- United Kingdom

- /

- Chemicals

- /

- LSE:CRDA

Discover 3 Top UK Dividend Stocks

Reviewed by Simply Wall St

In the current climate, the UK's FTSE 100 index has faced challenges as weak trade data from China impacts globally connected sectors, highlighting vulnerabilities in commodity-dependent industries. Amid these fluctuations, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking resilience in uncertain markets.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.17% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.33% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.48% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.27% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.40% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.09% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.73% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.97% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.69% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

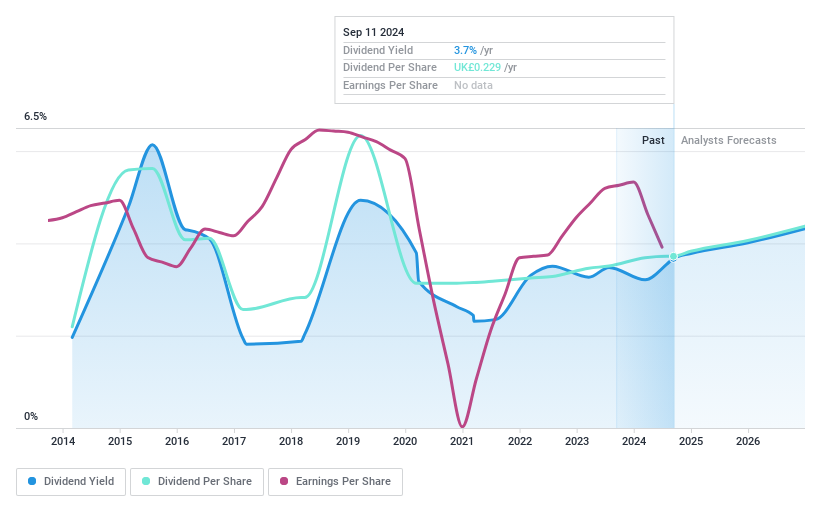

Bodycote (LSE:BOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bodycote plc offers heat treatment and thermal processing services globally, with a market cap of £1.15 billion.

Operations: Bodycote plc's revenue segments include £194.50 million from Aerospace, Defence & Energy in North America, £160 million in Western Europe, and £8 million in Emerging Markets; alongside Automotive & General Industrial revenues of £97.60 million from North America, £237.30 million from Western Europe, and £84 million from Emerging Markets.

Dividend Yield: 3.7%

Bodycote's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 69% and a cash payout ratio of 45.4%, respectively. However, its dividend yield of 3.65% is below the top quartile in the UK market. Despite an increase over the past decade, dividends have been volatile, experiencing significant annual drops. Recent strategic moves include a £30 million increase in its buyback plan and ongoing M&A activities to enhance growth prospects.

- Click here to discover the nuances of Bodycote with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Bodycote is trading behind its estimated value.

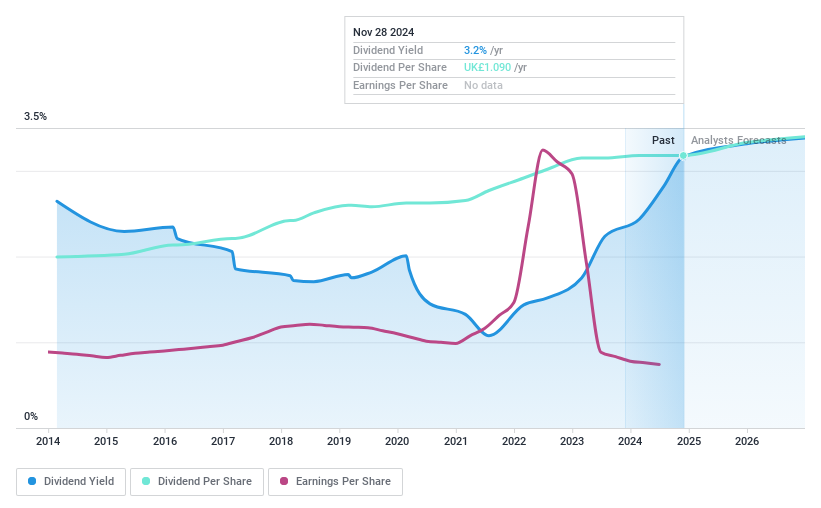

Croda International (LSE:CRDA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Croda International Plc operates in the consumer care, life science, and industrial specialty sectors across Europe, the Middle East, Africa, North America, Asia, and Latin America with a market cap of approximately £4.74 billion.

Operations: Croda International generates revenue through its Consumer Care segment (£898.90 million), Life Sciences segment (£545.30 million), and Industrial Specialties segment (£185.30 million).

Dividend Yield: 3.2%

Croda International's dividend yield of 3.21% is lower than the top UK payers, and its high payout ratio of 93.5% raises sustainability concerns, as earnings do not fully cover dividends. However, cash flows are more supportive with an 80.4% cash payout ratio. Dividends have been stable and growing over the past decade despite these challenges. Recent sales growth to £407 million reflects operational strength amidst executive changes in its audit committee leadership.

- Unlock comprehensive insights into our analysis of Croda International stock in this dividend report.

- Our expertly prepared valuation report Croda International implies its share price may be too high.

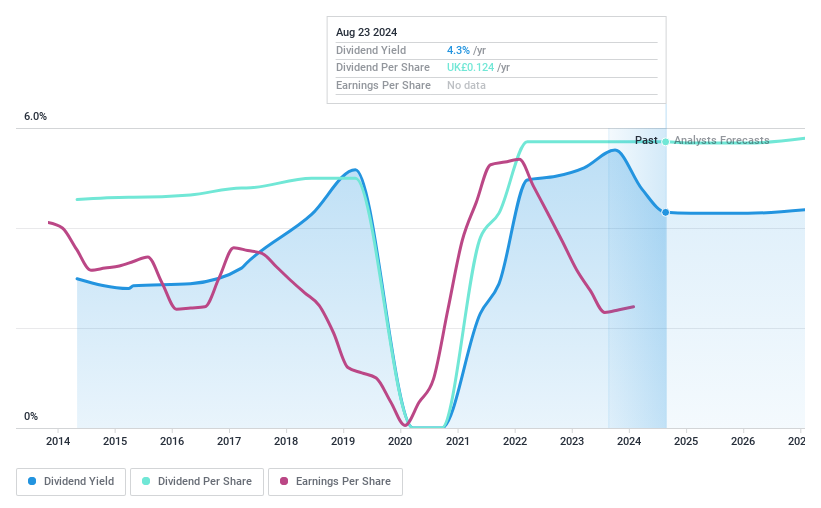

Kingfisher (LSE:KGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kingfisher plc, with a market cap of £4.49 billion, supplies home improvement products and services primarily in the United Kingdom, Ireland, France, and internationally through its subsidiaries.

Operations: Kingfisher plc generates its revenue of £12.86 billion from the supply of home improvement products and services.

Dividend Yield: 5%

Kingfisher's dividend yield of 4.99% is below the top UK payers, but its dividends are well-covered by earnings and cash flows, with a low cash payout ratio of 21.3%. Despite growth in dividend payments over the past decade, they have been volatile and unreliable. The stock trades at good value compared to peers and industry averages. Recent board changes include Lucinda Riches joining as a Non-Executive Director, potentially impacting future strategic decisions.

- Get an in-depth perspective on Kingfisher's performance by reading our dividend report here.

- According our valuation report, there's an indication that Kingfisher's share price might be on the cheaper side.

Key Takeaways

- Discover the full array of 63 Top UK Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRDA

Croda International

Engages in the consumer care, life science, and industrial specialty businesses in Europe, the Middle East, Africa, North America, Asia, and Latin America.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives