- United Kingdom

- /

- Capital Markets

- /

- LSE:IGG

Top UK Dividend Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are increasingly cautious about the global economic outlook. In such uncertain times, dividend stocks can offer a degree of stability and income potential, making them an attractive option for those seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.00% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.87% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.91% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.99% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.01% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.70% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.22% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.16% | ★★★★★☆ |

| Halyk Bank of Kazakhstan (LSE:HSBK) | 6.63% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.62% | ★★★★★☆ |

Click here to see the full list of 51 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

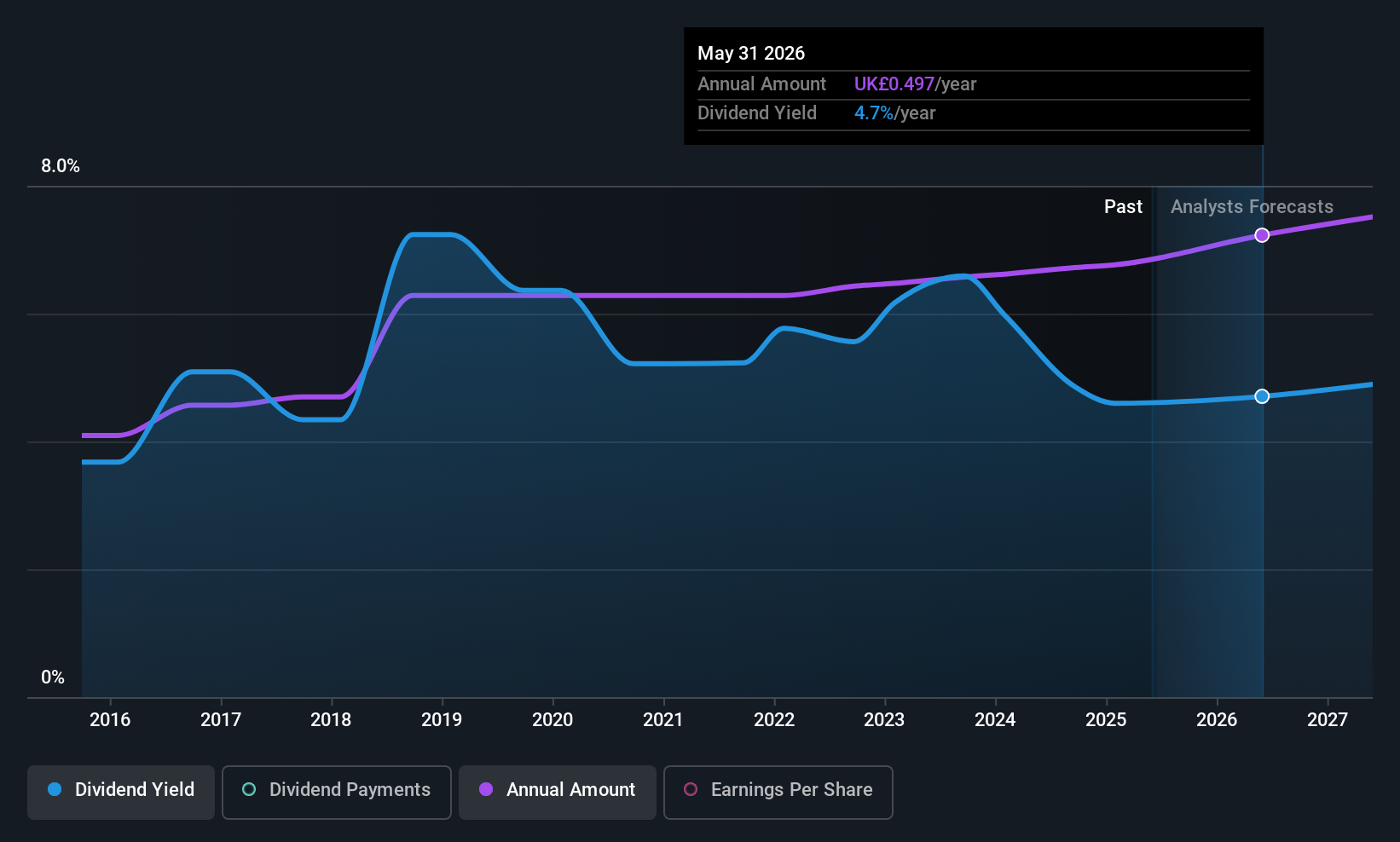

Eurocell (LSE:ECEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eurocell plc is involved in the manufacture, distribution, and recycling of PVC building products such as windows, doors, and roofline components in the UK and Ireland, with a market cap of £123.45 million.

Operations: Eurocell plc generates revenue from its Profiles segment (£208.80 million) and Building Plastics segment (£211.40 million).

Dividend Yield: 5%

Eurocell's dividend yield of 5.02% is below the top tier in the UK market, but its dividends are well covered by cash flows with a low cash payout ratio of 21.8%. However, the dividend history has been volatile over the past decade despite recent increases, including a 5% interim rise announced in September 2025. Recent executive changes and inclusion in the S&P Global BMI Index may impact future stability and investor confidence.

- Dive into the specifics of Eurocell here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Eurocell shares in the market.

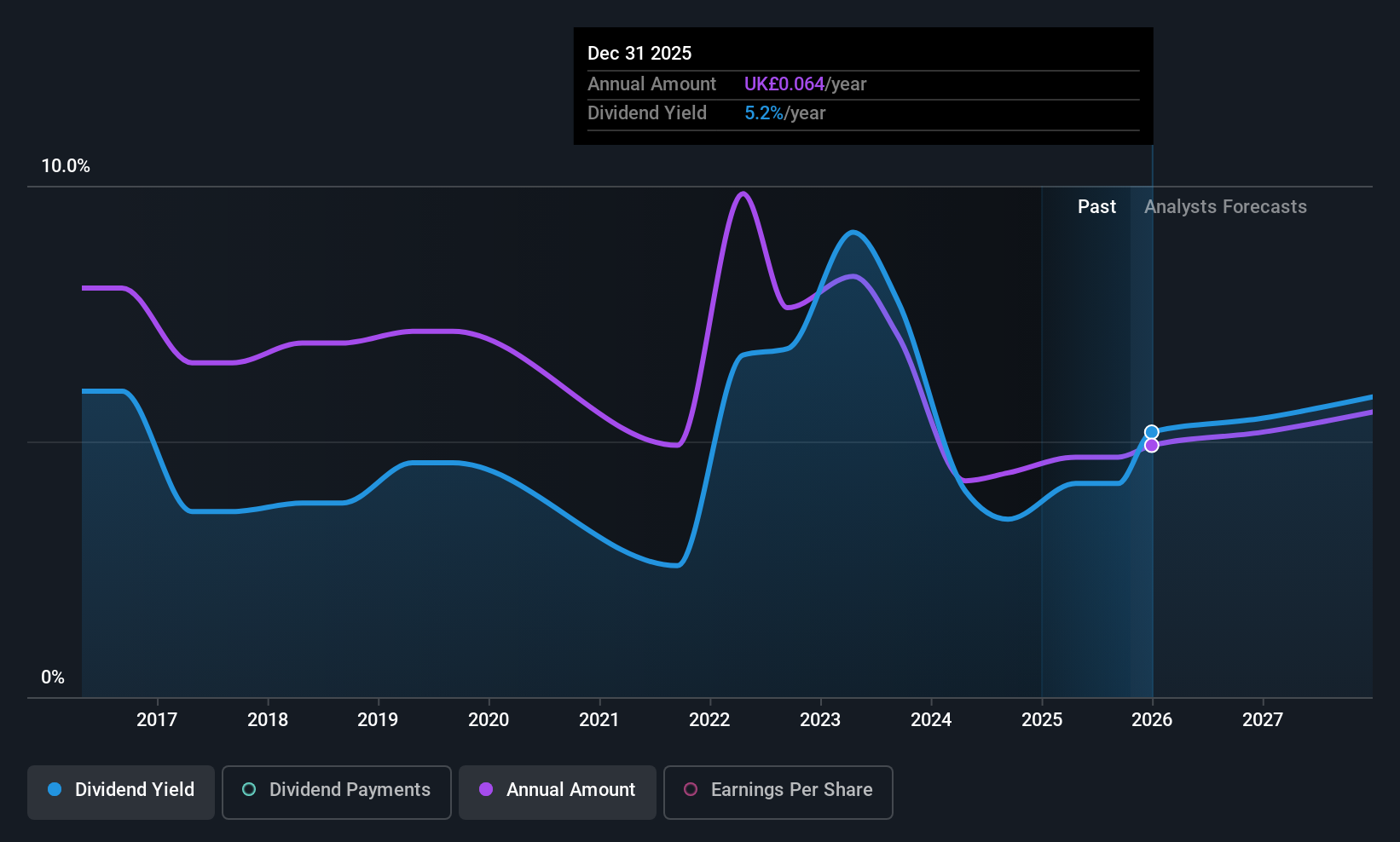

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading sector across various regions including the UK, Ireland, Asia-Pacific, the Middle East, the US, Europe, and emerging markets with a market cap of £3.88 billion.

Operations: IG Group Holdings plc generates revenue primarily through its brokerage services, which account for £1.05 billion.

Dividend Yield: 4.2%

IG Group Holdings offers a stable dividend history with growing payments over the past decade, supported by a low payout ratio of 44.4% and cash flow coverage at 33.2%. Despite trading below fair value, its 4.16% yield is lower than top UK payers. Earnings grew last year but are forecast to decline slightly over the next three years, while revenue is expected to grow modestly. Recent changes in fiscal year-end may influence reporting schedules and investor perception.

- Take a closer look at IG Group Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that IG Group Holdings' current price could be quite moderate.

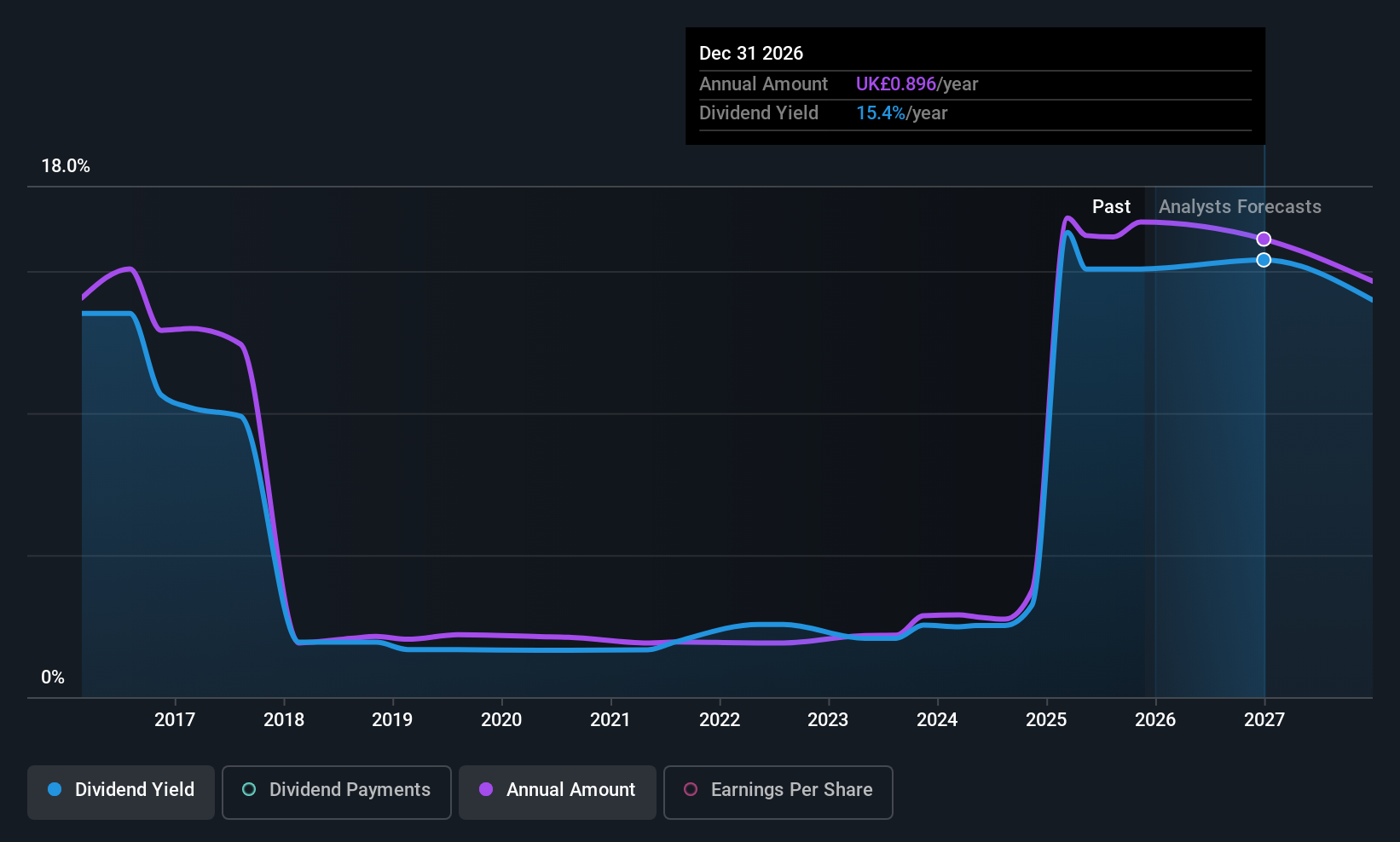

Lancashire Holdings (LSE:LRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lancashire Holdings Limited, with a market cap of £1.40 billion, operates in London, Bermuda, and Australia offering specialty insurance and reinsurance products through its subsidiaries.

Operations: Lancashire Holdings Limited generates revenue from its Insurance Segment, contributing $173.20 million, and its Reinsurance Segment, which brings in $454.20 million.

Dividend Yield: 16%

Lancashire Holdings' dividends are covered by earnings and cash flows, with a low payout ratio of 23.6% and a cash payout ratio of 75.3%. Despite a high yield in the top UK quartile, dividend reliability is questionable due to volatility over the past decade. Trading significantly below estimated fair value, its profit margins have decreased from last year. A special dividend ex-date was announced for November 5, highlighting potential short-term income opportunities for investors.

- Click here to discover the nuances of Lancashire Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Lancashire Holdings' share price might be too pessimistic.

Next Steps

- Reveal the 51 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IGG

IG Group Holdings

A fintech company, engages in the online trading business in the United Kingdom, Ireland, the Asia-Pacific, the Middle East, the United States, Europe, and institutional and emerging markets.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success