- United Kingdom

- /

- Machinery

- /

- LSE:GDWN

Undiscovered Gems In The UK AltynGold And 2 Other Promising Small Caps

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and global economic uncertainties impacting investor sentiment. Despite these broader market pressures, small-cap stocks often present unique opportunities for growth by offering innovative solutions or niche market positions that can thrive even in fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

AltynGold (LSE:ALTN)

Simply Wall St Value Rating: ★★★★★★

Overview: AltynGold plc, along with its subsidiaries, focuses on the exploration and development of gold mines in Kazakhstan and has a market capitalization of £281.53 million.

Operations: AltynGold generates revenue primarily through the exploration and development of mineral resources, specifically at the Sekisovskoye site, with reported revenues of $128.14 million.

AltynGold, a small player in the metals and mining sector, has been making waves with its impressive financial performance. Over the past year, the company's earnings surged by 171.8%, outpacing the industry average of 81.2%. With a net debt to equity ratio of 31.1%, AltynGold's financial health seems satisfactory, and its interest payments are well covered by EBIT at 14 times. The recent appointment of Maryam Buribayeva as CFO, who brings a wealth of experience, aligns with the company's growth trajectory. Trading at 89.4% below its estimated fair value, AltynGold presents a compelling case for investors.

- Get an in-depth perspective on AltynGold's performance by reading our health report here.

Evaluate AltynGold's historical performance by accessing our past performance report.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★★

Overview: Goodwin PLC, along with its subsidiaries, offers mechanical and refractory engineering solutions across the UK, Europe, the US, the Pacific Basin, and globally with a market cap of £1.01 billion.

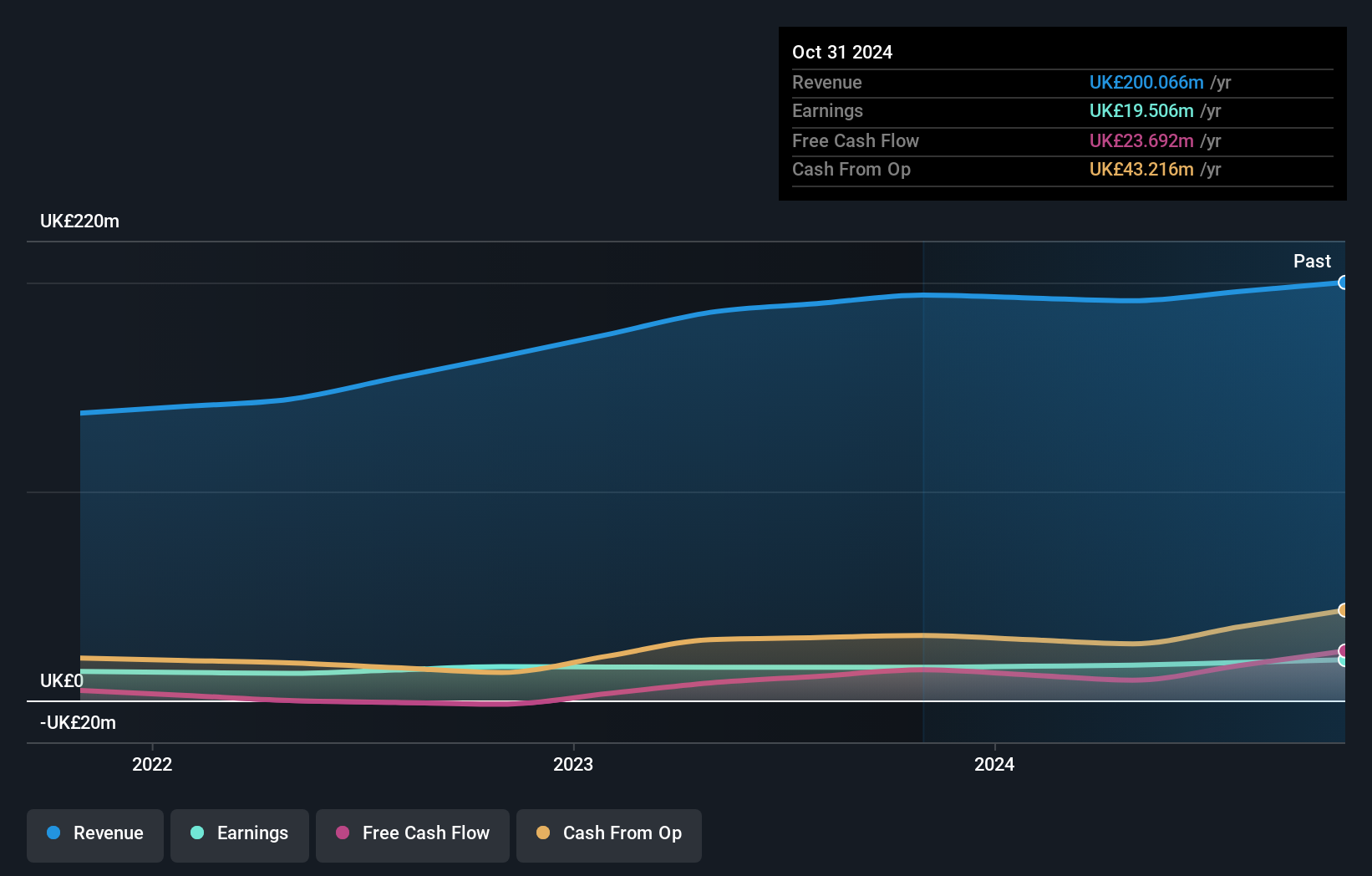

Operations: Goodwin generates revenue primarily from its Mechanical Engineering segment (£193.05 million) and Refractory Engineering segment (£78.16 million), with inter-segment sales adjustments of -£51.50 million.

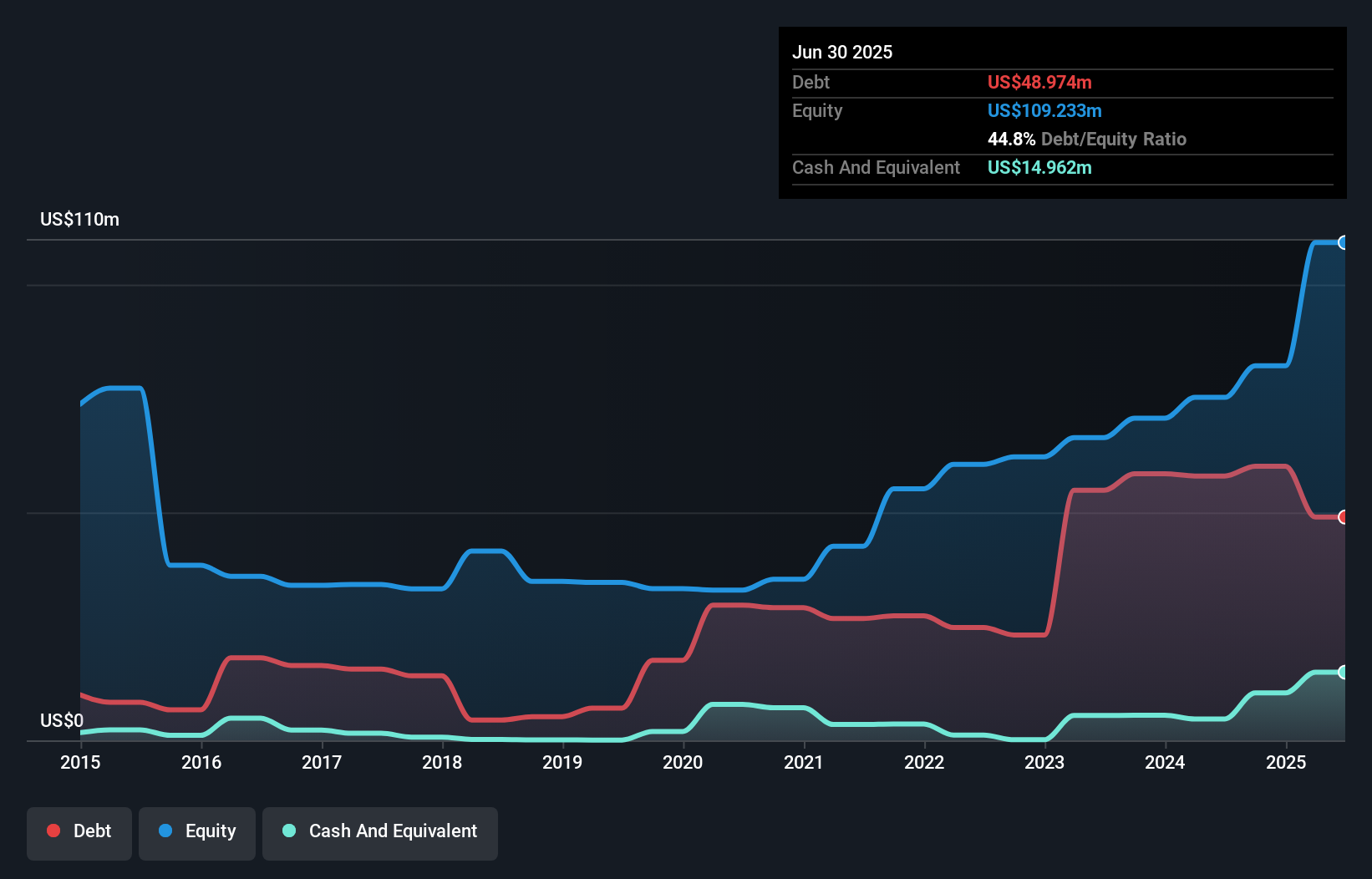

With a strong footing in the machinery sector, Goodwin has seen its earnings grow by 45.4% over the past year, outpacing the industry average of -11.7%. The company demonstrates high-quality earnings and trades at 50.7% below its estimated fair value, suggesting potential undervaluation. Its net debt to equity ratio stands at a satisfactory 6.2%, reflecting prudent financial management. Recent inclusion in the S&P Global BMI Index marks a significant milestone, while a proposed dividend increase to 280 pence per share underscores confidence in its financial health. Despite some share price volatility, Goodwin's performance and strategic moves paint a promising picture.

- Navigate through the intricacies of Goodwin with our comprehensive health report here.

Understand Goodwin's track record by examining our Past report.

Greencore Group (LSE:GNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Greencore Group plc, along with its subsidiaries, is involved in the manufacturing and sale of convenience food products across the United Kingdom and Ireland, with a market capitalization of £1.06 billion.

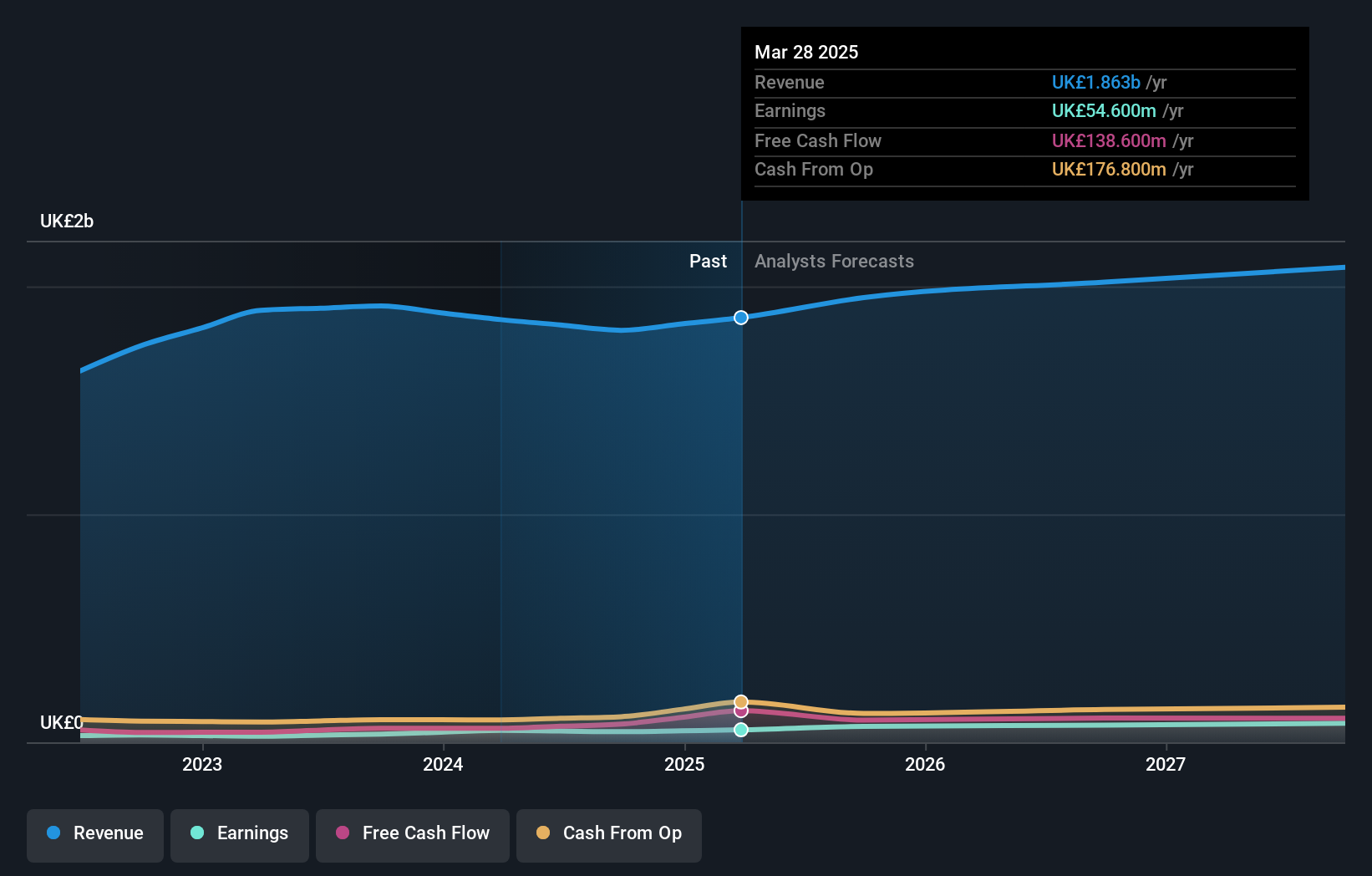

Operations: Greencore generates revenue primarily from its Convenience Foods segment in the UK and Ireland, totaling £1.86 billion. The company's cost structure and profitability are influenced by various operational expenses, with a notable focus on maintaining an efficient production process to optimize margins.

Greencore Group, a notable player in the UK and Ireland's convenience food sector, has seen its debt to equity ratio improve from 102.3% to 49.7% over five years, highlighting financial prudence. With high-quality earnings and a net debt to equity ratio of 30.3%, the company seems well-positioned for strategic growth. Despite facing industry challenges, Greencore's revenue rose 9.9% to £511.1 million in the last quarter, supported by renewed contracts and innovation. Trading at £2.41, slightly below the consensus target of £2.583, it offers potential value amidst mixed analyst opinions.

Where To Now?

- Unlock our comprehensive list of 60 UK Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GDWN

Goodwin

Provides mechanical and refractory engineering solutions in the United Kingdom, rest of Europe, the United States, the Pacific Basin, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives