- United Kingdom

- /

- Electrical

- /

- LSE:DIA

Investors Don't See Light At End Of Dialight plc's (LON:DIA) Tunnel And Push Stock Down 32%

Dialight plc (LON:DIA) shares have had a horrible month, losing 32% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

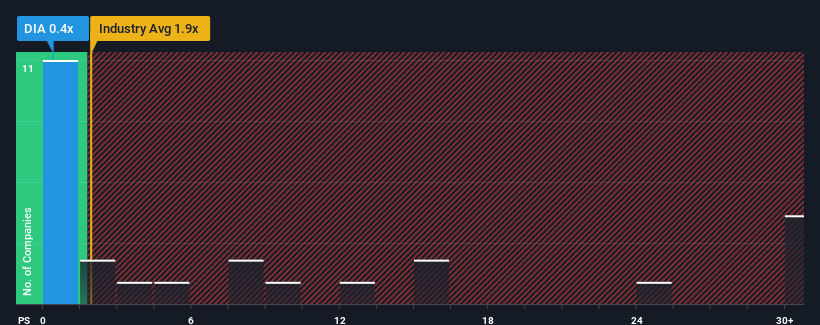

Since its price has dipped substantially, Dialight's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Electrical industry in the United Kingdom, where around half of the companies have P/S ratios above 1.9x and even P/S above 16x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Dialight

How Has Dialight Performed Recently?

Dialight hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Dialight's future stacks up against the industry? In that case, our free report is a great place to start.How Is Dialight's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Dialight's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 7.9% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 4.2% per annum during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 76% each year, which is noticeably more attractive.

With this information, we can see why Dialight is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Dialight's recently weak share price has pulled its P/S back below other Electrical companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Dialight's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Dialight (of which 2 don't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Dialight, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DIA

Dialight

Primarily develops, manufactures, and supplies LED lighting solutions for use in hazardous and industrial applications in North America, Europe, the Middle East, Africa, and internationally.

Undervalued with reasonable growth potential.