- United Kingdom

- /

- Electrical

- /

- LSE:CWR

Ceres Power Holdings plc's (LON:CWR) 28% Price Boost Is Out Of Tune With Revenues

Those holding Ceres Power Holdings plc (LON:CWR) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 50% share price decline over the last year.

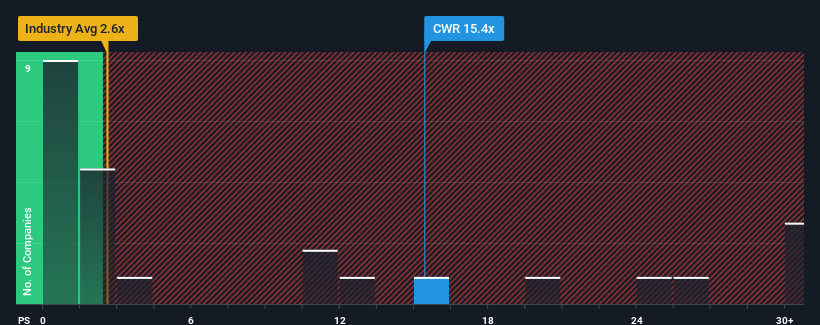

Since its price has surged higher, you could be forgiven for thinking Ceres Power Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 15.4x, considering almost half the companies in the United Kingdom's Electrical industry have P/S ratios below 2.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ceres Power Holdings

How Has Ceres Power Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Ceres Power Holdings has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Ceres Power Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ceres Power Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Ceres Power Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 5.7% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 46% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 144% per year, which is noticeably more attractive.

With this information, we find it concerning that Ceres Power Holdings is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Ceres Power Holdings' P/S?

Shares in Ceres Power Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ceres Power Holdings, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ceres Power Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CWR

Ceres Power Holdings

Engages in the development and commercialization of fuel cell and electrochemical technology in Europe, Asia, and North America.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives