7x

Kier Group, often overlooked, demonstrates a compelling narrative through its financial maneuvers and strategic market positioning. Recently, insiders have shown their confidence by purchasing shares, signaling strong belief in the company's prospects. With earnings expected to grow by 22% annually, this highlights not just recovery but potential underappreciated growth avenues. Despite relying solely on external borrowing—a riskier strategy—its ability to maintain high-quality earnings amidst significant one-off items suggests resilience and adaptability in challenging environments.

- Dive into the specifics of Kier Group here with our thorough valuation report.

Review our historical performance report to gain insights into Kier Group's's past performance.

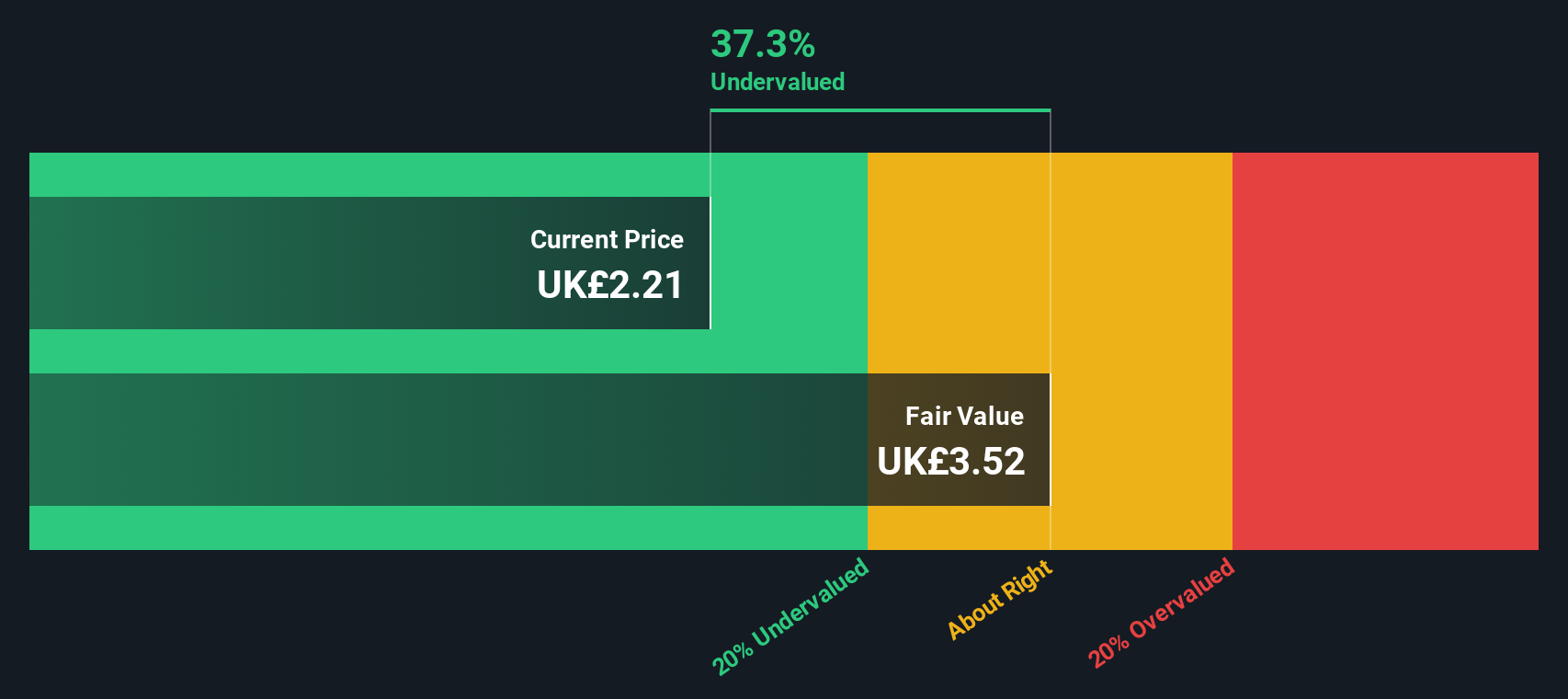

MONY Group (LSE:MONY)

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group operates in diverse sectors including insurance, money services, travel, cashback programs, and home services, boasting a market capitalization of approximately £1.5 billion.

Operations: The company generates its highest revenue from the Insurance segment at £220 million, followed by Money services which contribute £100.2 million. Gross profit margins have shown a consistent trend, with the most recent figure reported at approximately 67.67%.

PE: 17.5x

MONY Group, formerly known as Moneysupermarket.com, recently showcased a revenue increase to £115 million in Q1 2024 from £106 million the previous year, signaling robust operational momentum. With earnings expected to grow by over 10% annually, the company's financial health appears solid. Insider confidence is evident as they have recently purchased shares, underscoring a belief in the firm’s potential despite its reliance on external borrowing. Set to rebrand on May 20, MONY Group's evolution could further unlock value for investors looking at promising yet undervalued entities within the UK market.

- Click to explore a detailed breakdown of our findings in MONY Group's valuation report.

Assess MONY Group's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 33 of the Undervalued Small Caps With Insider Buying we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MONY

MONY Group

Engages in the provision of price comparison and lead generation services through its websites and applications in the United Kingdom.

6 star dividend payer and undervalued.

Market Insights

Community Narratives